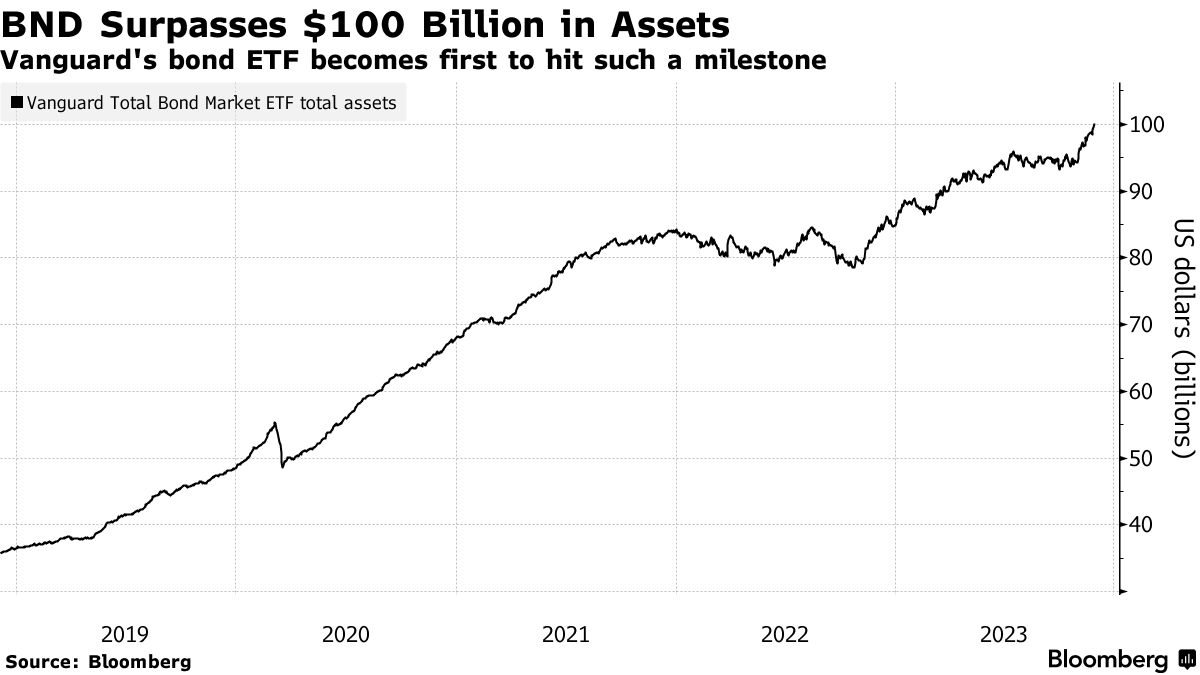

While stocks are getting all the attention lately, bonds are making history. Well, one bond ETF is. 👀

Vanguard’s Total Bond Market ETF ($BND) is the first bond exchange-traded fund to cross $100 billion in assets under management (AUM). That’s despite a massive bond rout over the last eighteen months, where prices have been pummelled in the face of higher interest rates.

However, two of this year’s biggest trends benefited the fund. The first is that investors flocked to fixed income’s higher yields, causing inflows to various fixed-income-related products like bond ETFs. Additionally, the move away from the mutual fund structures to lower-cost (and more tax-efficient) exchange-traded funds continued. 📊

The combination of these trends caused $BND to absorb $15.6 billion in net assets this year, helping it achieve this record milestone. After all, offering over 18,000 bonds for three basis points is a pretty attractive offer, especially for passive, weatherproof investor strategies.

Analysts expect this trend to continue, given the iShares Core U.S. Aggregate Bond ETF ($AGG) is close behind with $96 billion in assets. We’re not sure what the point of this story is other than highlighting a cool milestone for this less-widely-followed market. Between this and bonds’ spectacular rebound in November, “boring” investors have something to celebrate this weekend. 🥳