Advertisement|Remove ads.

Bitcoin Hashrate Drops 8% – Nano Labs CEO Estimates 400,000 Miners Now Offline In China’s Xinjiang

- Nano Labs CEO Jack Kong attributed the recent drop in Bitcoin’s network hash rate to the gradual shutdown of mining farms in Xinjiang, China.

- Data from HashrateIndex shows Bitcoin’s network hash rate fell from 1,124 EH/s to 1,078 EH/s since Friday.

- China has regained an estimated 14% share of global Bitcoin mining despite the 2021 crackdown.

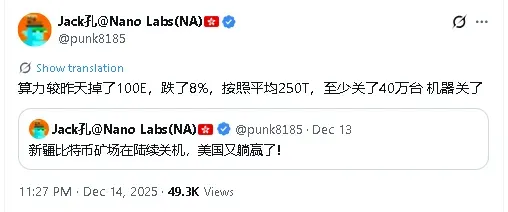

Nano Labs CEO Jack Kong on Sunday attributed a sharp decline in Bitcoin’s (BTC) network hash rate to the gradual shutdown of mining farms in Xinjiang, China.

In a post on X, Kong estimated that roughly 400,000 mining machines went offline, based on an average single-machine hash rate of 250 terahashes per second (TH/s). He stated that this equates to a 100 exahash-per-second (EH/s) drop, which is roughly 8% of the global Bitcoin network’s total hash rate.

He did not cite specific reasons for the shutdown, according to the translation of his message from WuBlockchain. Data from HashrateIndex showed the network hashrate at around 1,078 EH/s on Monday morning.

Hash Price Slump Pressures Miners

Despite China’s 2021 crackdown on cryptocurrency mining, underground and semi-official operations gradually resumed in subsequent years. Current estimates suggest China has reclaimed roughly a 14% share of global Bitcoin mining capacity.

The hash rate decline coincides with a broader slump in mining revenue, when Bitcoin’s hash price recently touched record lows.

Ethan Vera, chief operating officer at mining services provider Luxor Technology, said falling hash price has pushed miners to scale back operations. “Miners are using firmware to underclock their machines to save power,” Vera told Bloomberg, adding that energy costs remain a central pressure point for operators.

Bitcoin’s price remained below $90,000 in early morning trade on Monday, edging 0.2% lower in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘bearish’ territory over the past amid ‘low’ levels of chatter.

Nano Labs’ Crypto Pivot

Earlier this year, Nano Labs announced a strategic pivot toward cryptocurrency reserves alongside a sharp reduction in operating expenses. The company holds more than 128,000 BNB tokens and has made a strategic equity investment in BNB reserve company CEA Industries (BNC).

Nano Labs’ American depositary shares rose more than 4% in pre-market trading on Monday. Retail sentiment around the company on Stocktwits remained in ‘neutral’ territory over the past day, with ‘low’ levels of chatter.

Read also: Ethereum Co-Founder Vitalik Buterin Sells Uniswap, KNC, Dogey-Inu In Latest Wallet Move

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)