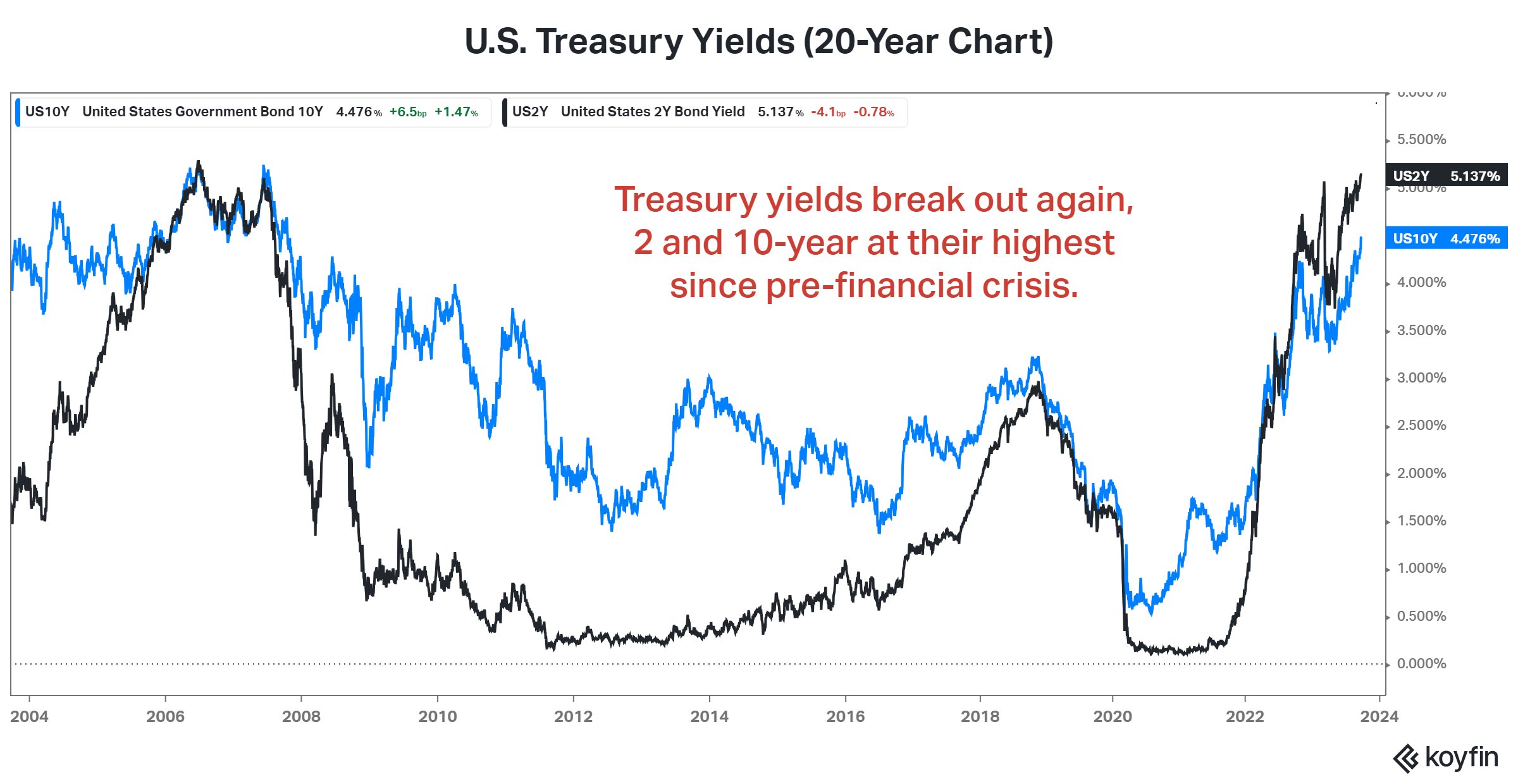

The Federal Reserve set a hawkish tone yesterday, causing U.S. Treasury yields to break out to new cycle highs. The benchmark 10-year yield touched its highest level in sixteen years as rates approached their pre-financial crisis peaks. 📈

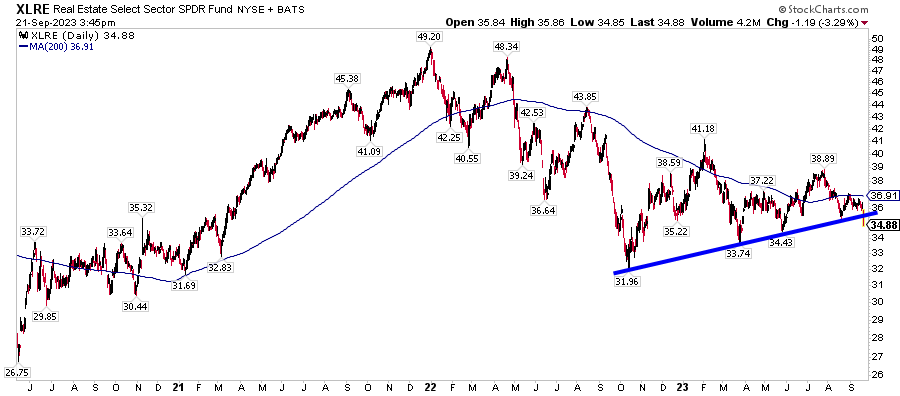

As a result, interest-rate-sensitive sectors like real estate followed bonds in their breakdown. Below is a great chart from ATMcharts, who shared his perspective on the breakdown in the real estate sector ETF. 📉

