Advertisement|Remove ads.

Arm Holdings Stock Jumps After Earnings Beat, Analyst Target Hikes: Retail Sentiment Skyrockets

Shares of Arm Holdings Plc. ($ARM) rose over 3% as markets opened on Thursday after the chip-design company beat second-quarter earnings estimates and received price target hikes from multiple analysts.

Arm reported earnings of $0.30 per share beating the estimated $0.26 earnings per share. Its revenue came in at $844 million beating the estimated $810.03 million by over 4%.

However, the stock was down as much as 6% during pre-market trading on Thursday, weighed down by earnings guidance.

Arm projected earnings per share (EPS) $0.23 to $0.27 for the third quarter, leaving its full-year revenue and adjusted EPS guidance unchanged.

Susquehanna cited concerns that the company’s recent report and future forecast suggest a potential 5% drop in expected earnings for the next quarter, which could continue into 2026. The brokerage raised its price target on Arm from $115 to $118, maintaining a ‘Neutral’ rating.

On the other hand, analysts at JPMorgan, Barclays, and TD Cowen have given a more optimistic outlook, raising their price targets while maintaining favorable ratings.

JPMorgan increased its target from $140 to $160 and kept an ‘Overweight’ rating on the stock, citing strong second-quarter results, particularly in licensing revenue.

Barclays raised its price target from $125 to $145, maintaining an ‘Overweight’ rating as well.

The brokerage highlighted Arm’s reaffirmed fiscal 2025 outlook and the potential for further growth driven by the successful transition to new v8/v9 architecture and the expansion of data center initiatives.

The company’s latest advanced chip technology, called Armv9, generates double the royalty rates of its previous Armv8.

Meanwhile, TD Cowen raised its price target from $150 to $165 and maintained a ‘Buy’ rating on the stock, also noting that Arm’s licensing performance was a key factor in its recent outperformance.

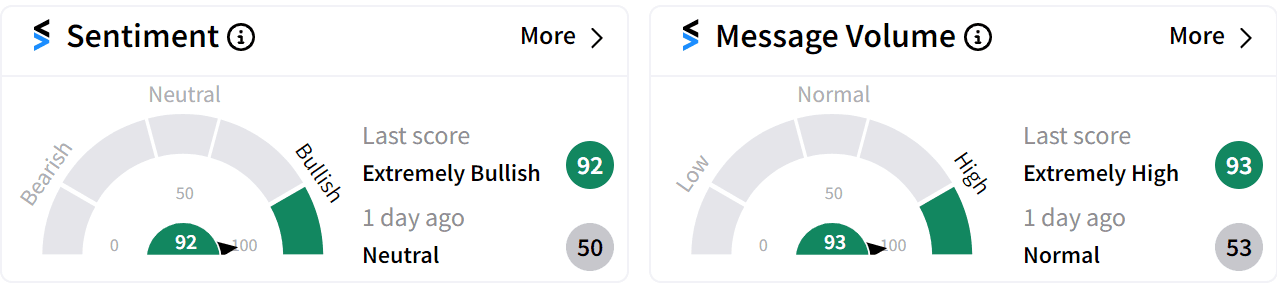

Retail sentiment on Stocktwits surged to ‘extremely bullish’ (92/100) from ‘neutral’ at the opening bell on Thursday, accompanied by ‘extremely high’ message volume.

Arm’s key customers include big tech companies such as Microsoft ($MSFT) and Nvidia ($NVDA), who are making chips with more than 100 “cores” using Arm’s designs.

However, Arm is currently embroiled in a legal battle with Qualcomm ($QCOM) over breach of contract and trademark after the latter acquired Nuvia. Last month, Arm gave Qualcomm a 60-day notice for the cancellation of its architectural chip design license.

“At a base level, contractual consent was required by Qualcomm to sign a Nuvia license, and that consent was not obtained. As a result of not obtaining that consent, they are in breach,” Arm CEO, Rene Haas, explained during the earnings call.

Qualcomm also reported its earnings after the bell on Wednesday, beating estimates and announcing a new $15 billion share buyback plan.

Arm’s stock has doubled in value this year, gaining 118% so far.

For updates and corrections email newsroom@stocktwits.com.

Read more: Arm Shares Rise Pre-Earnings, But Retail Worries Stock May Be Overvalued

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)