While the market’s four-week win streak ended, the good news is we’ve gotten some interesting data to consider. 🕵️

Let’s make lemons out of lemonade — or whatever the saying is… 🍋

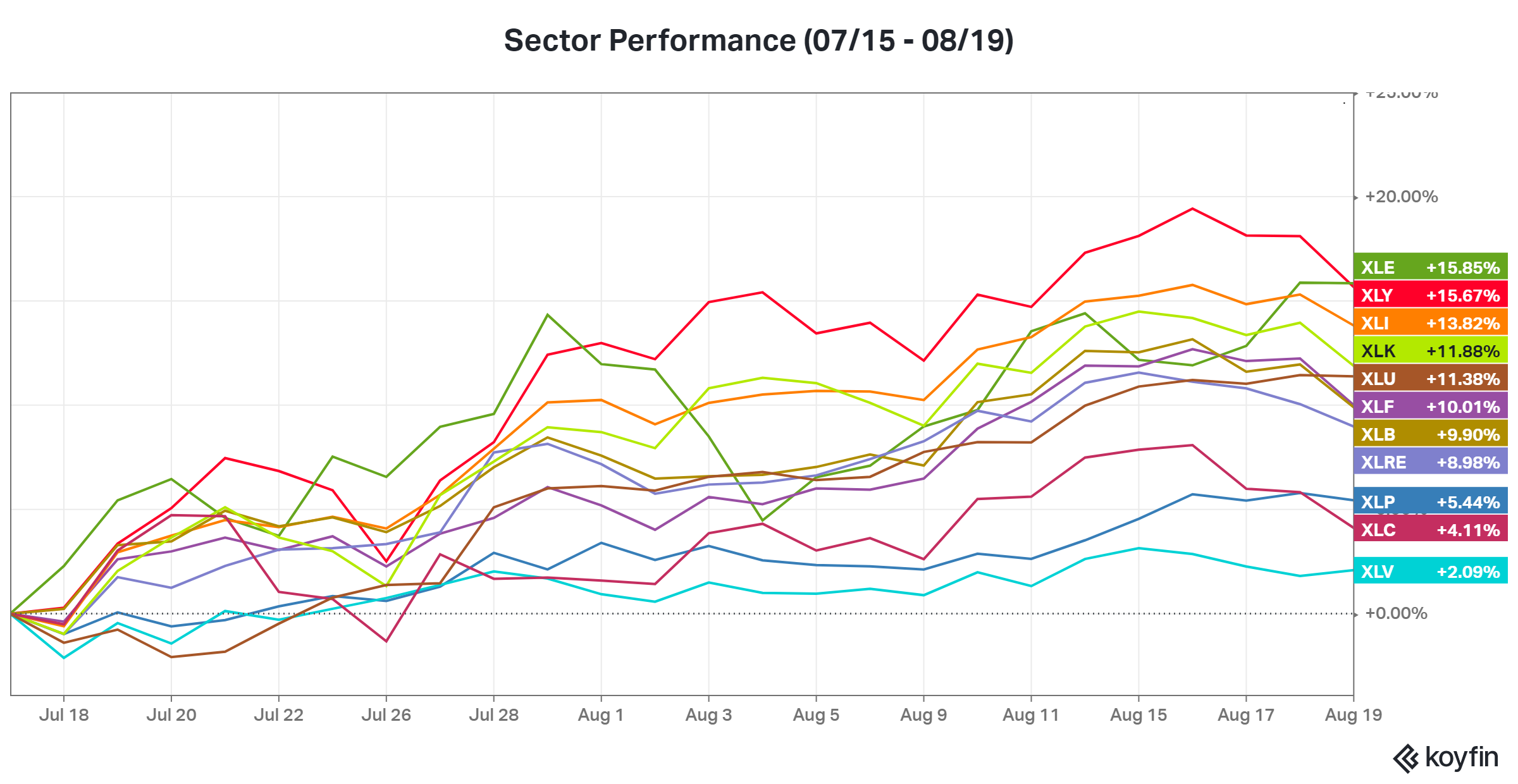

First, let’s start by looking at the eleven U.S. sector SPDR ETFs’ performance from July 15th through today, which includes four up weeks and one down. In terms of major winners, we had energy (XLE), consumer discretionary (XLY), industrials ($XLI), and technology (XLK). And the losers were health care (XLV), communication services (XLC), and consumer staples (XLP).

