Home country bias is a big issue among investors, where investors overexpose themselves to domestic equities in their investment portfolio. This plays out across the spectrum, with active short-term traders and long-term buy-and-hold investors both exhibiting this behavior. 🌎

Luckily for U.S. investors, that bias has worked out pretty well…especially since the financial crisis. However, now and again, foreign stocks make enough noise to get people’s attention. 📢

It’s unclear whether now is one of those times more broadly, but investors are beginning to notice Japan’s recent outperformance as its primary index hits nearly 33-year highs. 👀

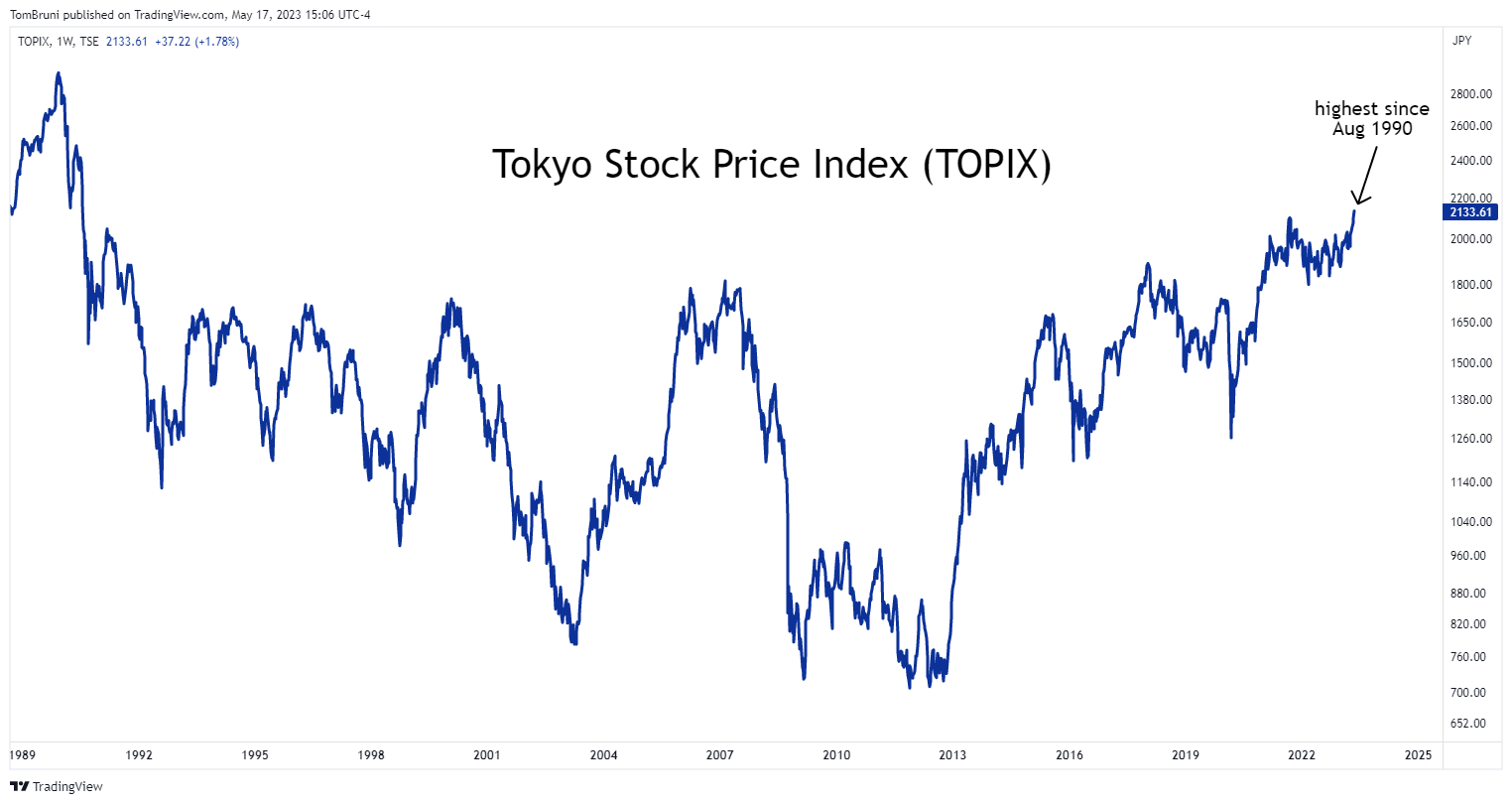

For those unfamiliar with the country’s stock market, it has two major indexes.

Its Tokyo Stock Price Index (TOPIX) is said to provide the broadest measure of the stocks listed on the Tokyo Stock Exchange. That’s because it is a free-float market-capitalization-weighted index, while the Nikkei 225 is a price-weighted index focused on the largest 225 Japanese stocks. 🔍

We clarify because sometimes their performance differs significantly. Nonetheless, the important part of today’s conversation is that both indexes are hitting new heights.

