Advertisement|Remove ads.

Bitcoin's Price Plunges Below $71,000 With Traders Bracing For Deeper Losses – XRP Hit Hardest

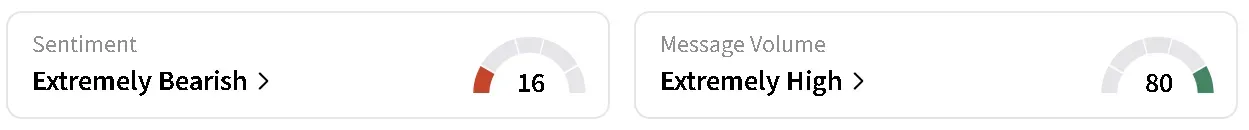

- Bitcoin’s price declined 7.4% over the past 24 hours, with retail sentiment sinking deeper into ‘extremely bearish’ territory on Stocktwits.

- Prediction markets show traders anticipating a move below $70,000 this month.

- Total cryptocurrency market value dropped below $2.5 trillion amid the selloff.

Bitcoin (BTC) was in the red for a third straight session on Wednesday night, marking another low for the year, falling to under $71,000.

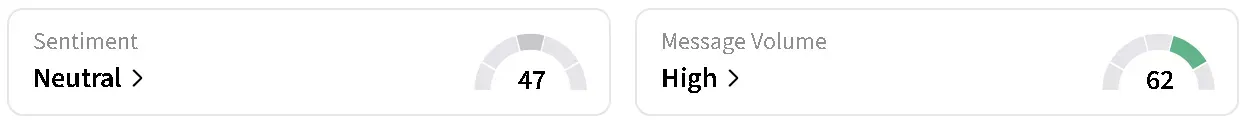

Bitcoin’s price fell 7.4% in the last 24 hours to $70,900, with retail sentiment on Stocktwits dropping lower within the ‘extremely bearish’ territory as chatter remained at ‘extremely high’ levels.

Markets Are Betting Bitcoin’s Price Will Fall Further

Polymarket’s real-money contracts showed that 90% of bettors believe that the apex cryptocurrency is set to fall below the $70,000 mark in February. Kalshi data reflected that around 82% of bettors believe Bitcoin will fall under $65,000 this year, and another 70% feel it could even drop below $60,000.

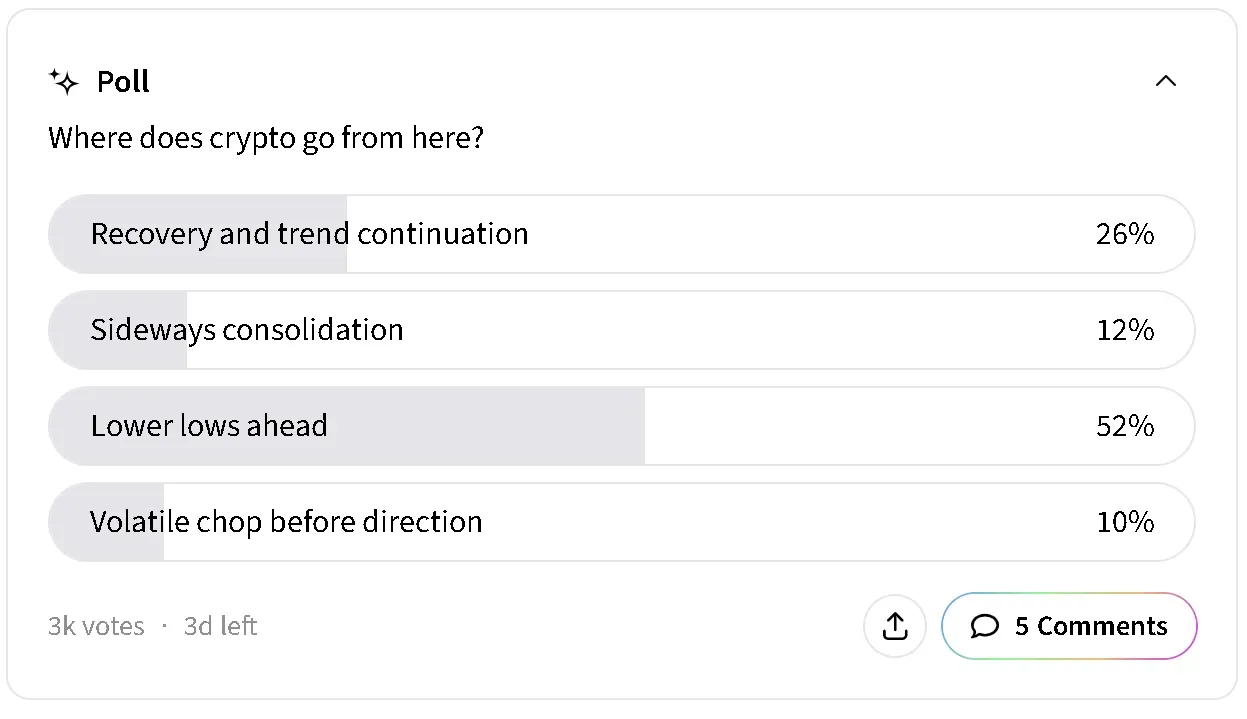

An ongoing poll on Stocktwits asking users where they think the crypto market is headed saw more than 50% of respondents anticipating ‘lower lows ahead.’ Only 26% expect the market to recov, with another 12% betting on sideways consolidation.

