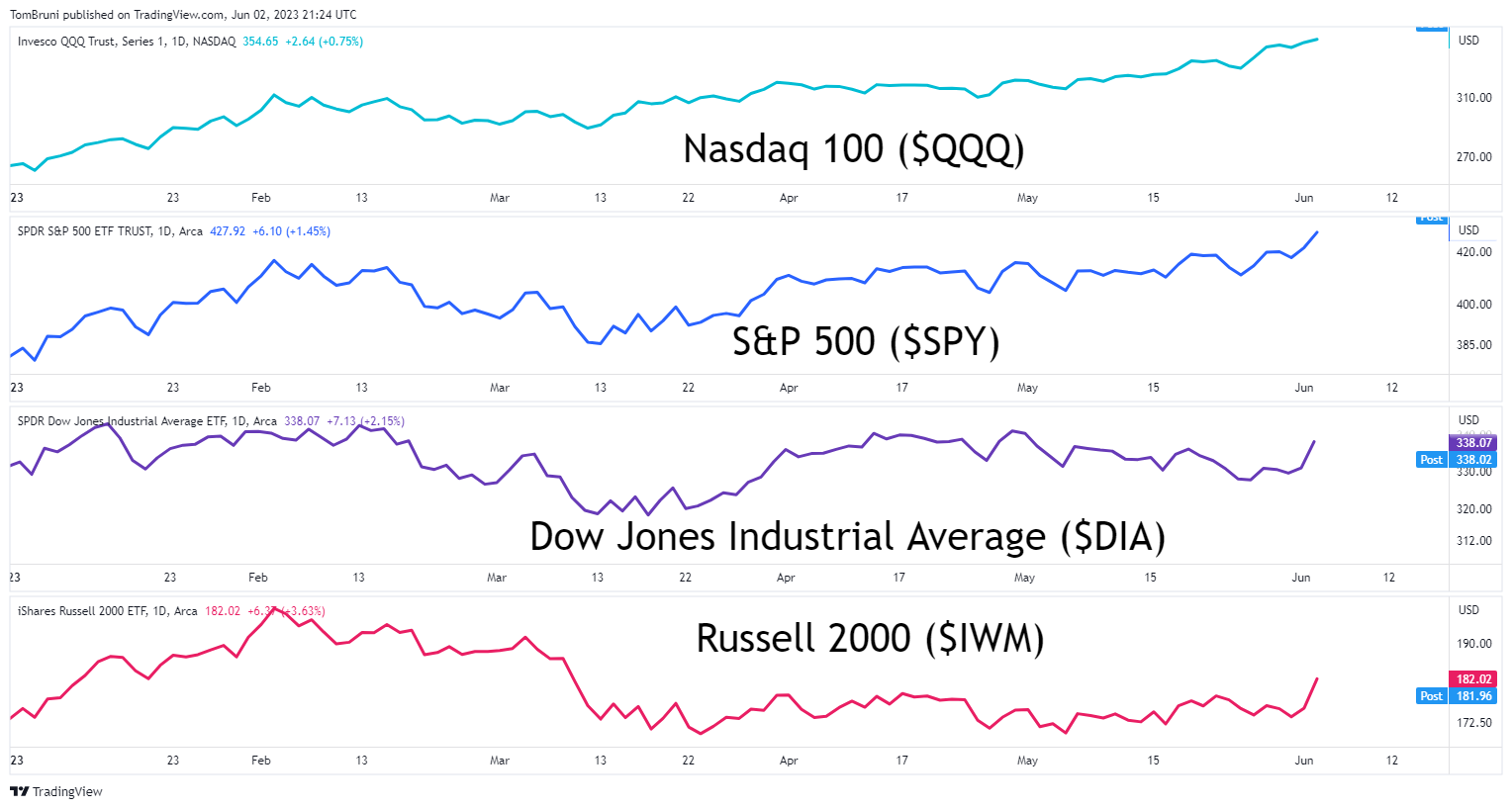

By far, the most talked about chart today was the S&P 500, which broke out to a new year-to-date high. The index joins the Nasdaq 100, which has been leading the U.S. stock market higher, marking two of the four major indexes breaking out. 📈

Bullish investors view this as a broadening out of market participation and the potential nail in the coffin of the “bear market” narrative. However, bearish investors suggest that the overlap between holdings skews the results, as only a few mega-cap stocks account for most of the gains. 🐻🐂

Regardless of your side, all eyes are on whether the Dow Jones Industrial Average and Russell 2000 begin to play catch up. Both indexes have lagged their counterparts off their October lows, so the bulls want to see them play catch up. The more stocks that are participating, the better the argument for a “new bull market” becomes.

That’s particularly true of the small-cap Russell 2000, which has been sitting near year-to-date lows since March. Whether or not today’s 3.63% rally in the index is the start of its move higher remains to be seen. Rest assured, investors will be watching this development in the coming weeks. 👀