Advertisement|Remove ads.

Bitcoin Breaches $116K, Ethereum Rallies Over 7% After US-China Trade Framework Deal Sets Off Risk-On Mood

Bitcoin and major cryptocurrencies rallied in early trading on Monday after the U.S. and China agreed to a framework for a trade deal ahead of the meeting of the two countries' top leaders.

The apex cryptocurrency rose nearly 4% to $116,049.79 at the time of writing, according to CoinMarketCap data. It, however, traded below an all-time high of $126,198.07, set on Oct. 6. Meanwhile, Ethereum gained 7.5% to $4,239.28 and XRP rose 1% to $2.63. Among other tokens, BNB rose 2.4%, while Solana and Dogecoin gained 5.8%, each.

Positive Trade Talks Set The Stage For Trump-Xi Meeting

“We are moving forward to the final details of the type of agreement that the leaders can review and decide if they want to conclude together,” Jamieson Greer, the United States trade representative, said to reporters, according to a New York Times report. Greer was part of a team of negotiators who met with senior Chinese officials on the sidelines of an Association of Southeast Asian Nations meeting.

As per the report, China’s top trade negotiator, Li Chenggang, described the talks between the two countries as “candid and in-depth discussions” on the trade deal, adding that the two sides had reached a “preliminary consensus.”

The trade talks came ahead of the meeting between U.S. President Donald Trump and his Chinese counterpart, Xi Jinping, scheduled on Thursday in South Korea. Separately, U.S. Treasury Secretary Scott Bessent said on CBS’s “Face the Nation” that the 100% tariffs that Trump had threatened earlier are “effectively off the table.” He also assured that China will resume soybean purchases and delay the imposition of curbs on rare-earth exports.

What Is Retail Thinking?

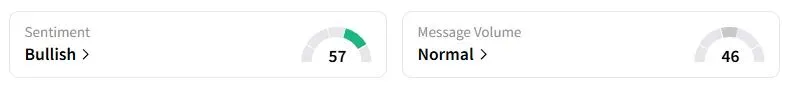

Retail sentiment on Stocktwits about Bitcoin was in the ‘bullish’ territory at the time of writing.

“The minute this hits 116k, [a] full-blown rally [is] going to start - mark it,” one trader said.

A Look Forward

Investor Ted Pillows said the unfolding week will likely be volatile with “rate cuts, earnings, and trade war updates.”

The Federal Open Market Committee (FOMC) is set to meet on Oct. 29-30 to decide on the benchmark interest rates. According to Bureau of Labor Statistics data, the core consumer price index, excluding the often volatile food and energy categories, rose 0.2% in September compared to the previous month. It was the slowest pace in three months, and further emboldened the case for rate cuts.

Also See: Brazil’s Lula Says Trade Deal With US Coming Sooner Than ‘Anyone Thinks’ After Trump Meet

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)