Two weeks ago, we updated the roadmap many technical analysts are using to navigate the current market as the S&P 500 and other major indexes looked for support. Since then, prices breached several key levels before popping back above them this week, so it’s worth an update. 👀

Below, we can see the S&P 500 ETF $SPY briefly breaking below several key levels, including the May breakout level, VWAPs from its ’22 high and low, and the 200-day moving average. With sentiment stretched and Powell giving the bond market a breather, prices have quickly reclaimed all those levels. Now, traders are watching how high prices get before seeing sellers step back in again. 🧭

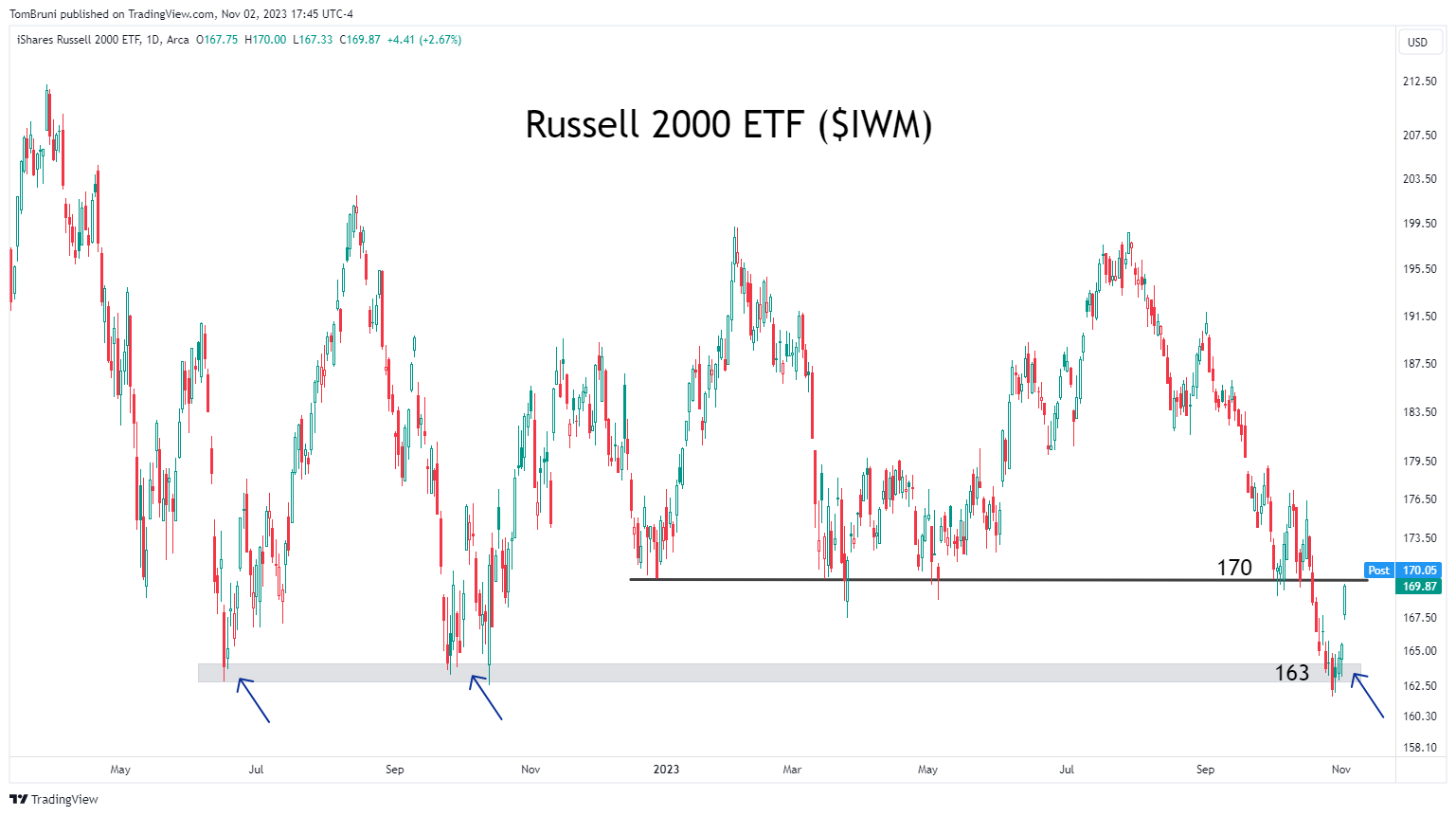

The same thing happened in the small-cap Russell 2000 ETF $IWM, which made three-year lows before quickly reversing back above its previous lows. Whether it can get back up to the top of its range from the last 15 or 18 months remains to be seen. But buyers once again saved themselves right where many expected. 😮💨

Investors and traders will be watching these charts closely into year-end. It got a little shifty there, but for now, the bulls are doing their best to move the ball forward. 🐂