Nvidia earnings re-ignited the animal spirits in the market, causing the stock and major indexes to reach several new milestones. Let’s check’em out. 👇

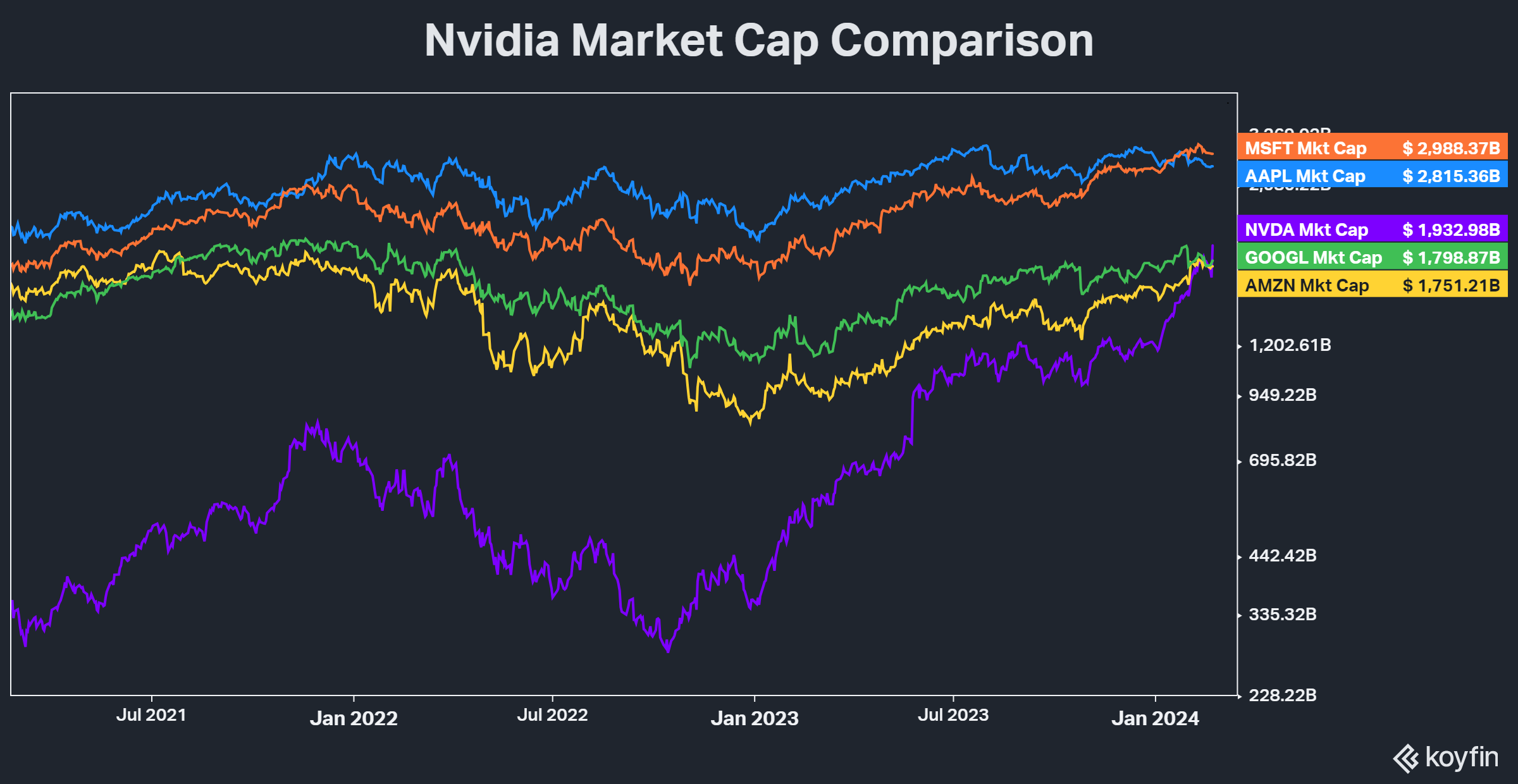

Firstly, a 16% rise in the stock today caused its market cap to rise $277 billion, the largest one-day increase of any stock in history. Secondly, today’s move put it firmly ahead of Google and Amazon as the fourth-largest stock in the world (Saudi Aramco not pictured below). It also moved it a stone’s throw away from $2 trillion. 🤩

The strength in Nvidia also helped push the Nasdaq 100 and S&P 500 to new all-time highs. But it’s not just the U.S. indexes experiencing a major bull run. 🌏

One of the markets we’ve been talking about for well over a year is Japan’s Nikkei 225. After 34 years, the index has made a new all-time high as low interest rates continue to drive the country’s currency lower and its stock market higher. 💴

In addition, India’s Nifty 50, Germany’s DAX, France’s CAC 40, and several other global stock market indexes made new all-time highs. While the bears continue to argue about the stock market’s valuation and breadth, the global bull market continues to rip-roar higher. 🐂

Eventually, it will come to an end; it always does. But for right now, there doesn’t seem to be a clear catalyst to stop this runaway bull market. Especially if tech stocks continue to deliver the goods… 🤷