Advertisement|Remove ads.

Block Tumbles After-Hours On Q4 Earnings Miss, But Retail Spots A Buying Window

Block Inc (XYZ) stock fell 6.9% in aftermarket trade on Friday after the company’s fourth-quarter earnings missed Wall Street’s estimates.

According to FinChat data, the payments firm reported adjusted earnings of $0.71 per share for the fourth quarter, while analysts, on average, expected the company to post $0.87 per share in earnings.

The company reported an operating income of $13 million compared to a year-ago loss of $131 million. However, operating income fell from $323 million during the third quarter.

Its bitcoin segment revenue fell to $2.43 billion during the fourth quarter from $2.52 billion last year.

Transaction-based revenue in its Cash app fell to $74.6 million, compared with $109 million in the year-ago quarter.

However, the company said its gross payment volume improved by 10%, driven by a

combination of improved same-store growth and improved seller retention.

Total inflows in its Cash app increased 14% in 2024 compared to last year.

The company projected at least 15% gross profit growth in 2025 compared to last year, with growth for Cash app and Square expected to improve meaningfully in the back half of the year.

CEO Jack Dorsey said that the company would invest heavily in building applied artificial intelligence tools to ‘remove the toil of mechanical tasks’ for both the company and its customers.

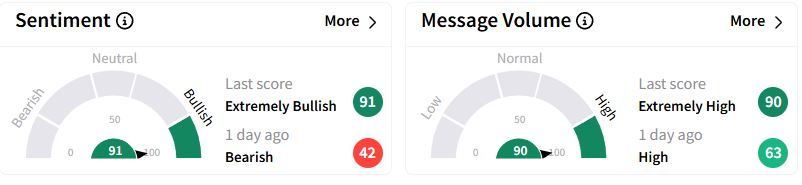

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (91/100) territory from ‘bearish’(42/100) a day ago, while retail chatter rose to ‘extremely high.'

Some users viewed the dip in share prices as a buying opportunity as they expected a rebound.

Over the past year, Block shares have gained 26.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)