The stock market had quite a run through the end of July before hitting some turbulence in August. But as we look ahead at what’s next for the market, investors are searching for the leaders of tomorrow. 🕵️♂️

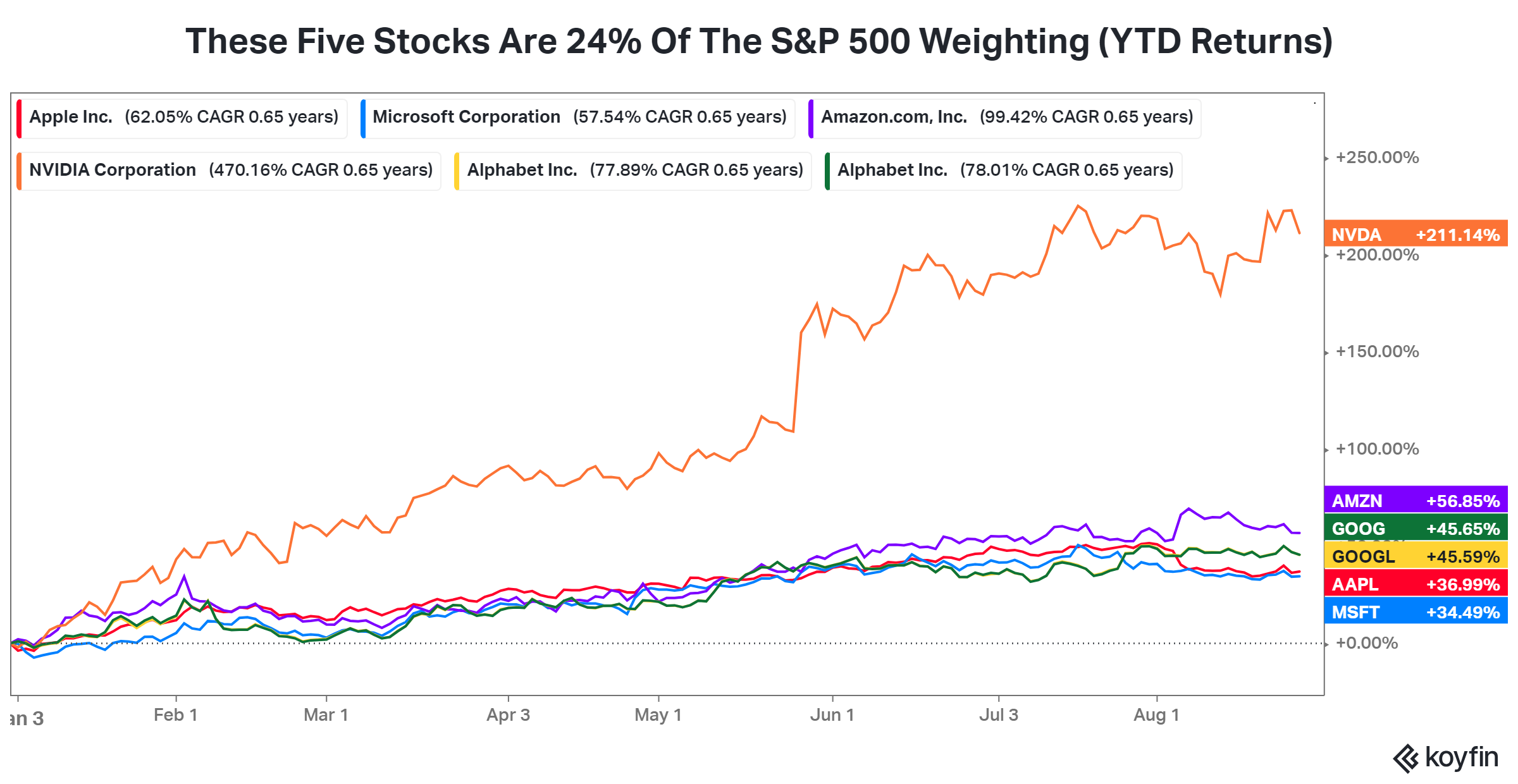

So far in 2023, the top 5 stocks in the S&P 500 have added more than $3 trillion to their market capitalizations and now account for roughly 24% of the index’s weighting. 🤩

Despite earnings that beat expectations, many of these stocks experienced lackluster reactions from the market following their reports. The most recent example is Nvidia, which briefly soared above $500 before dipping back into the mid-$400s. 🔻

Now, the fear is that growth expectations for these companies are too high, leaving little room for their stock price to grow even if their businesses meet their high bars. Others fear that these names could be running out of things to invest their vast cash piles in, instead choosing to return capital in the form of buybacks. 💸

With all of these stocks already up over 30% year-to-date (and Nvidia up bigly), where will the next leg of leadership come from? Some are pointing to cyclical sectors like industrials and financials. However, given their smaller weights in the index, they’d have to rally sharply to offset weakness in the tech and consumer discretionary sectors.

Time will tell, but this (along with the path of interest rates) is the critical question on everyone’s minds as we head into year-end. 🤔