Advertisement|Remove ads.

Bitcoin Falls Below $90,000, Dragging Altcoins Lower While Traders Wait For A Bounce

- Crypto analysts said technical indicators and on-chain data suggest selling pressure may be moderating.

- Retail sentiment on Stocktwits for major cryptocurrencies remained bullish over the past day, with elevated chatter across the board.

- Ethereum’s pullback is viewed by some analysts as a technical retest rather than a trend reversal.

The cryptocurrency market traded in the red on Thursday morning, with its market capitalization falling by more than 2% to $3.17 trillion.

Bitcoin’s price fell 2.2% over the past 24 hours, slipping below the $90,000 level and dragging most major cryptocurrencies lower. Despite the pullback, retail sentiment around Bitcoin on Stocktwits remained in ‘extremely bullish’ territory, and chatter remained at ‘extremely high’ levels.

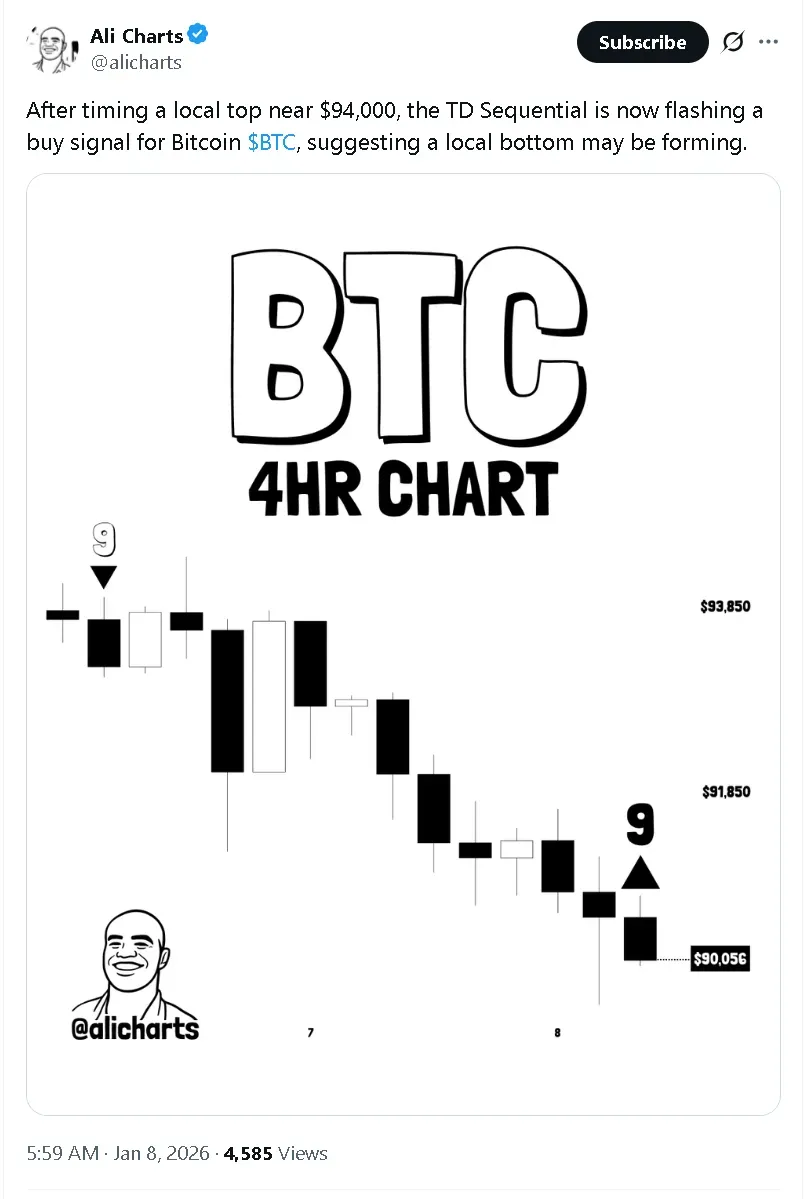

The move lower follows Bitcoin’s recent rejection near $94,000, a level some analysts had flagged as short-term resistance. CoinGlass data showed liquidations at $467 million, with longs accounting for $422 million of the forced unwinds.

