While everyone is focused on technology stocks, another market sector has been performing quite well. That sector is industrials, which includes everything from aerospace & defense to machinery, ground transportation, and more. 🏭

The cyclical sector is also a widely-watched proxy for how investors feel about the economy. After all, if the economy is going to grow, these types of companies are needed to help produce, ship, and deliver the goods. And right now, investors are apparently bullish on their outlook because sector ETF $XLI broke out to new highs late last year and hasn’t looked back. 📈

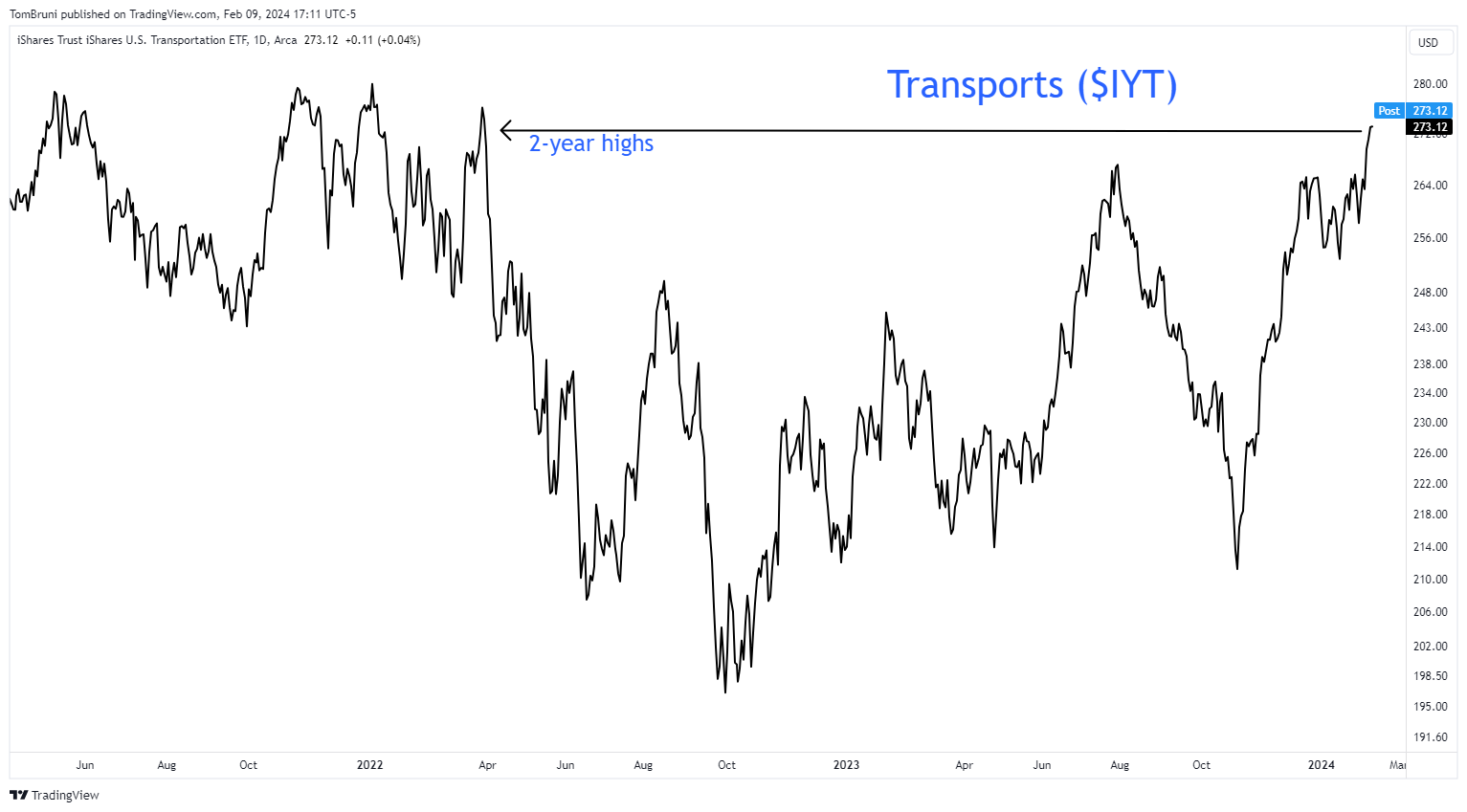

Helping drive this strength is the transportation industry. The $IYT ETF that tracks the Dow Jones Transportation Average is pushing to 2-year highs, with traders watching to see if it can follow the broader industrial sector to new all-time highs. ✈️

Technical analysts say these developments are a positive sign for the broader market. “Offensive” sectors like industrials show that investors are willing to take on more risk in their portfolios rather than hide in “defensive” sectors like consumer staples or utilities. 🤑

On top of that, old-school “Dow Theorists” look for the Dow Jones Industrial Average and Dow Jones Transportation Average to confirm each other. In other words, if one is trending and making new highs, they want to see the other follow. The fundamental reasoning behind this theory is that the industrial average holds companies that make the goods, while the transportation average holds companies that ship the goods. 🤝

You need companies from both sides of the aisle to support the economy, so they should both perform well if the economy is good (and vice versa).

As always, time will tell if the optimism is warranted. But for now, market bulls believe the stock market and economy will continue on their upward trajectory for the foreseeable future. 🐂