Thanksgiving is often a time we reconnect with friends and family we may not see often, and almost no topic is off-limits. 🗫

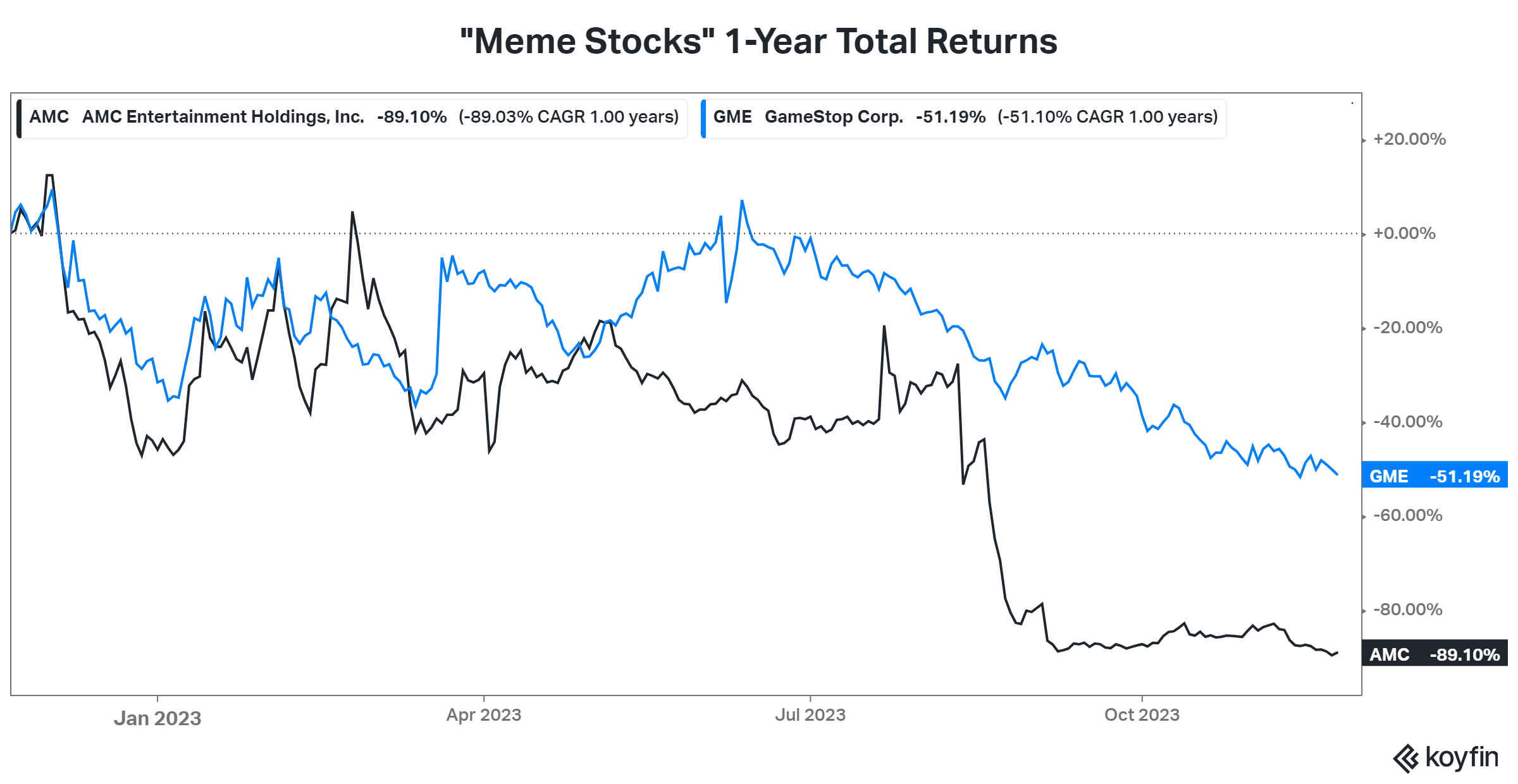

However, traditional meme stocks like AMC Entertainment and GameStop will unlikely be making the rounds for the second straight year. While they were hot topics back in 2020 and 2021, lackluster performance has seen them fall to the wayside of other more trending assets.

