Advertisement|Remove ads.

Upstart Stock Hits Over Two-Year Highs After Earnings Beat, Analyst Upgrades: Retail Sentiment Skyrockets

Shares of Upstart Holdings ($UPST) surged over 40% to hit over two-year highs in early trading on Friday, following bullish upgrades from JPMorgan, Citi, and Piper Sandler.

The stock peaked at $79.64 after the company significantly exceeded third-quarter earnings expectations, reporting a loss of just $0.07 per share, far better than the anticipated $0.48 loss.

Upstart, an AI-powered lending platform, also exceeded revenue expectations, posting $162.1 million in revenue, surpassing the estimated $149.3 million.

The last time the stock traded at these levels was 9 May 2022. Its shares fell more than 50% in the following trading session after the company slashed its full-year revenue forecast and have been trying to climb back ever since.

Analysts have become more optimistic about Upstart’s prospects with Citi upgrading the stock to ‘Buy’ from ‘Neutral’ and raising the price target to $87 from $56.

The brokerage cited growing interest from private credit managers and Upstart’s partner network due to improved liquidity that could lead to better stock performance.

Meanwhile, JPMorgan has upgraded Upstart to ‘Neutral’ from ‘Underweight’ and increased the price target to $45 from $30.

With steady improvement in loan performance and new originations expected to generate higher returns, JPMorgan believes Upstart has emerged from challenging times.

Piper Sandler also upgraded Upstart, this time to ‘Overweight’ from ‘Neutral’, with a price target of $85, up from $31.

The brokerage expects Upstart to benefit from an accommodating rate environment, improved lending conditions, and updates to its lending model.

It also noted the company’s strategic partnership with Blue Owl, which will enable Upstart to purchase up to $2 billion in loans over the next 18 months.

Upstart has guided for revenue of about $180 million and a loss of about $35 million in the fourth quarter.

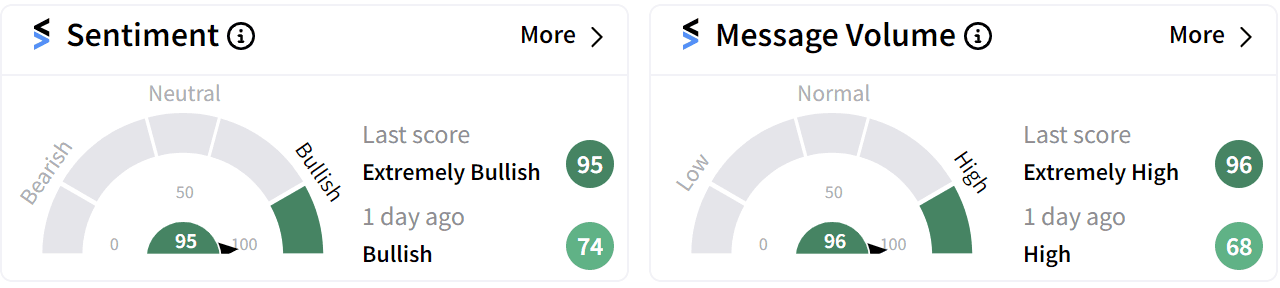

Retail sentiment on Stocktwits improved to ‘extremely bullish’ (95/100) from ‘bullish’ a day ago with ‘extremely high’ (96/100) chatter.

Upstart CEO Dave Girouard struck a bullish tone amid third-quarter results. "Even without a significant boost from the macroeconomy, we're back in growth mode," he said during the earnings call.

The stock has more than doubled in value this year with gains of 104% so far.

For updates and corrections email newsroom@stocktwits.com.

Read more: IIPR Stock In Focus After Q3 Earnings Miss, CEO Bullish On Cannabis Regulation

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)