Advertisement|Remove ads.

Bitcoin Finds A Floor At $70K Amid Surging Liquidations And Fed Succession Talk Enters The Frame

- Bitcoin’s bounce looks mechanical, with prices holding near $70,700 amid heavy short liquidations, while retail sentiment remains firmly bearish.

- Macro forces are still in control, as Fed leadership uncertainty and liquidity expectations continue to outweigh crypto-specific factors.

- Altcoins edged higher but lacked conviction, with high liquidations pointing to short-term relief rather than a trend shift.

On Sunday, cryptocurrency majors saw a small bounce of relief. Bitcoin (BTC) held onto the $70,700 level, but most large-cap tokens were still down sharply for the week.

Bitcoin was trading at $70,700.78, up 2.0% over the previous day and down 7.5% over the last week. According to Coinglass data, Bitcoin saw over $211.46 million in total liquidations over the past day, with $33.90 million in longs and $177.56 million in shorts. As traders responded to the weekend volatility, on Stocktwits, the retail sentiment around Bitcoin remained in the ‘bearish’ territory, with chatter at ‘extremely high’ levels over the past day.

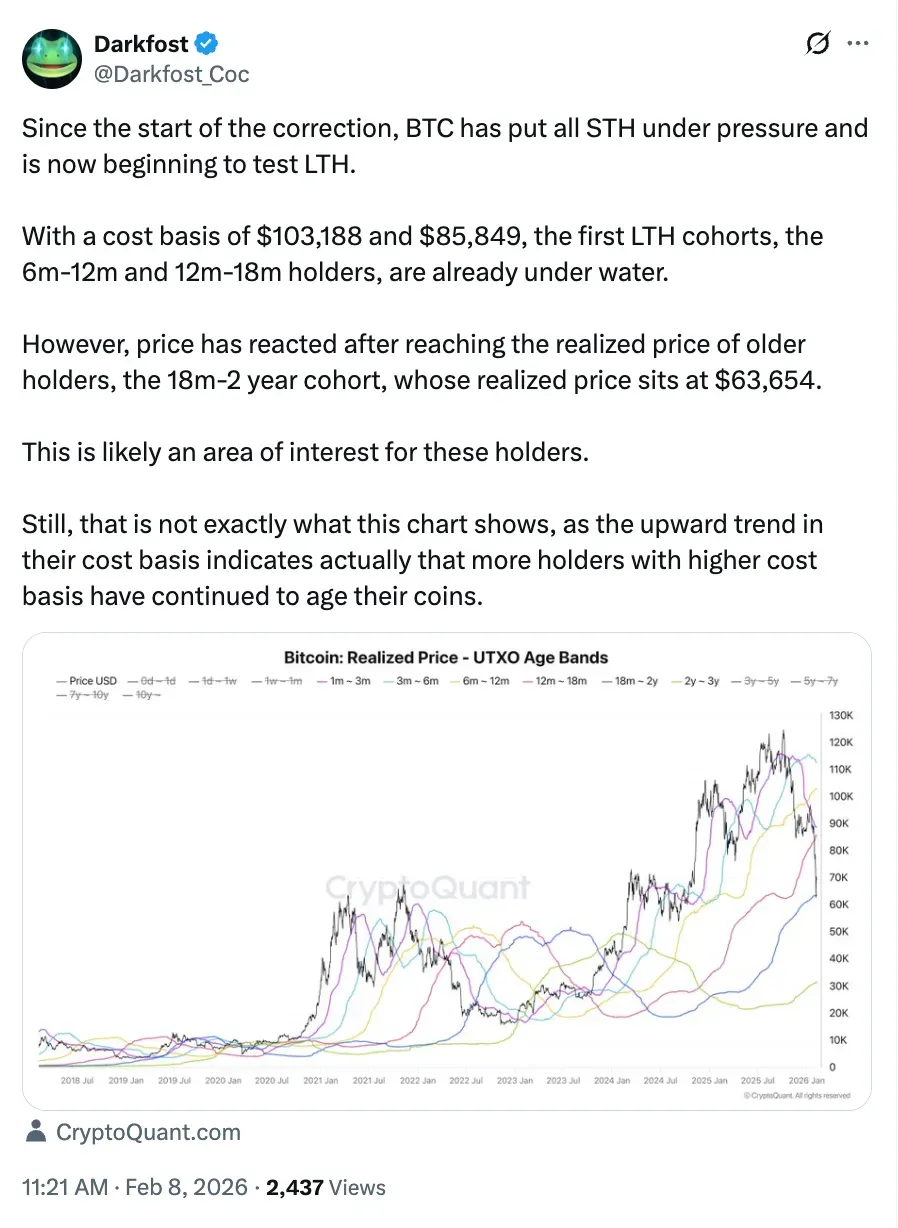

On-chain commentary DarkFrost noted that the correction of Bitcoin has put pressure on short-term holders and is now "beginning to test" longer-term holders (LTH). The realized price for the 18-month to 2-year cohort was approximately $63,654, and earlier LTH cohorts were underwater, with cost bases of approximately $85,849 and $103,188, respectively.

Is Trump’s Fed Pick Good For Bitcoin?

In the $30 trillion U.S. bond market, Kevin Warsh's call for a new Fed-Treasury agreement has rekindled discussion of policy coordination, which often spills over into the crypto market. After a new debate about a possible Fed–Treasury coordination framework raised concerns about yield curve control, the macro focus remained on rates and liquidity expectations, especially as Kevin Warsh, President Trump’s nominee, is expected to take over from Jerome Powell as Fed Chair.