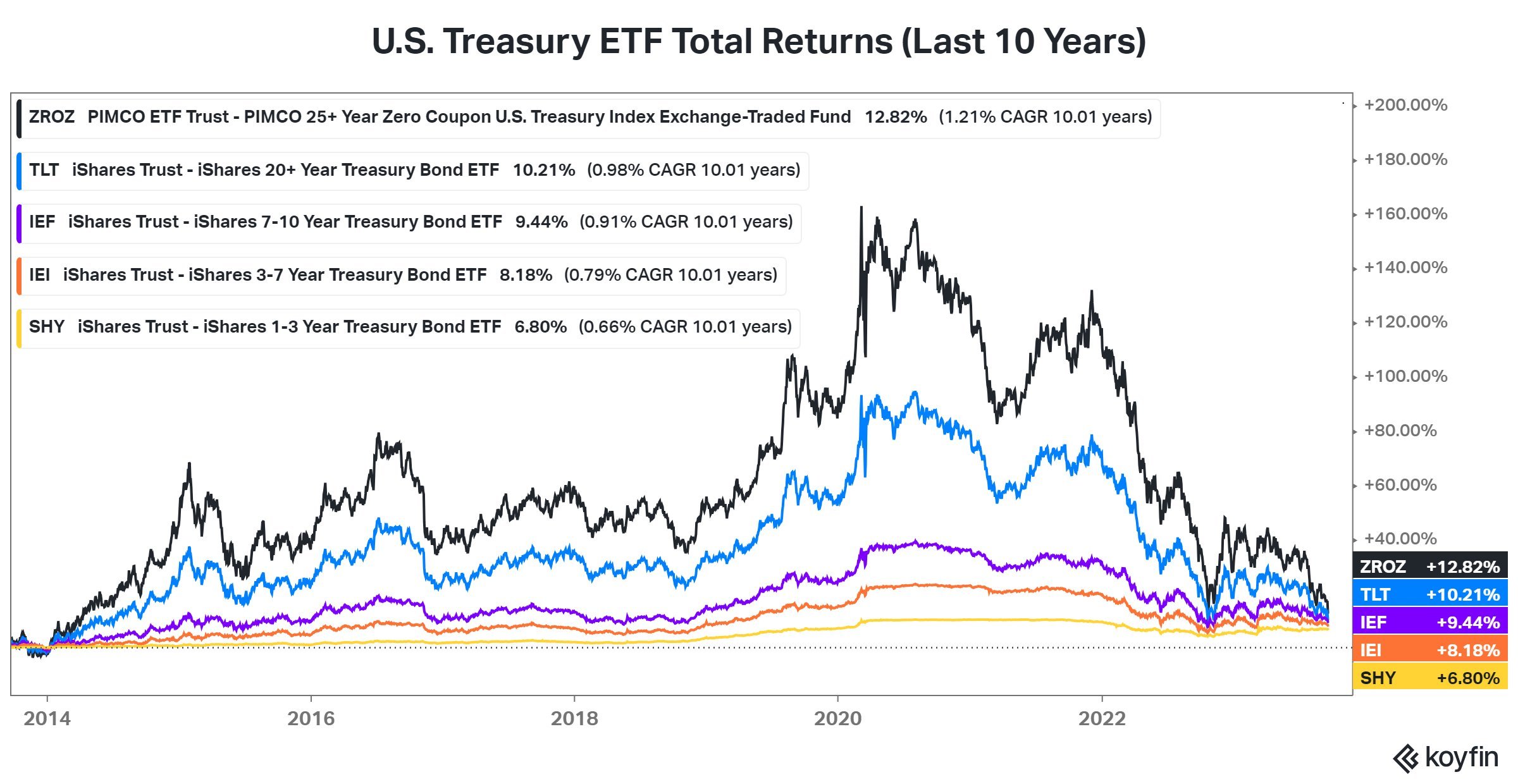

And bond ETF investors continue to feel the pain, as most of their gains from the last decade have been wiped out in just two short years. Talk about a round trip! 😱

But the U.S. central bank wasn’t the only one making its decision this week. So, let’s quickly review the other countries that announced changes. 📝

- Brazil cut rates by 50 bps to 12.75%

- Indonesia kept rates unchanged at 5.75%

- The Philippines kept rates unchanged at 6.25%

- South Africa kept rates unchanged at 8.25%

- Switzerland kept rates unchanged at 1.75%

- The U.K. kept rates unchanged at 5.25%

- China kept rates unchanged at 3.45% and 4.20%

- Norway raised rates by 25 bps to 4.25%

- Turkey raised rates by 500 bps to 30%

- Sweden raised rates by 25 bps to 4.00%

The Bank of Japan is expected to keep its negative interest rate policy intact at its meeting tonight, with most not anticipating the easy-money approach to change until at least late 2024 or 2025.

Overall, most developed market central banks have paused their rate hiking cycles after reaching a rate that they deem appropriately restrictive. However, they’re remaining hawkish in their stance, leaving further hikes on the table if inflation’s downward path does not continue. ⏯️

Over the last few months, core inflation has ticked up in several of these countries due to their economies and labor markets holding up better than anticipated. Central bankers will watch this closely as they make their future monetary policy decisions.

Meanwhile, many emerging markets have suffered major currency devaluation relative to the U.S. Dollar as their economic growth suffers. As a result, they’re having to cut rates in an attempt to stimulate growth at the risk of further reducing their currency’s attractiveness. 🔻

After years of bonds being the boring thing to talk about, they’re now the talk of the town as rates wreak havoc on the stock market’s recent gains. We’ll continue to keep you updated as these market moves develop. 👀