Advertisement|Remove ads.

Fidelity National Financial Stock Gains Aftermarket On Upbeat Q4 Profit, Retail Stays Bearish

Fidelity National Financial (FNF) stock rose 1.3% in aftermarket trade as the company’s fourth-quarter earnings topped Wall Street’s estimates.

According to FinChat data, the company reported adjusted earnings of $366 million, or $1.34 per share, while analysts, on average, expected it to post earnings of $1.21 per share.

It also reported a net income of $450 million, or $1.65 per share, for the three months ended Dec. 31, compared with a loss of $69 million, or $0.25 per share.

Fidelity National primarily provides title insurance and settlement services to the real estate and mortgage industries.

The Jacksonville, Florida-based company’s fourth-quarter revenue of $3.62 billion topped Wall Street’s estimated $3.33 billion.

The company said revenue at its Titles segment, which contains title insurance underwriters and related businesses, rose to $2 billion, from $1.7 billion last year.

Its direct title premiums increased by 28% to $625 million, while agency title premiums grew 27% to $787 million.

Revenue at its unit F&G, which provides insurance solutions to retail annuity and life customers, remained flat compared to last year.

Its assets under management in the F&G segment rose by 10% to $53.8 billion driven by retained new business flows.

“Our Title segment has significantly outperformed the prior cycle troughs and is well positioned for the eventual upturn in the residential housing market once mortgage interest rates begin to normalize,” Chairman William Foley said.

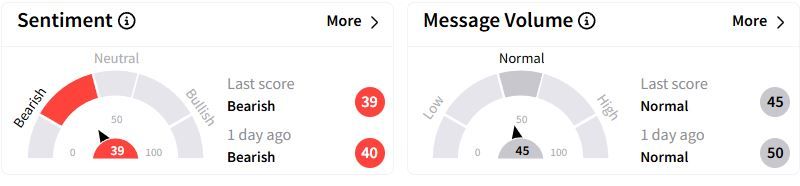

Retail sentiment on Stocktwits stayed in the ‘bearish’ (39/100) territory, while retail chatter remained ‘normal.’

Over the past year, Fidelity National Financial stock has gained 10.7%.

Also See: Block Tumbles After-Hours On Q4 Earnings Miss, But Retail Spots A Buying Window

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)