Advertisement|Remove ads.

Bitcoin Could Bounce On MSTR Buying, But Jim Cramer Warns – Don’t Trust It

- Cramer’s post followed Strategy executive chairman Michael Saylor, hinting that the firm may announce a big Bitcoin purchase on Monday with a “more orange” post on X.

- Cramer said that while this may show Bitcoin’s price, it may distract traders from the fact that BTC slipped below $80,000, which is usually a bearish signal.

- MSTR is also scheduled to report its fourth-quarter earnings on Thursday, later this week.

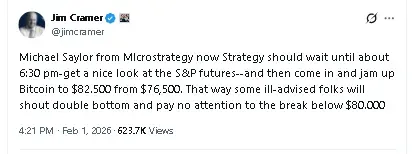

CNBC’s ‘Mad Money’ host Jimmy Cramer said on Sunday that Michael Saylor-backed Strategy (MSTR) could announce a large Bitcoin (BTC) purchase on Monday to push BTC’s price higher after the weekend crash.

His comments come after Saylor hinted that Strategy could be adding to its reserves on Monday with a “more orange” post on X.

According to Cramer, the recovery in Bitcoin’s price would come with the risk of traders perceiving it as a “double bottom” and ignoring that it already broke below the $80,000 level, which is usually a bearish signal.

MSTR Earnings, Short Sellers Add Pressure

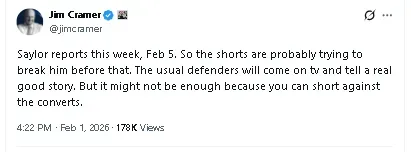

Cramer also suggested that short sellers may attempt to pressure the stock and Bitcoin’s price ahead of MSTR’s fourth quarter (Q4) earnings report, scheduled for Thursday. “The usual defenders will come on TV and tell a real good story,” he wrote in a post on X. “But it might not be enough because you can short against the converts.”

Strategy is expected to report revenue of $118 million and earnings before interest, taxes, depreciation, and amortisation (EBITDA) of $10 million, according to Koyfin. MSTR’s stock was down 0.27% in overnight trade, following a gain of 4.55% on Friday. Retail sentiment around the firm fell to ‘bearish’ from ‘neutral’ over the past day, while chatter remained at ‘high’ levels on Stocktwits.

Bitcoin Is ‘Unreliable’

While Bitcoin is positioned as a “currency,” Cramer said the weekend crash was an example of its “unreliability” as an exchange of value on a short-term basis. He compared the market’s fixation on Bitcoin to similar reactions seen in gold and silver with sudden price swings distracting investors from company earnings and fundamentals.

He hedged his statements, saying that he owns some amount of Bitcoin himself, even though he did not disclose how much. Cramer first predicted that Bitcoin would rebound to $82,000 by Monday in a post on X on Saturday. “I am always surprised that those have the most to lose by a falling Bitcoin ($80,000 line in the sand) don’t defend it over the weekend,” he wrote.

On Stocktwits, one user wrote that Monday would likely see people panic-selling MSTR’s stock.

Another said they expect Strategy to announce a Capital 7 liquidation by the end of the week.

MSTR was among the top trending tickers on Stocktwits at the time of writing as trader debated Saylor’s gamble, open volatility and if a forced sell would be on the cards.

Read also: MSTR, BMNR Dominate Retail Chatter After Bitcoin’s Weekend Selloff, While GME Stock Rallies

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)