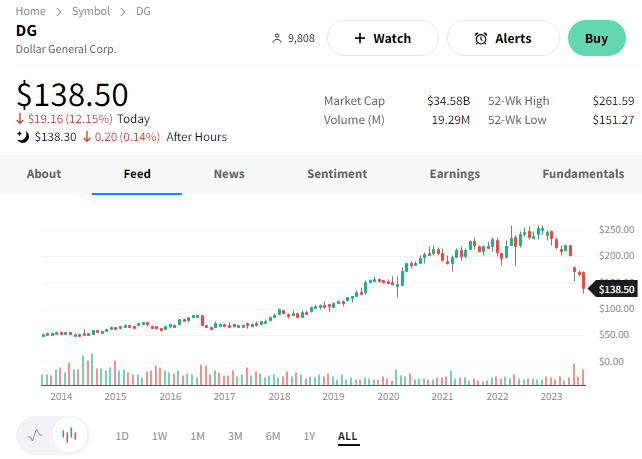

We last discussed Dollar General in June when a spending slump weighed on its earnings results. And unfortunately for shareholders, its share price continued its retreat today after another set of weak results. ☹️

The discount retailer reported $2.13 in earnings per share on $9.796 billion in revenues. Both numbers trailed estimates of $2.47 and $9.926 billion. Same-store sales also declined 0.1% vs. expectations for a 0.9% increase. 👎

Its core lower-income consumer remains challenged in the current economic environment, pulling back discretionary spending and focusing on essentials. That product mix, increased shrink, and lower inventory markups weighed on gross profit margins, which fell 126 bps YoY to 31.40%.

Higher average transaction amounts and positive contributions from new stores partially offset lower traffic volumes at existing stores.

Looking ahead, executives reduced their guidance. They now expect full-year sales to rise 1.3%-3.3% vs. previous guidance of 3.5%-5%. They also expect earnings per share to decline 22%-34% YoY vs. prior guidance for a 0%-8% decline. 🔮

Like other retailers, the company faces several headwinds but is still sticking to its longer-term investment strategy. It’s making some adjustments to address the near-term challenges but believes it will be positioned well for when the environment improves.

Unfortunately, investors are not feeling as patient as management, abandoning ship as $DG shares slid another 12% today. 📉

While discussing consumer goods, Hormel and Campbell Soup’s results are worth noting. 👀

Campbell Soup Co. matched profit expectations and beat revenue estimates after a 10% price increase offset a 5% decline in volume and mix. Its guidance now looks for fiscal 2024 sales growth of negative 5% to positive 1.5% as demand and its pricing power both wane. 🥫

As for Hormel Foods, lower pork and turkey prices combined with sluggish demand in China contributed to a double miss. It now expects full-year sales to be flat to down 4% YoY, down from previous guidance of 1%-3% growth as high input costs and reduced pricing power hurt results. 🥓

Lower volumes remain a theme across most industries. So, if a company doesn’t have pricing power, they’re facing a double-whammy and will likely continue to through year-end.