The risk-on sectors rallied significantly during this period, while defensive sectors lagged. 🤔

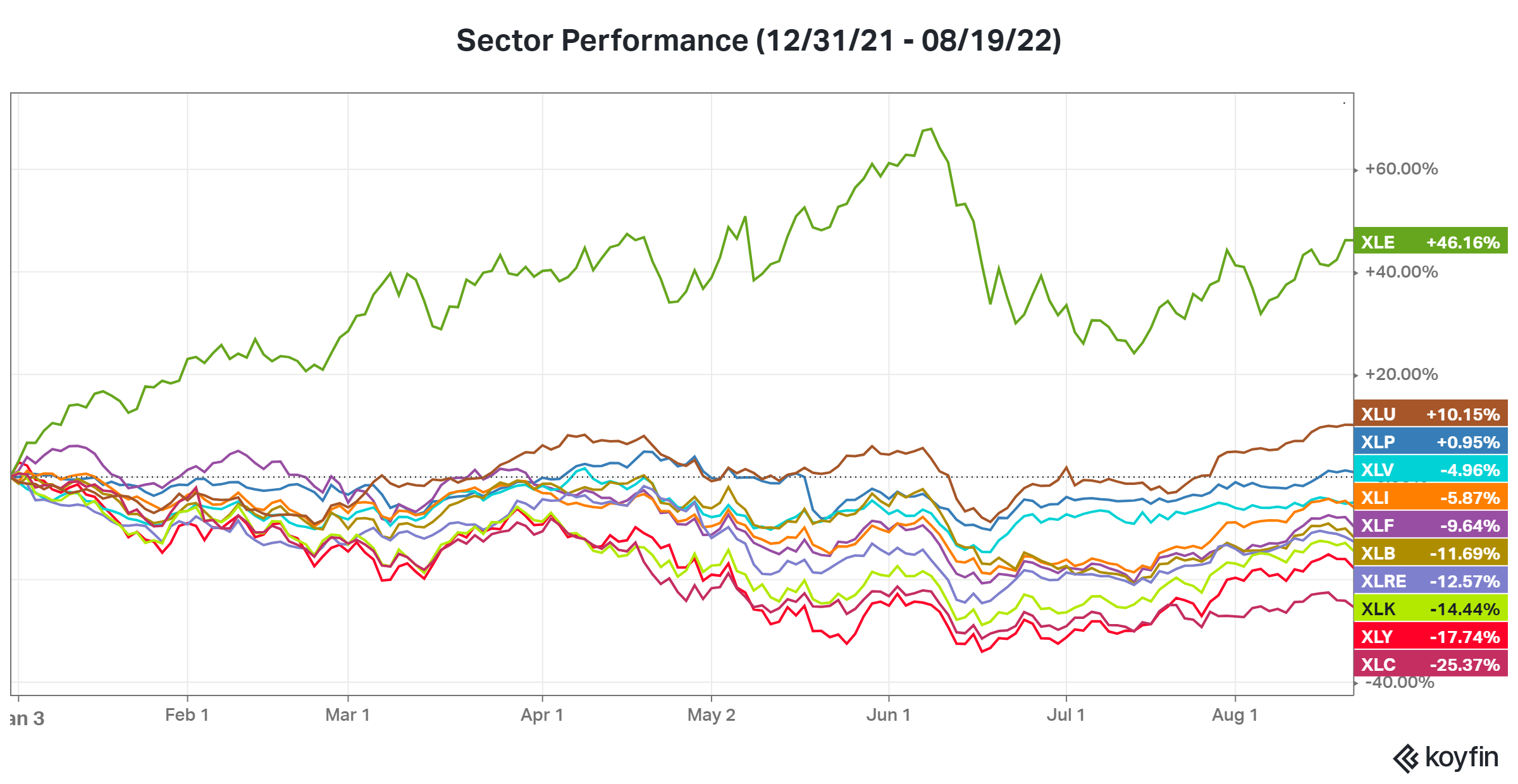

Meanwhile, if we look at the year-to-date performance of these sectors, we see a very different picture. Some of the top winners (excluding energy) were the defensive sectors like utilities, consumer staples, and health care. And some of the biggest losers were the risk-on sectors of the market like communication services, consumer discretionary, and technology. 👀

Some technical analysts point to this data as evidence that the recent rally was nothing more than a bear-market rally. 💭

They argue that the risk-on areas only rallied the most over the last five weeks because they were hit hardest year-to-date. They also suggest that the defensive sectors holding up best throughout the year is continued evidence that institutions are positioned for more downside.

Because if you’re bearish on the market and the economy, you’d probably be investing in toothpaste and utility companies, not high-flying growth names, right?

Whether or not they’re reading too much into this data remains to be seen, but we wanted to pass it along so you could draw your own conclusions. 🤷♂️