Days after Dollar Tree raised a warning flag about the lower-income consumer, Dollar General is doing the same. ⚠️

In its first fiscal quarter Dollar General reported adjusted earnings per share of $2.34 vs. $2.38 expected. And revenues of $9.34 billion vs. $9.46 billion expected. Same-store sales also rose just 1.6%, less than half the 3.8% increase Wall Street anticipated. 🛒

High inflation and concern over the economy are causing consumers to spend more on necessities. While that means more middle-income consumers are likely to trade down to retailers like dollar stores, the product mix and level of overall spending are putting pressure on earnings. Consumables remain the strongest category but were insufficient to offset weakness in higher-margin seasonal, home, and apparel categories. 🥫

CEO Jeff Owen said the macroeconomic environment “has been more challenging than expected, particularly for our core consumer.” Further, the company believes the headwinds are having a “significant impact on customers’ spending levels and behaviors.”

As a result, the company cut its fiscal 2023 full-year outlook. Its net sales growth forecast was revised from 5.5%-6% to 3.5%-5%, trailing analyst estimates of 5.7%. Same-store sales are expected to rise 1%-2%, down from 3%-3.5% and below the 3.4% consensus view. And its earnings per share forecast was revised lower from +4% to +6% to 0% to -8%, well below the +4.3% expectations. 🔻

Dollar General is the industry’s fastest-growing retailer by store count and remains bullish, planning to open 990 stores in 2023. Though, it’s cutting back on Popshelf stores, which sell discretionary items to higher-income consumers. It’s also making other operational improvements to help preserve margins.

However, it also needs to address workplace safety concerns at its stores. Shareholders approved an independent audit into worker safety after it was revealed 49 people died, and another 172 were injured at its stores over the last decade. That vote passed despite the board of directors recommending shareholders vote against the resolution proposed by Domini Impact Investments and worker advocacy groups. 🦺

Overall, investors remain concerned about the industry’s health in the external environment. Combine that with company-specific troubles at Dollar General, and it’s a bit of a mess right now.

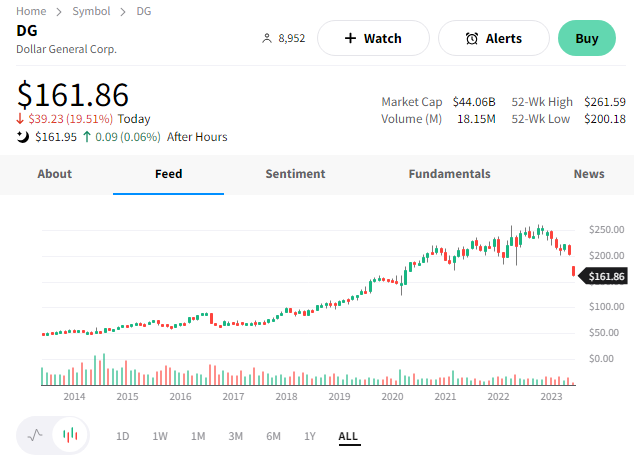

As a result, $DG shares fell 20% to their lowest level in over three years. 👎