For example, over the last year, AMC is down 89%, and GameStop has been cut in half. And data from various platforms suggests that retail investor interest and sentiment have waned as market participants look for opportunities elsewhere. 🕵️♂️

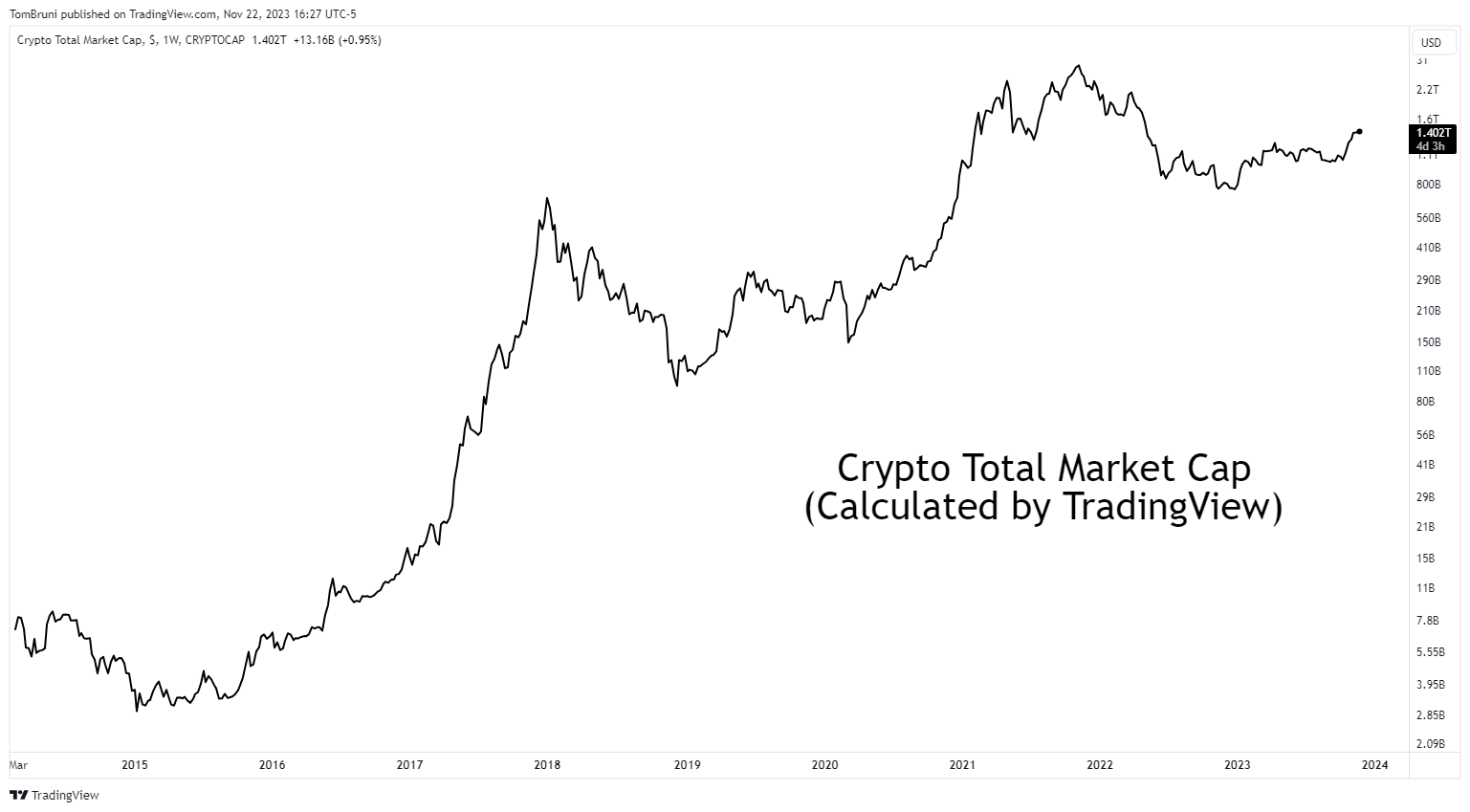

One of those areas they’re looking for opportunity is the crypto market, which has seen its total market cap surge over 60% in the last year. While U.S. regulators have done their best to continue cracking down on crypto, the market has remained resilient and is one of the best-performing asset classes this year. ₿

For those of you who need a refresher on crypto, our Litepaper newsletter has two introductory lessons for you (Crypto 101 and Blcokchain 101). 📝

Regardless of what markets you discuss this Thanksgiving, we want to hear about it. Make sure to hop on the streams to share what you learned and tag @Stocktwits so we can follow along! 📱