Advertisement|Remove ads.

Aurinia Pharmaceuticals Stock Soars After Earnings Beat, Strategic Overhaul: Retail Sentiment Turns Extremely Bullish

Shares of Aurinia Pharmaceuticals Inc. ($AUPH) surged more than 12% on Thursday morning after the company announced changes to its board of directors and plans to slash nearly half of its workforce

The stock is currently ranked second among the top 10 trending stocks on Stocktwits.

During its third-quarter earnings before the bell, the Canadian biotech company reported earnings of $0.10 per share, beating the estimated $0.01 earnings per share by a wide margin.

Its revenue came in at $67.77 million, over and above the estimated $57.48 million.

Aurinia also unveiled details about its strategic overhaul that will slash 45% of the company’s entire workforce. The company expects the trimming will save it more than $40 million in annual operating expenses.

The cost savings will strengthen Aurinia’s financial position and “provide more flexibility to engage in future business building activities,” CEO Peter Greenleaf said during the second quarter earnings call.

This is the second round of layoffs at Aurinia in less than a year. Back in February, reduced its headcount by about 25%.

The move will allow the company to focus on the commercialization of its lupus nephritis drug Lupkynis and the development of AUR200, an autoimmune disease candidate that Aurinia had discontinued earlier this year.

Greenleaf called AUR200 an “important pipeline product” during the earnings call.

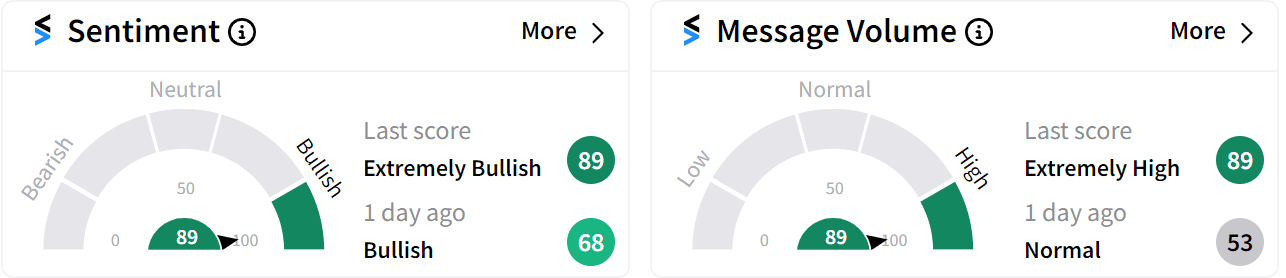

Retail sentiment around the stock jumped into the ‘extremely bullish’ (89/100) territory, supported by ‘extremely high’ (89/100) message volume.

The strategic overhaul comes amid a period of turbulence for CEO Peter Greenleaf, whose leadership was questioned following his failure to secure majority stockholder support in the company’s June annual meeting.

Despite this, Greenleaf retained his position after the board accepted the resignation of three other directors but rejected his conditional resignation.

Meanwhile, Aurinia announced the appointment of Craig Johnson to the board to “support its next phase of growth.” Johnson has over three decades of experience in senior financial management and governance roles in the biotechnology industry.

Aurinia’s stock has lost 4% of its value so far this year.

For updates and corrections email newsroom@stocktwits.com.

Read also: Arm Holdings Stock Jumps After Earnings Beat, Analyst Target Hikes: Retail Sentiment Skyrockets

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)