Advertisement|Remove ads.

Ripple’s XRP, Cardano Outperform While Bitcoin Defends $93,000 Amid $400 Million In Liquidations

- Ripple’s XRP rose about 10% over the past 24 hours, briefly touching an intraday high near $2.41 before slipping lower.

- Cardano and Dogecoin also outperformed Bitcoin, supported by retail chatter and an improvement in sentiment on Stocktwits.

- The total cryptocurrency market capitalization climbed to about $3.3 trillion over the past day.

- CoinGlass data showed roughly $410 million in liquidations, with short positions accounting for the bulk of it.

Ripple’s native token XRP (XRP) and Cardano (ADA) led gains among the top 10 cryptocurrencies by market capitalization in early morning trade on Tuesday, as Bitcoin (BTC) held above $93,000.

XRP’s price rose 10% in the last 24 hours to $2.35 – still 35% below its record high of $3.65 seen in July last year. The token went as high as $2.41 in intraday trade before slipping lower. According to one user on Stocktwits, the cryptocurrency may see bouts of increase, but is likely to keep coming back down until clearer regulation comes into play.

Another user predicted that XRP’s price could go as high as $3.40 this week.

XRP was among the top trending crypto tickers on Stocktwits at the time of writing. Retail sentiment around the altcoin on the platform rose to ‘extremely bullish’ from ‘bullish’ over the past day as chatter rose to ‘extremely high’ from ‘high’ levels.

Altcoins Outperform While Bitcoin Holds $93,000

Cardano’s price gained 4.6% over the last 24 hours, trading around $0.418. Retail sentiment around the token on Stocktwits also rose to ‘extremely bullish’ from ‘bullish’ territory over the past day, while chatter remained at ‘high’ levels.

Dogecoin (DOGE) also outperformed Bitcoin, rising 2.6% over the last 24 hours to $0.1506. Retail sentiment around the leading meme coin trended in ‘extremely bullish’ territory over the past day, with chatter at ‘extremely high’ levels.

Solana (SOL) gained 1.8% in the last 24 hours while Ethereum (ETH) rose 1.7%. Binance Coin (BNB) moved 1% higher to around $911.

Bitcoin’s price, meanwhile, traded at around $93,530 – edging 0.7% higher in the last 24 hours after briefly crossing the $94,000 mark. Retail sentiment around the apex cryptocurrency on Stocktwits trended in ‘extremely bullish’ territory over the past day as chatter rose to ‘high’ from ‘normal’ levels.

