Advertisement|Remove ads.

‘Bitcoin Is Dead’ Searches Spike On Google To Post-FTX Highs, But Traders Not Over With Crypto Yet

- Even as Bitcoin is trading near the upper end of its current cycle range, the phrase ‘Bitcoin Is Dead’ has reached highs last seen during the FTX collapse.

- Whales and liquidation activity point to pressure from derivatives rather than a wide range of spot distribution.

- Some market participants on Stocktwits are hopeful that XRP, Ethereum, or memecoins might be pushing the market sentiment forward instead of Bitcoin.

Google Trends data showed that searches for the phrase "Bitcoin is dead" have reached their highest level since the FTX collapse on Friday. As Bitcoin trades just below its cycle highs, the rise in negative search interest suggests the market structure is changing.

Traders are using the data point as a classic skeptic's sentiment signal, where, in retail, anxiety is growing stronger instead of giving up. While search behavior isn't a price trigger in itself, it does shed light on how people perceive crypto assets in real time.

Co-founder of Binance (BNB), Changpeng Zhao (CZ), also responded to this data. Reposting the post that highlighted the spike in searches for “Bitcoin is dead," CZ wrote, “Bad or good sign?”

Whales Moving Out Of Bitcoin?

This comes at a time when large holders are still selling Bitcoin. On-chain Lens flagged that a whale called "1011 Insider Whale" has sold about 60% of his BTC holdings. After putting 11,318 BTC, which is worth about $760.61 million, into Binance, he took out $464.48 million in USDT from seven new addresses. His Bitcoin holdings on Binance are worth about $296 million.

According to Coinglass data, Bitcoin saw over $70 million in liquidations in the last 24 hours. Bitcoin (BTC) traded at $67,632.38, up by 0.5% in the last 24 hours. On Stocktwits, the retail sentiment around Bitcoin remained in ‘bearish’ territory, with chatter at ‘low’ levels over the past day.

From a market-structure perspective, sentiment lags price. However, traders on Stocktwits are still hopeful about crypto.

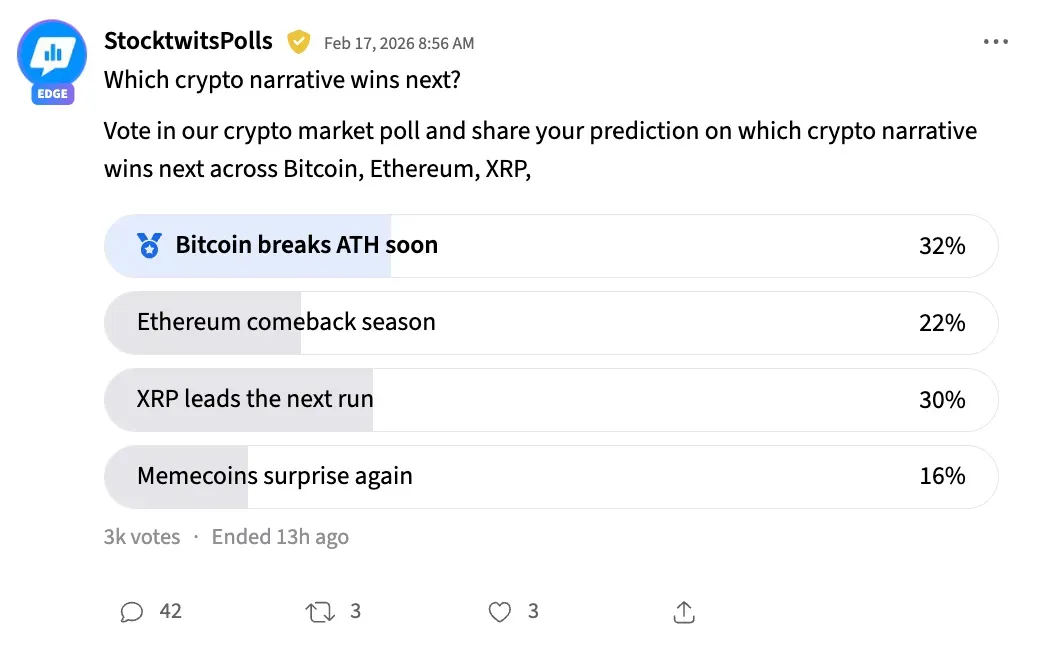

What Story Comes Next Is Up For Debate Among Traders

A recent poll on Stocktwits shows that the market is divided on what will win the next leg up. For example, 32% think Bitcoin could hit an all-time high soon, and 30% think XRP will lead the next run. 22% thought Ethereum could be the next big thing in the market, while 16% are betting the same on memecoins.

One market commentator named SCN on Stocktwits wrote that Bitcoin's price drop below $90,000 was caused by leveraged short pressure, not real spot selling. Demand is still strong, and supply on exchanges is shrinking. He explained that this creates a positioning squeeze that could push the price back up toward higher levels of supply and demand.

Ripple’s XRP (XRP) traded at $1.43, up by 1.5% in the last 24 hours. On Stocktwits, the retail sentiment around XRP remained in ‘bearish’ territory, with chatter at ‘low’ levels over the past day.

Ethereum (ETH), trading at $1,957.18, went up by 1.1% in the past 24 hours. On Stocktwits, the retail sentiment around Ethereum went down from ‘bearish’ to ‘extremely bearish’ territory, as chatter remained at ‘low’ levels over the past day.

Read also: Figure Completes Pricing For First Fully On-Chain Public Equity

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244604426_jpg_3ed8dfd495.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264079099_jpg_413be497c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_697933476_jpg_e664f6ffff.webp)