Just nine months ago, markets were pricing in the end of the world as we know it. Some high-flying tech stocks fell over 90% from their peaks, and the market believed a recession in 2023 was all but guaranteed. Fast forward to today, and we’re in a totally different environment, with stocks having their best first half in decades and the market expecting gains to continue. 🤯

Technical analysts tend to say, “Nothing changes sentiment like price.” And boy, is that applicable lately. A stunning example of this is with online car retailer Carvana, which has been on one heck of a ride.

In December of last year, all the headlines were about the company potentially going bankrupt. The stock had crashed about 99% from its all-time highs just a year earlier. And short sellers were pressing their bets that this company was a zero. Since it bottomed in January, prices have rallied some 1500%, and the goods news is rolling in. Today the company reported a debt restructuring agreement and better-than-expected second-quarter results. 📈

The craziest part about this story is that, despite its massive rally, it’s still down 85% from all-time highs. Returning to those former highs would require another 550%+ return from current levels. Whether or not shares eventually get there is everyone’s big question. But we share this story because it’s not unique to Carvana.

Many stocks and market indexes have experienced sharp gains during the last few months, and the consensus view has slowly shifted from bearish to bullish. Measures of volatility and “fear,” like the CBOE Volatility Index ($VIX), are sitting near multi-year lows, and equity ETF flows have finally turned positive. 👍

Although many point to improving economic outlook as the primary driver, the true answer may be as simple as it always is. Fear and greed cause people to sell stocks when they’re going down and buy them when they’re going up. And right now, they’re going up. 🧠

As always, the markets oscillate between extremes and eventually trend back toward “the fundamental reality” over time. Just as the pessimism that took over last year was disconnected from reality, the levels markets reach on the back of this optimistic wave likely will be too.

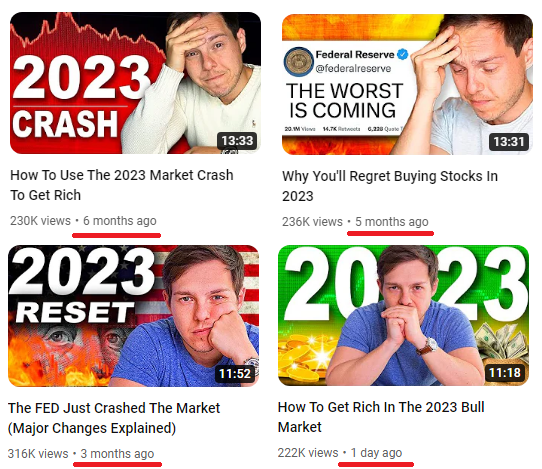

For now, there hasn’t been a risk significant enough to derail the bulls, but eventually, it will come. It always does. And if you need any other evidence that price is the best driver of sentiment, check out the shift in mainstream YouTuber headlines that’s taken place over the last six months. 🤦

Market psychology sure is a beautiful thing. Can’t wait to see what the back half of 2023 brings. 👀