Advertisement|Remove ads.

Bitcoin Holds Steady At $107,000 After $750 Million Liquidations – Jim Cramer Warns Of ‘Huge Spec Wave’

- Over $747 million in leveraged positions were cleared across exchanges in 24 hours, according to CoinGlass data.

- Options open interest is rising sharply and nearing parity with futures, Glassnode said.

- CNBC’s Jim Cramer cautioned investors about speculative excess in crypto markets.

Bitcoin (BTC) held steady at around $107,000 in early morning trade after weekend volatility that liquidated over $747 million in the last 24 hours.

Bitcoin’s price edged 0.4% lower in the last 24 hours, trading at around $107,900, after briefly reaching $113,800 on Sunday. On Stocktwits, retail sentiment around the leading cryptocurrency improved to ‘neutral’ from ‘bearish’, accompanied by ‘high’ levels of chatter over the past day.

On-chain analytics firm Glassnode said Bitcoin’s derivatives structure is undergoing a significant shift as options open interest begins to rival futures. “Markets are shifting toward defined-risk and volatility strategies, meaning options flows, rather than futures liquidations, are becoming a more influential force in shaping price action,” it said.

Jim Cramer Warns Of Rising Speculation

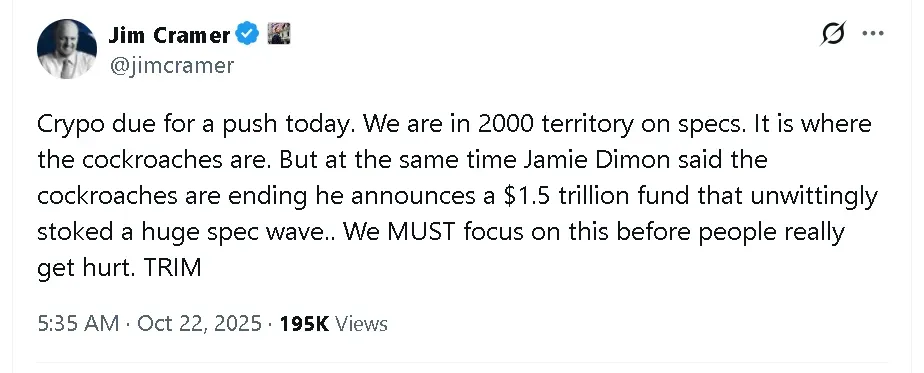

CNBC’s Mad Money host Jim Cramer weighed in on the speculative environment, warning retail traders to be cautious.

“Crypto due for a push today. We are in 2000 territory on specs. It is where the cockroaches are,” he wrote on X. “But at the same time Jamie Dimon said the cockroaches are ending he announces a $1.5 trillion fund that unwittingly stoked a huge spec wave. We MUST focus on this before people really get hurt. TRIM.”

Crypto Market Cap Drops To $3.7 Trillion

The overall crypto market capitalization slipped 0.8% in the last 24 hours, marking a value of around $3.7 trillion. Ethereum (ETH) and Dogecoin (DOGE) led losses among the top 10 cryptocurrencies by market capitalization. Ethereum’s price slipped 1.4% while Dogecoin’s price dropped 1.5% in the last 24 hours. While retail sentiment around the leading altcoin edged higher to ‘bearish’ from ‘extremely bearish’ over the past day, retail sentiment around Dogecoin continued to trend in the ‘bearish’ zone.

Cardano (ADA) and Ripple’s native token XRP (XRP) both slipped more than 1% in the last 24 hours. Meanwhile, Binance Coin (BNB) dipped around 0.5% and Solana (SOL) edged 0.3% lower.

According to CoinGlass data, nearly $750 million has been liquidated over the past 24 hours. Around $445 million came from long positions, and more than $305 million came from short bets.

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, slipped 3.1% in pre-market trade. Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) fell more than 2.6%. Crypto-exchange Coinbase (COIN) dipped 2.1%.

Read also: FalconX To Acquire 21Shares In Push Toward Crypto ETF Expansion: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)