Advertisement|Remove ads.

Binance Converts $1 Billion Reserve Into Bitcoin After Crypto Market Crash To November Lows

- The announcement followed a sharp Bitcoin selloff that triggered more than $1.7 billion in liquidations across crypto markets.

- Analysts and traders highlighted Binance’s trading volumes as a key factor influencing intraday Bitcoin price swings.

- Binance’s native BNB token fell more than 6% during the broader crypto market decline.

Binance (BNB) on Friday announced that it will convert $1 billion in reserves into Bitcoin (BTC) as the market crashed to November lows and the apex cryptocurrency shed nearly $10,000 in a single day.

In a blog post, the exchange said it plans to convert its $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin over the next 30 days. It added that the move is intended to support the crypto industry as the overall market capitalization dropped to below $3 trillion.

SAFU was created by Binance in 2018 to protect users from losses tied to unexpected events such as hacks or operational failures. "If the fund's market value falls below $800 million due to BTC price fluctuations, Binance will rebalance the fund to restore its value to $1 billion," the exchange wrote.

Binance Shifts SAFU Fund Into Bitcoin

To manage the volatility associated with holding Bitcoin rather than stablecoins, Binance said it will conduct regular audits and closely monitor the fund’s market value. The company did not disclose whether it plans to expand its Bitcoin holdings beyond the SAFU allocation.

The announcement follows growing calls from some in the crypto community, particularly on X, urging Binance to use its balance sheet to support Bitcoin during periods of market stress, like this week. Some critics have argued that the exchange should use profits to build a more explicit Bitcoin reserve.

Why Is Bitcoin’s Price Falling?

The announcement came as the crypto market saw over $1.7 billion in liquidations over the last 24 hours, as Bitcoin dipped from around $89,000 to an intra-day low of $81,000. BTC’s price recuperated to around $82,300 at the time of writing, still down over 6% in the last 24 hours.

On Stocktwits, retail sentiment around Bitcoin remained in ‘extremely bearish’ territory over the past day. Chatter rose to ‘high’ from ‘normal’ levels.

The crypto market selloff has been linked to several factors, including investor rotations into precious metals such as gold and silver, geopolitical tensions, uncertainty around President Donald Trump’s upcoming pick for Federal Reserve chair to replace Jerome Powell, and continued outflows from Bitcoin exchange-traded funds.

Trading Activity Puts Binance in Focus

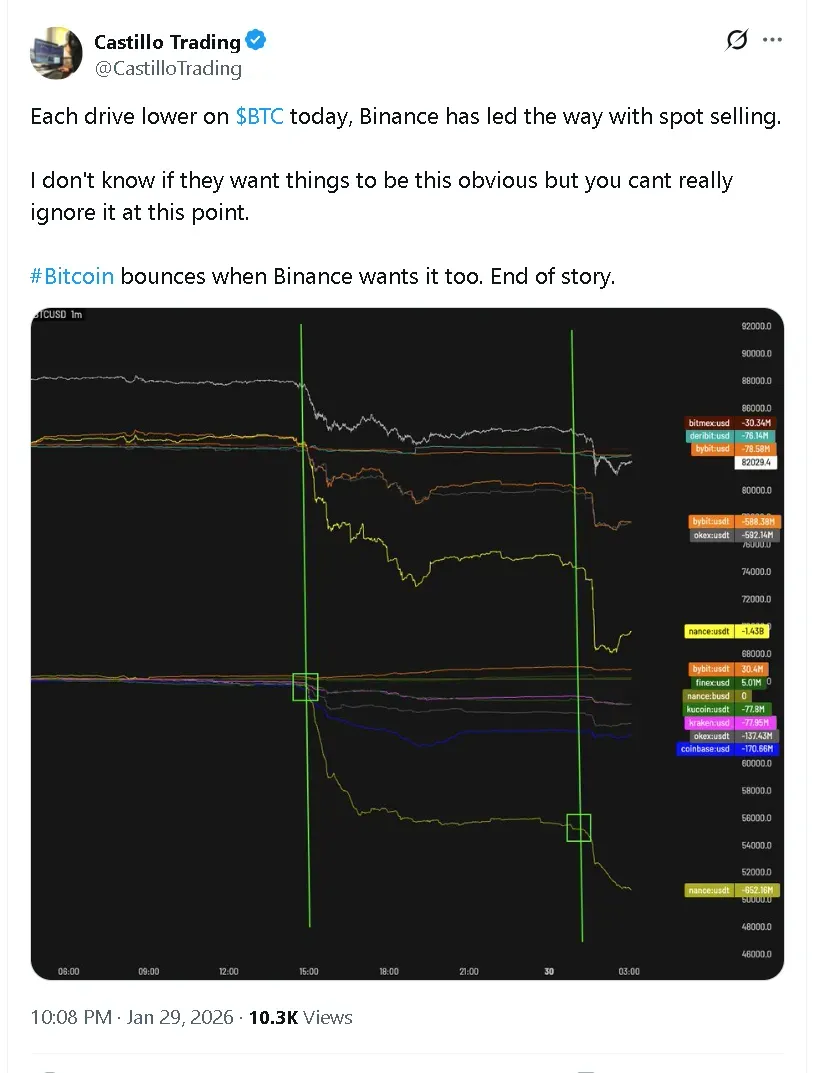

Some market observers pointed to Binance’s trading activity as a key driver of Bitcoin’s sharp intraday moves. In a post on X, analyst Castillo Trading said selling pressure during price dips appeared concentrated on Binance’s spot market.

“Bitcoin bounces when Binance wants it too. End of story,” the analyst wrote, adding that a sustained recovery may depend on easing sell pressure on the exchange. CoinGlass data showed Binance led Bitcoin spot and derivatives trading volumes over the past 24 hours, recording roughly three times the activity of rivals OKX and Bybit.

The crypto market crash also weighed on BNB’s price – Binance’s native token. It fell 6.6% in the last 24 hours to around $844. On Stocktwits, retail sentiment around the altcoin remained in ‘bearish’ territory over the past day.

Read also: Pro-Bitcoin El Salvador President Bukele Is Buying The Dip In Gold Too, Just In Case

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_walmart_jpg_05c61e928f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2217651413_jpg_838cf7a8bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_walmart_OG_jpg_8a74984dc4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347001_jpg_8286032c70.webp)