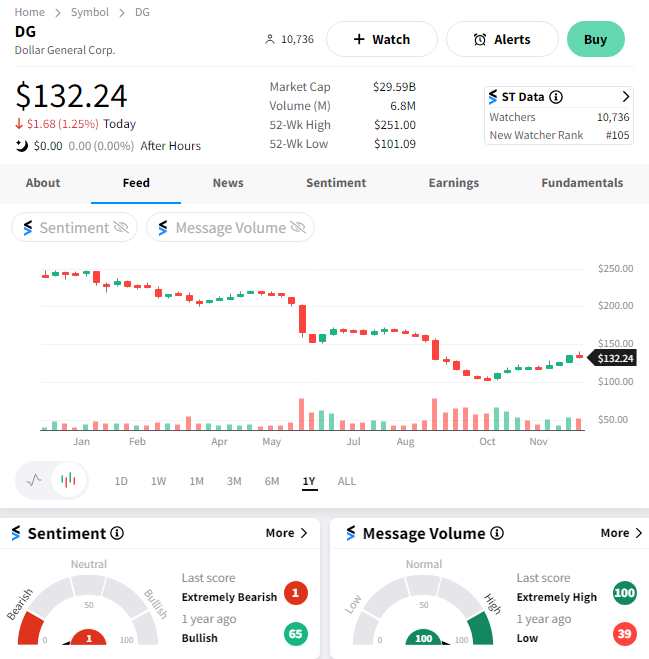

Dollar General is back in the news with the same old issues as in June and August. Let’s take a look at today’s earnings report. 👀

The discount retailer’s third-quarter earnings per share of $1.26 topped expectations of $1.20. Unlike previous quarters, its sales beat expectations, reaching $9.694 billion versus the $9.644 billion expected. Same-store sales also fell less than anticipated, 1.3% versus 2.1%. 🔺

In recent quarters, the company has struggled with low-income consumers pulling back on spending due to inflation and an uncertain economy. And when those consumers did spend at its stores, they primarily bought lower-margin necessities rather than higher-margin discretionary items. That continued this quarter, with consumables as the only category seeing positive sales growth and gross margins falling by 81 bps YoY.

Despite the lackluster sales growth, expectations have finally gotten low enough for the company to step over them. 👍

CEO Todd Vasos said, “While we are not satisfied with our financial results for the third quarter, including a significant headwind from inventory shrink, we are pleased with the momentum in some of the underlying sales trends, including positive customer traffic, as well as market share gains in both dollars and units.”

Overall, management believes its business model is relevant in all economic cycles and is working to address the several operational issues that caused it to stumble through the last year or so. As such, they’re charging ahead with their expansion plans, planning 800 new stores, 1500 remodels, and 85 relocations in fiscal 2024. 🏬

With that said, they acknowledged the lackluster stock performance and declared a $0.59 per share quarterly dividend to appease investors. It also has an open $1.4 billion authorized share repurchase program available should it want to support the price of its shares further.

To combat its shrink problem, which has been a roughly 100-basis-point margin headwind for the company, management is increasing staffing in the front of stores near the checkout area. It’s also reallocating labor investments toward store-level inventory-management processes to keep the shelves stocked. 🚨

Lastly, management said they’d seen an uptick in traffic trends during the middle of the quarter, which has continued into December. Should that remain through year-end, the company could be in a solid position to beat its sales guidance for the first time in many quarters.

$DG shares fell about 1% after failing to hold earlier gains. 🔻