Last night, the Bank of Japan pulled a ‘Hold My Beer’ moment on the FX (foreign exchange) markets and all asset classes. 🍻

The BoJ caught everyone off guard with a change in its YCC (Yield Curve Control) policy, which now allows the 10-year JPY bond to move 50 points either way of its 0% target.

The move tanked the Nikkei lower at its close by -2.25%. And the YCC change slaughtered any JPY foreign currency (FX) pairs like the GBPJPY, which was down -4.62% at one point… that’s around 770ish pips.

For FX traders, a 770 pip move in a single day is the definition of a WTF IS HAPPENING OMGOMGOMGOMGOMG moment. This is another example of why currency traders call the Yen the widow maker. 🥶

A Moment Of Silence For The Professional Money Short On The Yen

The Commitment Of Traders (COT) Report from last Friday (December 16) shows that professional speculators were/are heavily on the short side of the Yen.

Most of the time, traders, analysts, and investors have some ‘idea’ of what a central bank will or won’t do.

That being said, what the BoJ did last night was almost out of nowhere. But not entirely.

Japan DID Warn Everyone, Twice

In September, the BoJ intervened in the FX markets for the first time since 1998.

And shockingly, they did it again in October after the markets hit a 32-year low. PM Kishida and the MoF’s top FX diplomat previously established that they’re not gonna eff around. Last night, someone in charge told the PM, “watashi no bīru o mottete” – hold my beer.

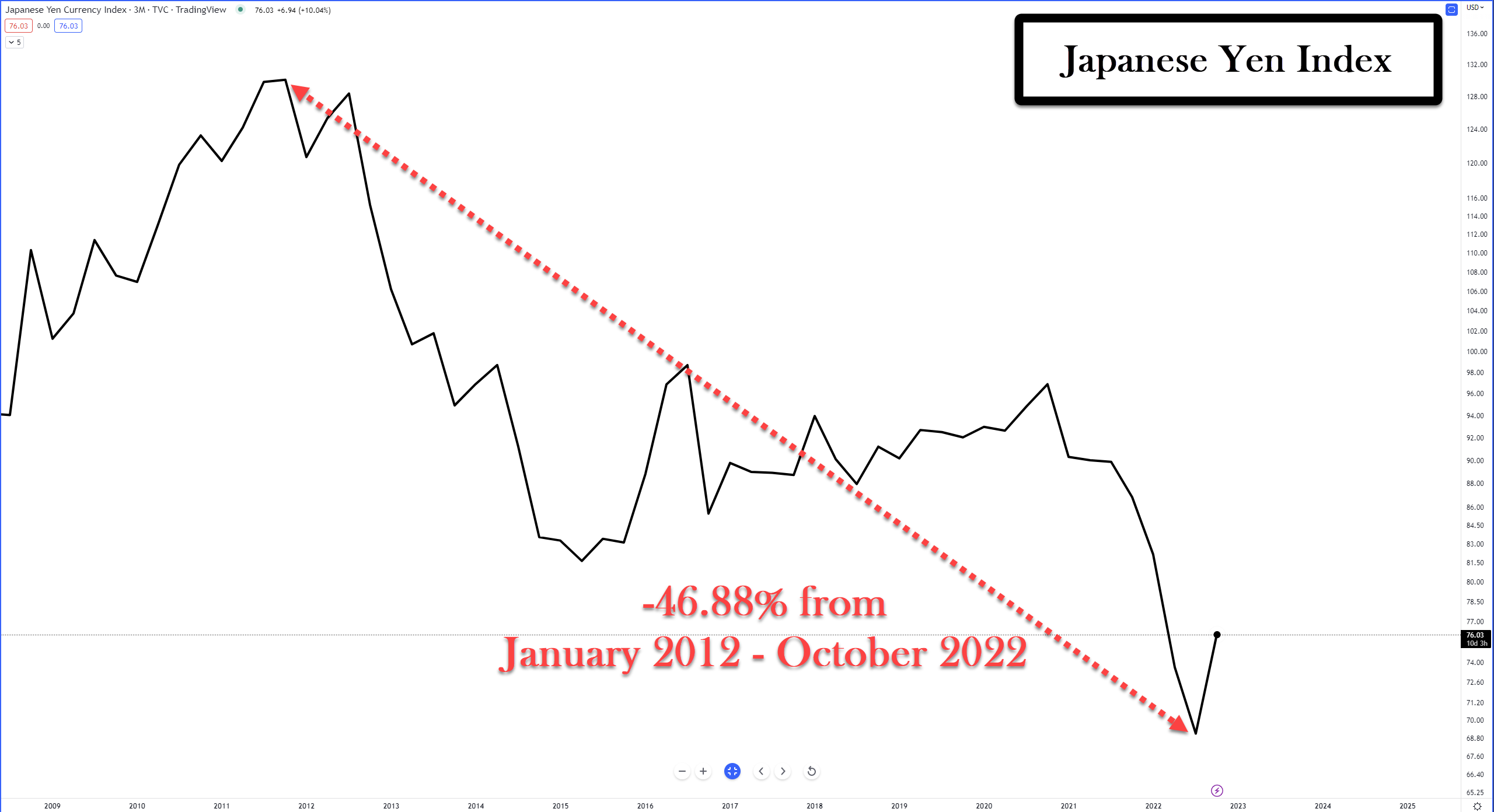

Here’s the Yen Index. It’s the Yen version of the Dollar Index:

Ugly, right? But analysts think the chart below is probably what the BoJ and the Ministry of Finance (MoF) have been looking at:

This is one of the scariest looking charts out there because the Yen matters a lot.

The Yen Matters

Japan is the third-largest economy in the world. Its currency is one of the most important currencies on the planet as a source of safety in times of uncertainty.

In the FX markets, the Yen is the third-most-traded currency after the U.S. Dollar and the Euro.

The stock market trades, on average, between an estimated $450 billion to $500 billion a day. That’s a lot of money, but it’s nothing compared to how much is traded in the FX markets.

Care to guess? 6.6 trillion. The forex market is the most-traded market in the world.

What makes the Yen attractive to speculators and investors alike is the income-generating potential of the currency carry trade, or the Yen Carry.

The Carry Trade

In a nutshell, a currency carry trade involves buying a high-interest currency with a low-yielding currency, with the difference paid out at the end of every day (the rollover).

For example: You go long on the USDJPY pair worth $100,000 because the USD has an interest rate of 4.5%, but the Yen is at -0.10% and you want to hold it for a year.

You receive daily interest on the carry trade of $12.60, or $4,600 a year.

Analysts believe the BoJ just put bond, stock, currency, and commodity markets on notice. There will be more to watch in the weeks ahead. Be careful out there, ladies and gents. 💀