In light of Tesla’s 3-for-1 stock split this week, let’s review all things stock split.

For those who may need a quick refresher, there are two types of stock splits: conventional and reverse. A conventional stock split, such as Tesla’s 3-for-1, increases the number of shares available in the market by splitting each single share by 3, making each post-split share worth ⅓ of its value before the split. A reverse split does just the opposite. After a reverse stock split, 1 share of the company post-split is worth 3 shares before the split.

You may be asking – why do companies bother with stock splits? Companies tend to conduct conventional stock splits when their individual shares get too expensive. Typically, a stock split is considered a bullish signal because more shares at a lower price may entice new buyers who lacked demand when the share price used to be too high, driving each post-split share price up and increasing the company’s total market cap. 💸

That being said, it’s important to remember that conventional stock splits do not always result in higher demand for shares after the stock split.

Companies conduct reverse stock splits for the opposite reason. When a company’s share price sinks too low, shares could be at risk for delisting because each exchange has a minimum per-share required price in order to remain listed.

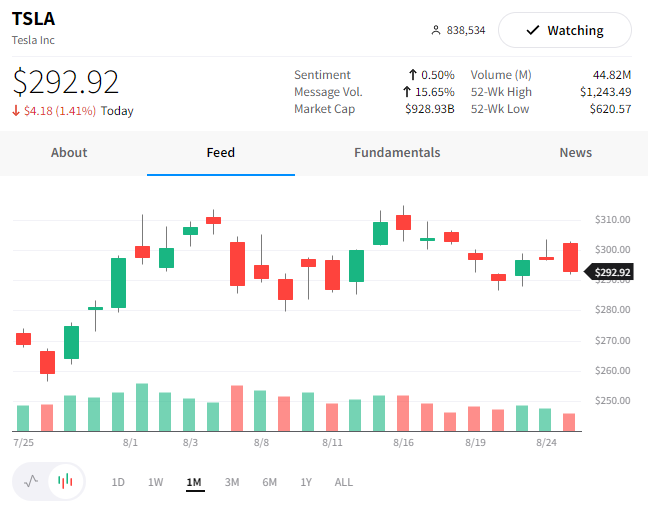

According to Tesla, the company decided to complete its 3-for-1 stock split in an effort to: 1. “offer every [Tesla] employee the option of receiving equity” 2. “reset the market price” and 3. provide Tesla employees with “flexibility in managing their equity.” The company’s board likely approved the stock split to aid $TSLA‘s struggling share price this year. Although $TSLA stock has recovered some of its losses this month, the company’s shares are still down 17% since January. Other large companies, including Alphabet and Amazon, also conducted stock splits this year to help broaden their investor base.

If you owned 1 share of Tesla before today’s split, you are now the owner of 3 $TSLA shares, each worth roughly ⅓ of 1 $TSLA share yesterday. And remember what we said about stock splits not always driving up the share price? $TSLA closed down today and is at the same level as August 5th when it announced the split. So take that info as you may…🤷