Advertisement|Remove ads.

Bitcoin Lender Says ‘World Order Has Broken Down,’ Positions BTC As Structural Hedge

- Arch Lending warned that it would not be an easy road for it to reclaim the new order.

- The thesis came as Ray Dalio and global leaders publicly stated that the existing world order has fractured.

- With BTC trading near $68,000, Arch framed the volatility as part of a structural transition.

As central banks hoard gold amid rising geopolitical tensions, Bitcoin-backed loan company Arch Lending is positioning Bitcoin as a long-term structural hedge. This echoes recent warnings from hedge fund billionaire Ray Dalio.

In a note titled “Bitcoin and the New World Order,” the firm argued that structural geopolitical changes reshaped the monetary landscape in favor of Bitcoin (BTC).

Bitcoin Built For Multi-Polar World: Arch

Arch Lending explained that the shift from the post-1945 global order would not be smooth, describing the current period as volatile and uncertain due to government regulations and shifting alliances. The firm stated that Bitcoin differed from traditional assets such as fiat currencies because it operated outside the control of any single nation, institution, or alliance.

Arch Lending described the ongoing shift as a move “away from centralized trust and toward multipolar competition,” adding that assets not dependent on counterparties may become more relevant in such an environment.

The firm also acknowledged short-term drawdowns and market discomfort, stating that the transition “won’t be comfortable,” but framed the broader shift as structural rather than cyclical.

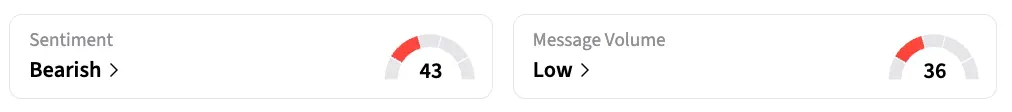

Bitcoin (BTC) was trading at $68,042.51, down 2.02% over the last day. On Stocktwits, retail sentiment around BTC remained in ‘bearish’ territory, as chatter remained at ‘low’ levels over the past day.

Dalio: ‘The World Order Has Broken Down’

Arch’s Monday note followed a post by hedge fund billionaire Ray Dalio, who claimed that the post-1945 world order “has officially broken down.”

Dalio cited remarks from leaders at the Munich Security Conference held last week. It included German Chancellor Friedrich Merz, French President Emmanuel Macron, and U.S. Secretary of State Marco Rubio, who said, “The world order as it has stood for decades no longer exists,” describing a period of “great power politics.”

Dalio wrote that the global system entered “Stage 6” of the Big Cycle, a period marked by disorder and realignment of power among nations. He argued that global power structures move through multi-decade “Big Cycles,” in which monetary regimes and geopolitical dominance eventually give way to new systems.

The term “new world order” is not new. It has historically been used to describe major geopolitical transitions, including the post-Cold War period in the early 1990s, when academics and policymakers debated how global institutions would evolve after the collapse of the Soviet Union.

Gold Buying Surges

The discussion also came amid increased central bank gold accumulation. Data from Visual Capitalist showed that since 2020, central banks have added nearly 2,000 tonnes of gold, with China and Poland among the largest buyers.

At the same time, the freezing of Russia’s central bank reserves in 2022 was the turning point in how sovereign reserves are perceived.

Arch’s article positioned Bitcoin within this broader context, arguing that it combined portability, scarcity, and settlement without intermediaries at a time when monetary systems were being reassessed.

Read also: TRON Defies Crypto Market Slump As Bitcoin, Ethereum Lead $221M Liquidation Wave

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)