The TOPIX is back to August 1990 levels. 😮

And the Nikkei 225, although still shy of the highs it made a few months ago, is still sitting at levels not seen since mid-1990. 📈

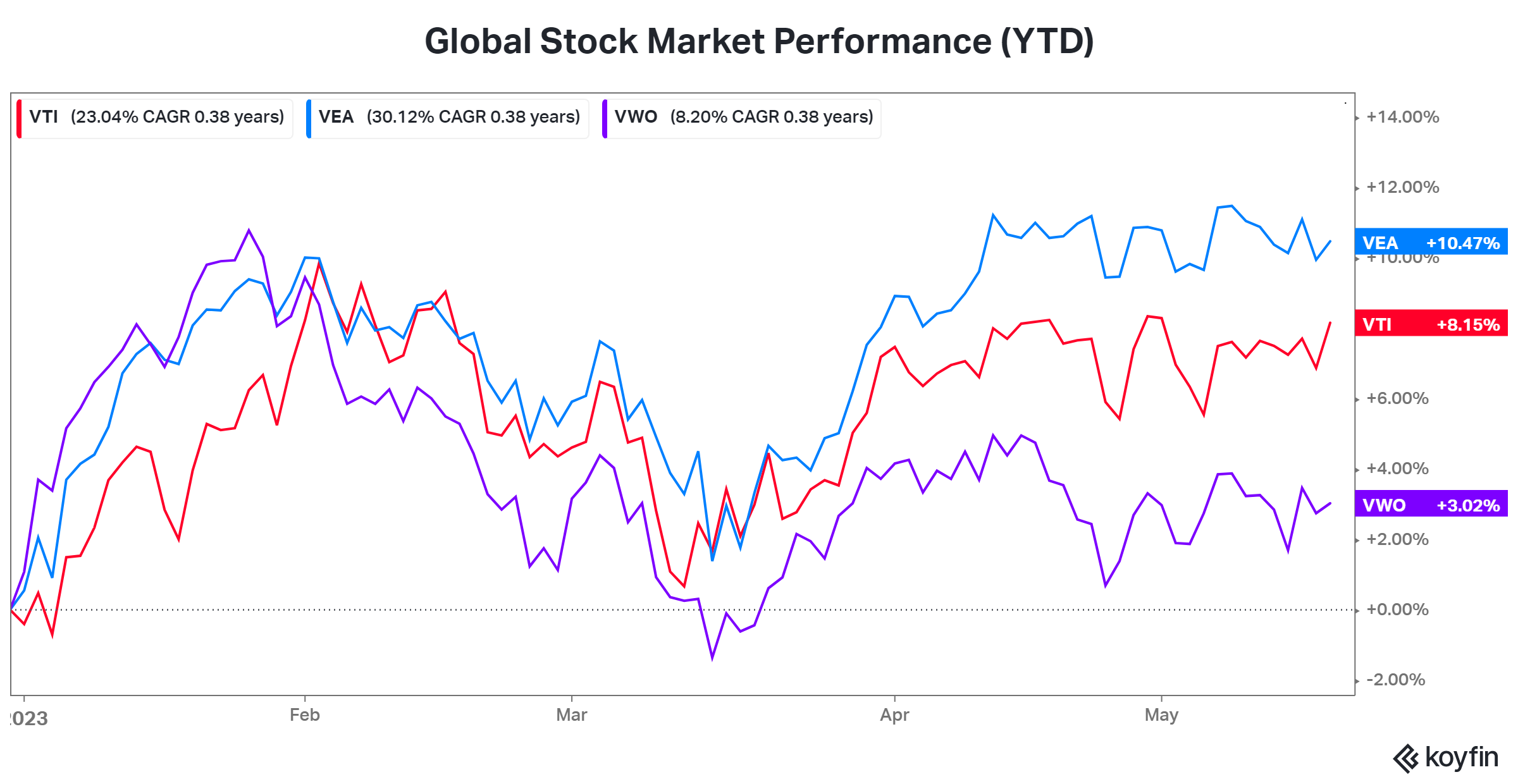

The chart below has ETFs tracking the U.S. stock market ($VTI), developed markets excluding North America ($VEA), and emerging markets ($VWO). 👇

While exposure to China has hurt emerging market stocks, exposure to Japan has helped developed markets outperform the U.S. so far this year, especially since the March bottom.

As we said, this will likely be another blip on investors’ radars this year. Until there’s significant broad-based outperformance from foreign stocks, they’re unlikely to garner much attention.

That said, some retail investors and traders are taking advantage of these overseas trends through ETFs, U.S.-listed ADRs, and other vehicles. Time will tell if their bets on Japan will continue to pay off. As always, we’ll keep you updated as this trend progresses. 👍