Previously, Warsh said, “Even without direct investment in virtual assets, the cycles of Bitcoin’s rapid surges and crashes are worth noting.” He also said, “Bitcoin does not unsettle me,” in a Hoover Institution interview at Stanford University last year, describing it as a tool that “helps policymakers check whether they are implementing the right policies."

In an email to Stocktwits, incoming CEO and Chairman of EMJX-SRX Health Eric Jackson stated that, despite short-term risk-off jitters, Warsh's nomination as Fed chair appears neutral-to-positive for cryptocurrency over the medium term, with tighter balance-sheet discipline potentially supporting Bitcoin as a hard, non-sovereign asset.

Altcoins Tick Higher, Momentum Still Thin

Ethereum (ETH), trading at around $2,098.60, up 0.9% in the last 24 hours, recorded approximately $63.95 million in total liquidations over the past 24 hours. On Stocktwits, the retail sentiment around Ethereum remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Solana (SOL), trading at around $87.53, up 0.7% in the last 24 hours, recorded roughly $8.42 million in total liquidations over the same period. On Stocktwits, the retail sentiment around Solana dropped from the ‘extremely bullish’ to ‘bullish’ territory, with chatter staying at ‘extremely high’ levels over the past day.

Ripple’s XRP (XRP), trading at around $1.45, up 2.2% in the last 24 hours, recorded about $7.35 million in total liquidations over the past 24 hours. On Stocktwits, the retail sentiment around XRP remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Dogecoin (DOGE), trading at around $0.09668, down 0.3% over the past 24 hours, recorded approximately $3.20 million in total liquidations. On Stocktwits, the retail sentiment around Dogecoin remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Binance BNB (BNB), trading at around $642.01, down 0.1% in the last 24 hours, recorded roughly $556,830 in total liquidations over the past 24 hours. On Stocktwits, the retail sentiment around BNB improved from ‘bearish’ to ‘bullish’ territory, with chatter staying at ‘high’ levels over the past day.

The total liquidation in the crypto market was $347.6 million over the last 24 hours.

Read also: Top 5 Altcoins Dominating The Weekend Relief Rally While Bitcoin Reclaims $70K

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)