Advertisement|Remove ads.

Arthur Hayes Predicts AI Carnage Will Prompt Massive Fed Liquidity, Lifting Bitcoin And Sending HYPE To $150

- In a Substack post, Hayes stated that AI-driven layoffs among white-collar workers could trigger a large amount of consumer credit and mortgage defaults.

- He also predicted that smaller and regional banks could face solvency pressure as a result.

- He expects the Federal Reserve to ultimately respond with aggressive liquidity measures, pushing Bitcoin’s price to new highs.

- Hayes named Zcash and Hyperliquid among his preferred tokens once policy conditions shift.

Arthur Hayes, BitMEX co-founder and the chief investment officer at Maelstromfund, said Bitcoin’s (BTC) recent price action is flashing a warning about looming deflation risk driven by artificial intelligence and potential job losses.

In a post on Substack, Hayes described Bitcoin as a “global fiat liquidity fire alarm,” often moving ahead of traditional markets when credit conditions tighten. He flagged that the recent divergence between Bitcoin and the Nasdaq 100 Index signals a possible credit contraction that could ripple through the U.S. banking system.

Hayes forecast that widespread displacement of white-collar workers by AI tools could trigger consumer loan defaults, strain bank balance sheets and ultimately force the Federal Reserve to respond with aggressive monetary easing.

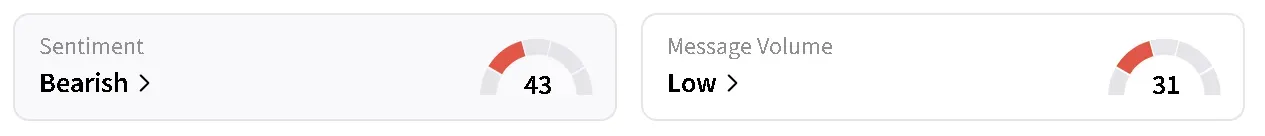

Bitcoin’s price was trading at around $67,300 on Monday morning, trading sideways over the last 24 hours. On Stockwits, retail sentiment around the apex cryptocurrency trended in ‘bearish’ territory over the past day.

Fed Response Could Fuel Bitcoin Rally

Hayes’ core thesis centers on AI-driven disruption. He estimates that if 20% of U.S. knowledge workers were displaced, banks could face hundreds of billions of dollars in consumer credit and mortgage losses. While the largest institutions might absorb the shock, smaller and regional lenders could face acute pressure, raising the risk of deposit flight and broader financial instability.

He hypothesized that such a downturn would likely force the Federal Reserve to respond. Once the Fed expands liquidity to stabilize the system, risk assets tend to recover, and Bitcoin has historically responded strongly to monetary easing, Hayes wrote.

ZEC, HYPE Crypto Tokens Will See Gains

The BitMEX co-founder said he plans to deploy capital into select altcoins once the Fed “blinks”, with Zcash (ZEC) and Hyperliquid (HYPE) among his top picks. He expects HYPE’s price to appreciate five-times its current price by July and reach $150.

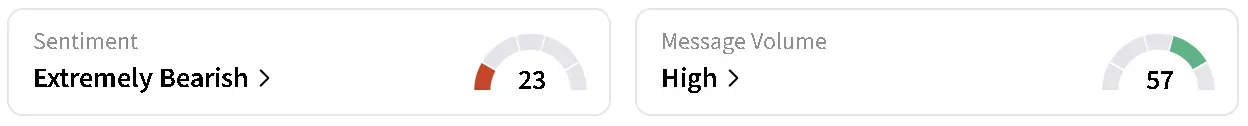

Hyperliquid’s native token was trading at around $29 on Wednesday morning, down 1.5% in the last 24 hours amid broader weakness in the crypto market. On Stocktwits, retail sentiment around HYPE trended in ‘extremely bearish’ territory over the past day, with chatter at ‘high’ levels.

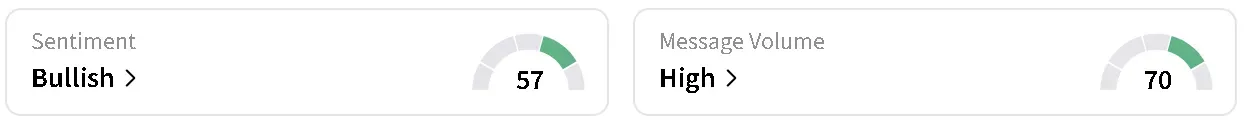

ZEC’s price was trading at around $284 on Wednesday morning, down 3.2% in the last 24 hours. Retail sentiment around the privacy-focused token on Stocktwits rose to ‘bullish’ from ‘neutral’ over the past day amid ‘high’ levels of chatter.

For Hayes, the playbook is familiar – deflation shock first, central bank response next, and risk assets rally once liquidity returns.

Read also: MSTR's Michael Saylor Says ‘Bitcoin Is Winning’ Amid Crypto Winter, Sees ‘Glorious Summer’ Ahead

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2216479170_jpg_edce233c83.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)