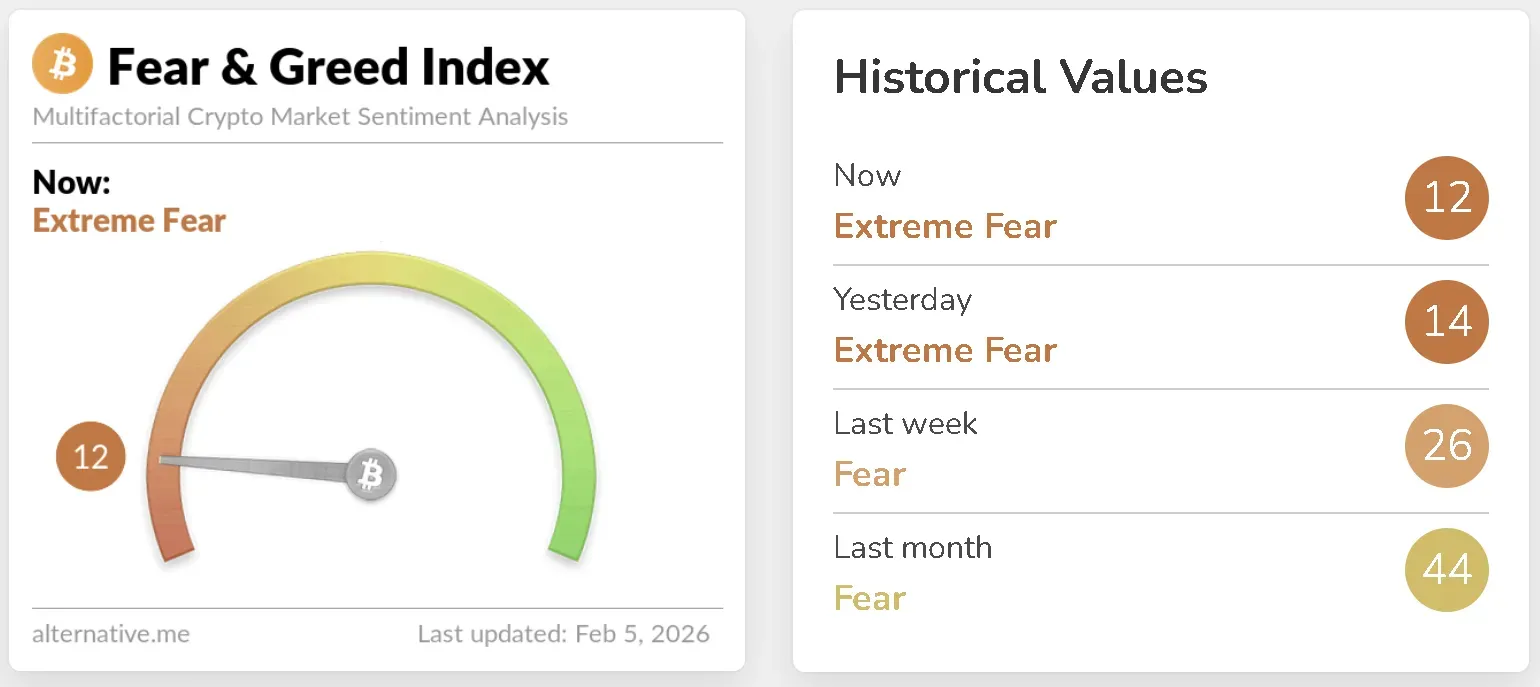

The overall cryptocurrency market fell under $2.5 trillion, down 6.2% in the last 24 hours. CoinGlass data showed nearly $770 million wiped out during that drop, led by liquidations in long positions, amounting to $635 million. The Crypto Fear & Green Index also continued its drop, falling to its lowest level since November 2024 at a reading of 12 in the ‘Extreme Fear’ zone.

XRP’s Price Worst Hit By Bitcoin Drop

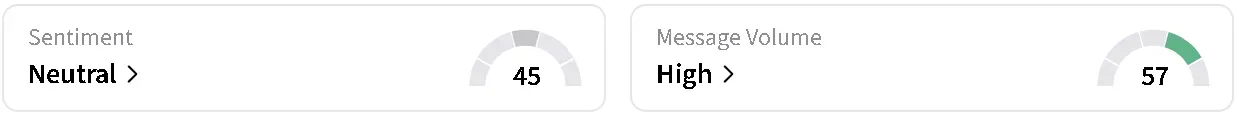

The crash hit Ripple’s XRP (XRP) the hardest among the top 10 cryptocurrencies by market capitalization. XRP’s price dropped nearly 10% in the last 24 hours to $1.44. Retail sentiment, however, improved to ‘neutral’ from ‘bearish’ territory over the past day on Stocktwits. Chatter trended at ‘high’ levels.

Binance Coin (BNB) followed with a drop of 8.9% to $692.11. The altcoin also saw retail sentiment improve to ‘neutral’ from ‘bearish’ territory over the past day, with chatter at ‘high’ levels.

Solana (SOL) and Ethereum (ETH) also underperformed, fallen 8.1% and 7.9% respectively, over the last 24 hours. Retail sentiment around Solana on Stocktwits jumped to ‘bullish’ from ‘neutral’ over the past day after the value of tokenized stocks on its network hit a record high of over $230 million. Chatter increased to ‘extremely high’ from ‘high’ levels.

Meanwhile, retail sentiment around Ethereum remained in the ‘bearish’ zone, accompanied by ‘extremely high’ levels of chatter over the past day.

Read also: Cathie Wood’s Ark Invest Adds More Robinhood, Coinbase, Bitmine Shares In Crypto Dip Buying Spree

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)