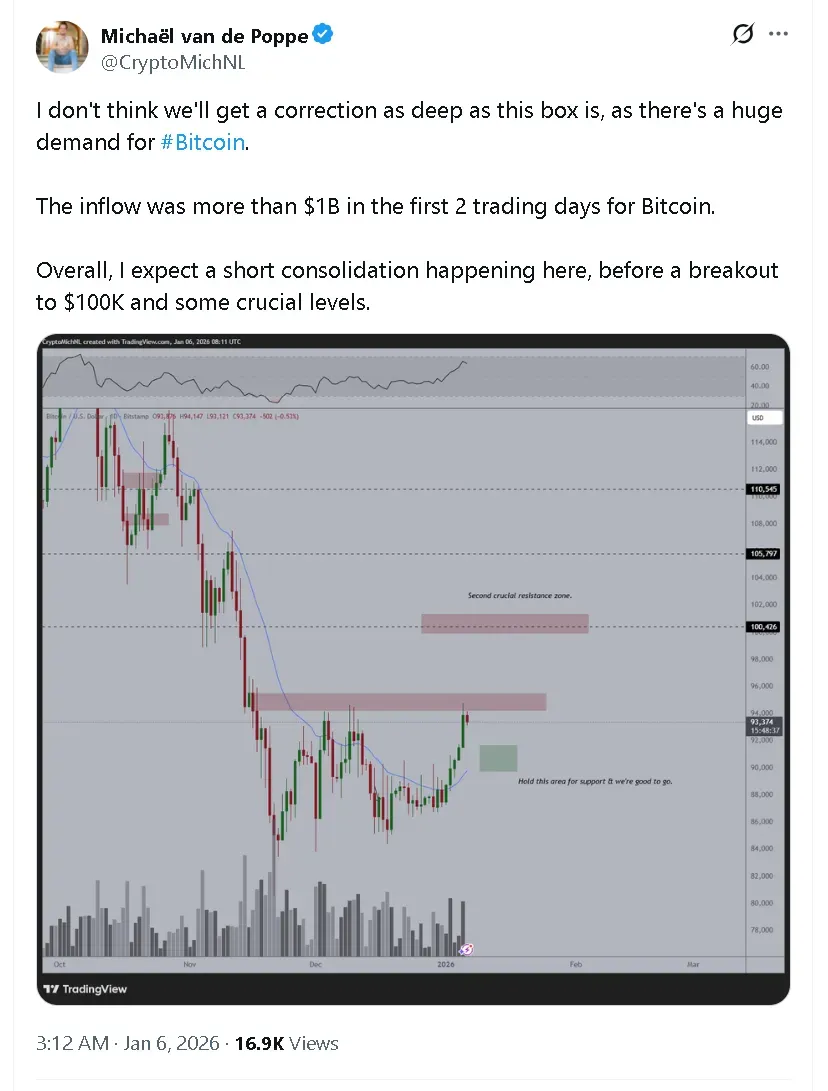

While some market watchers like Peter Schiff believe that Bitcoin’s recent rally is nothing more than “hype,” others like MN Fund founder Michael van de Poppe have a more bullish view.

In a post on X, Van de Poppe stated that while there be a small correction in Bitcoin’s price in the short term, it’s likely to breakout to $100,000 soon.

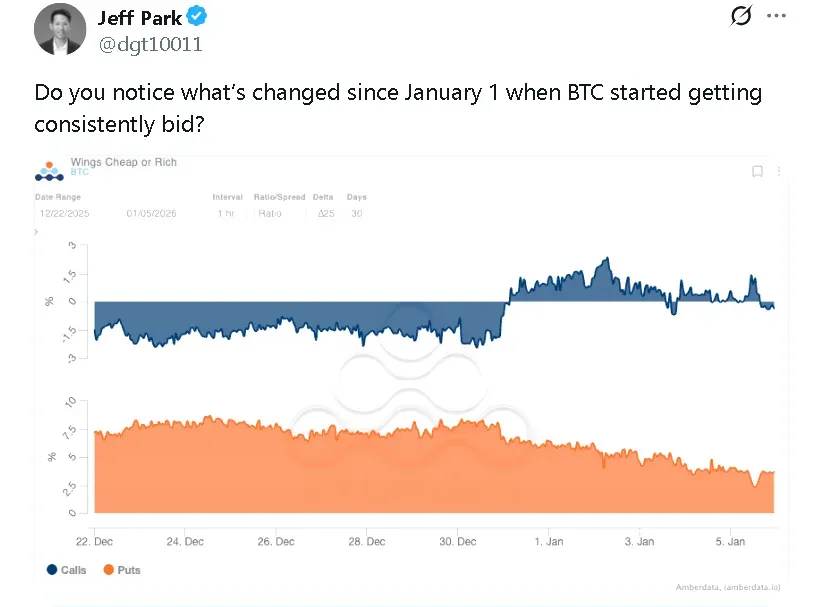

The chief investment officer at ProCap, Jeff Park, noted that Bitcoin’s gains in January have been driven by calls skewing positive again.

The overall cryptocurrency market rose 1.3% in the last 24 hours to around $3.3 trillion. Coinglass data showed liquidations at $410 million, with shorts accounting for $330 million of the forced unwinds. Bitcoin saw the largest amount of liquidations at $186 million, followed by Ethereum at $74.44 million and XRP at $32 million.

Read also: The First US Crypto Fund To Pay Staking Rewards Is Also Staring At $5 Billion In Outflows

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)