According to crypto charter Ali Martinez, the TD Sequential indicator, which previously signaled a local top near $94,000, is now flashing a buy signal. The shift suggests a potential local bottom could be forming for Bitcoin, even as broader market sentiment remains cautious, he said in a post on X.

Altcoins Extend Losses

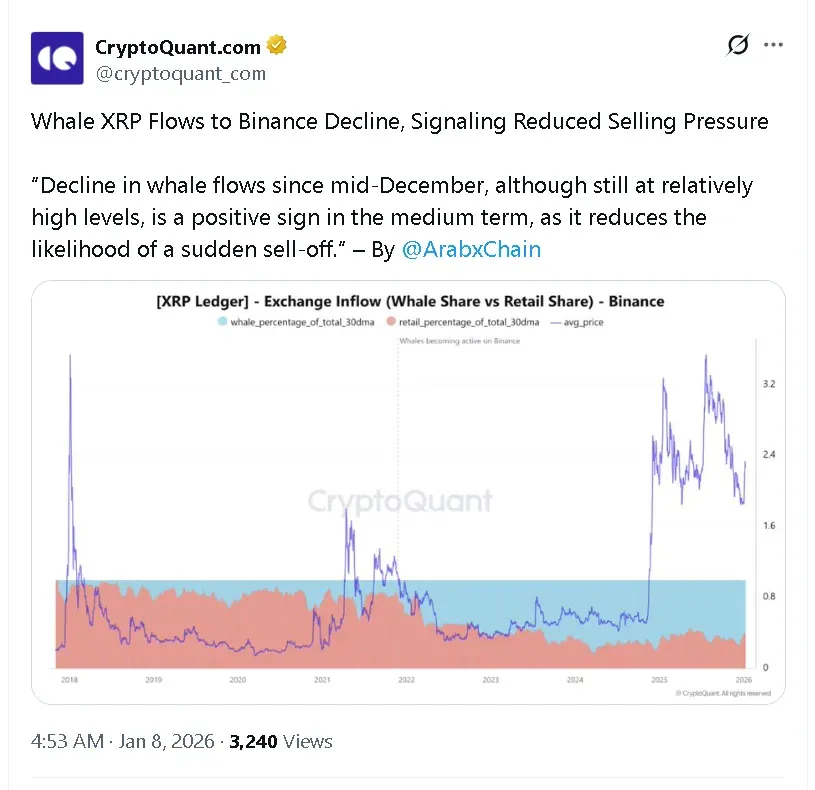

Bitcoin’s dip weighed on other digital assets as well, with Ripple’s XRP (XRP), Cardano (ADA), and Dogecoin (DOGE) leading losses among major cryptocurrencies. XRP’s price fell more than 7% to $2.09 in the last 24 hours, while Dogecoin’s price fell around 5.6% to $0.14. Both cryptocurrencies saw retail sentiment on Stocktwits trending in ‘extremely bullish’ territory over the past day, with ‘extremely high’ levels of chatter.

According to analysts at CryptoQuant, a decline in XRP whale flows since mid-December may be constructive in the medium term. While large-holder activity remains elevated, the moderation reduces the likelihood of a sudden, sharp selloff driven by concentrated selling pressure.

Cardano’s price dropped around 6.2% to $0.389 in the last 24 hours. Retail sentiment around the altcoin on Stocktwits was also ‘extremely bullish’ over the past day, but chatter remained at ‘high’ levels.

