Advertisement|Remove ads.

MSTR, BMNR Dominate Retail Chatter After Bitcoin’s Weekend Selloff, While GME Stock Rallies

- Traders on Stocktwits speculated whether crypto treasury firms might announce new digital asset purchases.

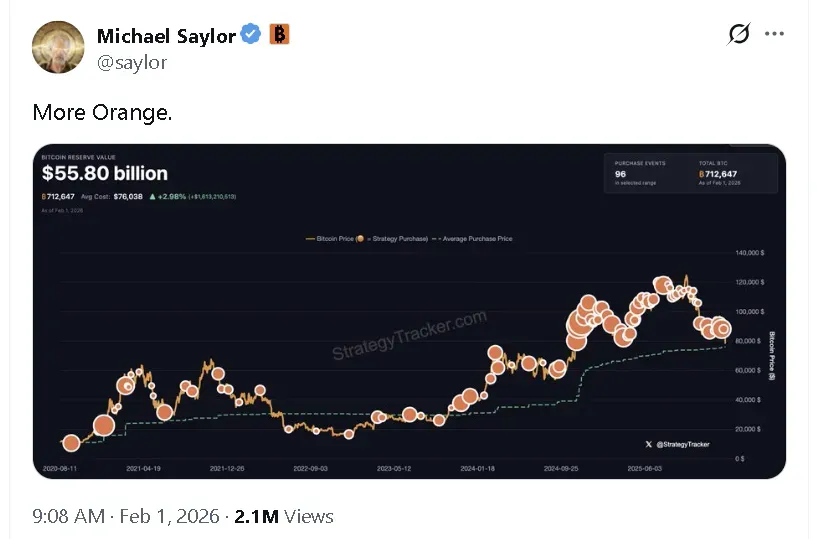

- Michael Saylor’s weekend post added to expectations of potential Bitcoin accumulation.

- GameStop outperformed other crypto-linked stocks, rising more than 4% overnight.

Tom Lee’s Bitmine Immersion Technologies (BMNR) and Michael Saylor-backed Strategy (MSTR) were among the top trending tickers on Stocktwits on Sunday night as traders speculated whether the digital asset treasuries (DATs) would report fresh crypto buys on Monday after Bitcoin’s (BTC) crash over the weekend.

The overall cryptocurrency market fell 4.1% in the last 24 hours to around $2.6 trillion. Coinglass data showed over $500 million in liquidations over the past day, with almost $3 billion in forced unwinds over the weekend.

Crypto DATs Draw Retail Focus

Bitmine, the largest corporate Ethereum (ETH) treasury in the world, was the top trending ticker on Stocktwits on Sunday night. Many users on the platform reported buying the dip, while others wondered if the company would announce a fresh acquisition on Monday.

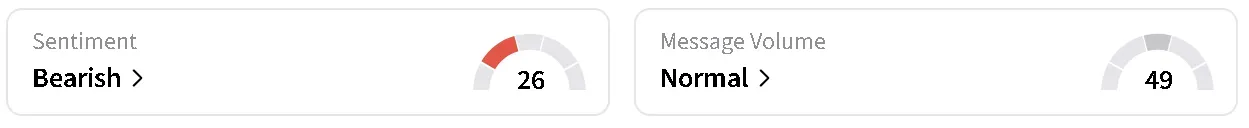

BMNR’s stock traded flat in overnight trade after falling nearly 6% on Friday to November lows. Retail sentiment around the shares remained in ‘bearish’ territory but chatter rose to ‘normal’ from ‘low’ levels over the past day.

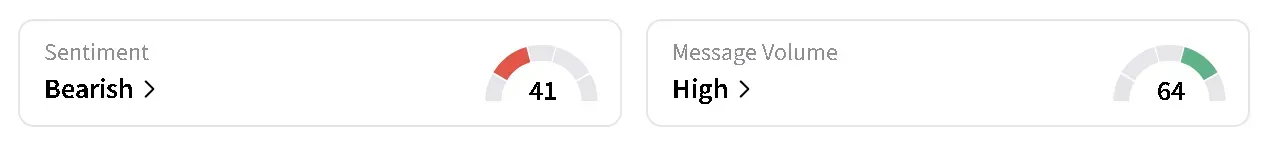

MSTR’s stock dipped 0.27% in overnight trading on Sunday following a gain of 4.5% in regular trade on Friday. On Stocktwits, retail sentiment around the top trending stock fell to ‘bearish’ from ‘normal’ territory over the past day as chatter remained at ‘high’ levels.

Saylor also hinted at more Bitcoin acquisitions coming on Monday, stating “more orange” in a post on X over the weekend.

Strive (ASST) led losses among crypto equities in after-hours, down 2.35%. It was followed by Forward Industries (FWDI), which fell 1.23%. Retail sentiment around both stocks trended in ‘bearish’ territory over the past day.

GameStop Bucks Trend Among Crypto-Linked Stocks

Meanwhile, GameStop (GME) outperformed among crypto-equities, with its stock up over 4% in overnight trade after CEO Ryan Cohen announced last week that the company might be too into new acquisitions.

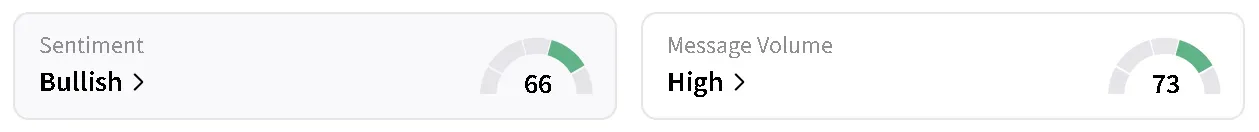

The “Big Short” investor, Michel Burry, also disclosed he was long on GameStop’s stock, adding that he supports Cohen’s long-term turnaround plan. Retail sentiment around GME on Stocktwits dipped to ‘bullish’ from ‘extremely bullish’ over the past day as chatter fell to ‘high’ from ‘extremely high’ levels.

Why Are Crypto-Linked Stocks Falling?

Bitcoin’s price fell 3.5% in the last 24 hours, dipping to under $75,900 at the time of writing. Nearly $15,000 of its value has been wiped out since Friday, with the apex cryptocurrency going as low as $74,420, according to Coinbase data – a level not seen since November 2024.

On Stocktwits, retail sentiment around BTC remained in ‘extremely bearish’ territory, dipping to its lowest level in over a year. Chatter, however, was at ‘extremely high’ levels as traders discussed Bitcoin's next move.

Read also: Oracle Draws Retail Attention After Plan To Raise Up To $50B Debt And Equity In 2026

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)