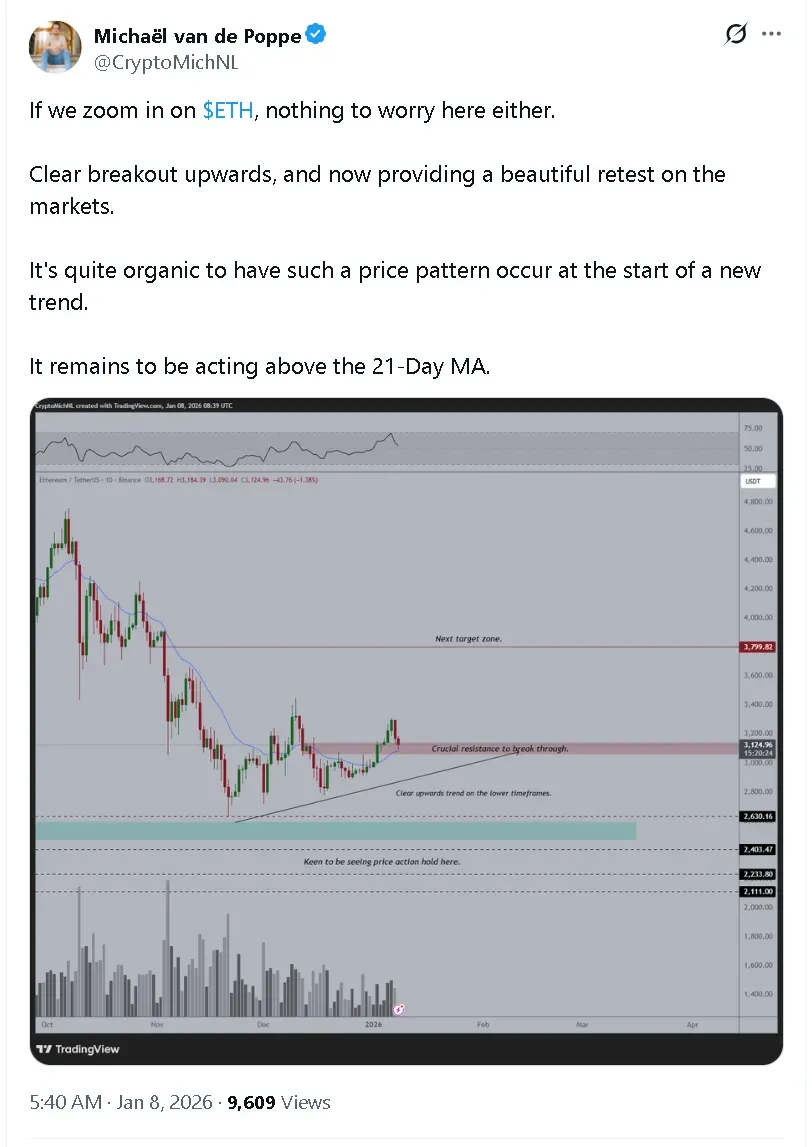

Ethereum Is Just Riding The Wave

Ethereum (ETH), Binance Smart Network (BNB), and Solana (SOL) also underperformed Bitcoin. Ethereum’s price fell more than 3% to around $3,100 in the last 24 hours. The leading altcoin saw retail sentiment trending in ‘bullish’ territory over the past day.

In a post on X, MN Fund founder Michael van de Poppe said Ethereum’s recent move appears technically healthy. He described the pullback as a retest following a the altcoin’s recent breakout. Van de Poppe also noted that ETH continues to trade above its 21-day moving average, a level many traders view as a key trend indicator.

BNB and Solana fell by over 2.5% each in the last 24 hours. While BNB saw ‘bullish’ retail sentiment, Solana’s retail sentiment was in ‘bearish’ territory over the past day.

Tron (TRX) outperformed its peers yet again, as the only coin to appreciate, rising by 0.4% in the last 24 hours.

Read also: Semler Outperforms Crypto Equities While Bitcoin Slips Below $91,000

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)