Advertisement|Remove ads.

Bitcoin Rally Loses Steam After US-China Trade Deal – Retail Sees Apex Crypto Topping $150,000 By Year-End

The cryptocurrency market continued to trend downwards in U.S. pre-market hours on Tuesday as the weekend rally lost steam after the U.S.-China trade deal. Bitcoin (BTC) lost 0.8% in the past 24 hours.

Bitcoin traded just below $103,500 after touching $105,500 in the previous session, but retail traders remain bullish on its upside.

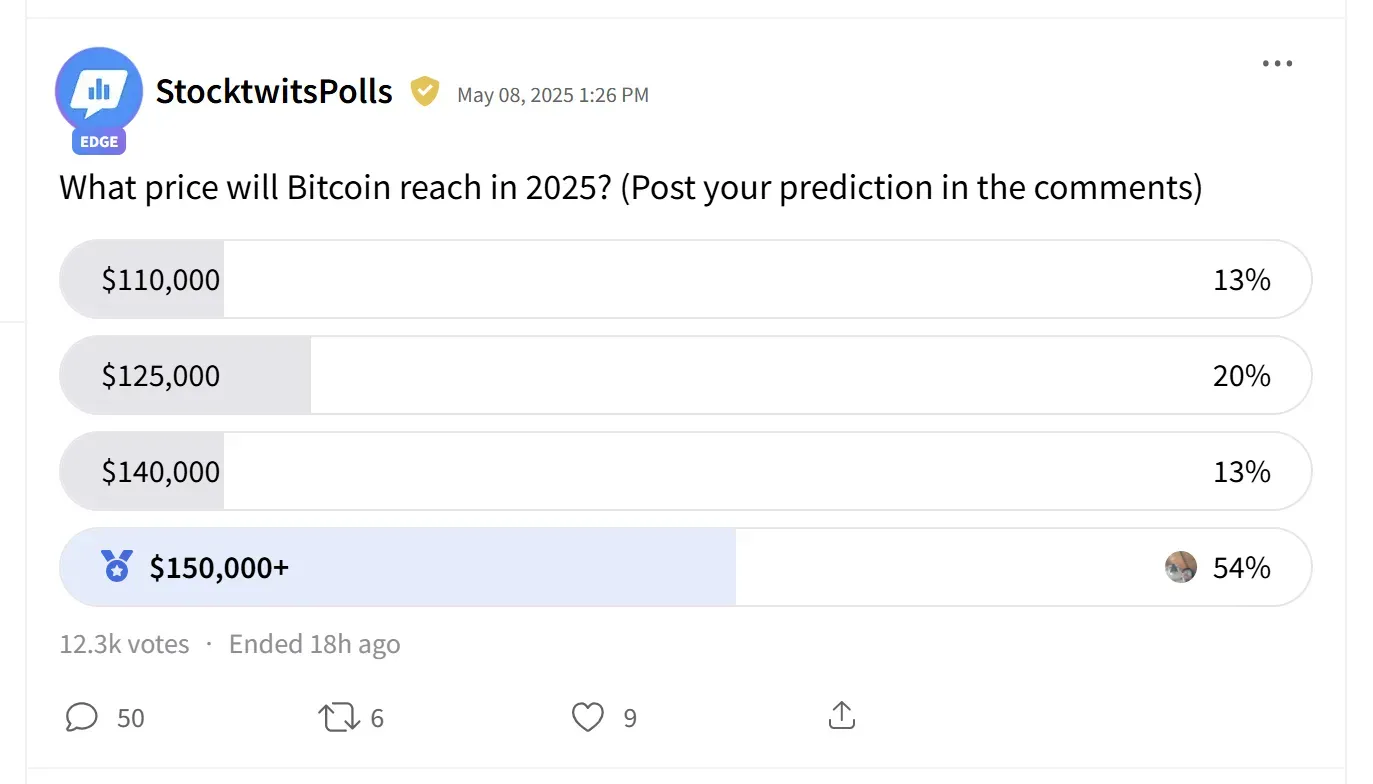

In a Stocktwits poll with over 12,000 respondents, 54% said they expect Bitcoin to top $150,000 by year-end. About 20% forecast a peak around $125,000, while 13% see $140,000 as a likely high. Only 13% believe it will stall near $110,000.

Last week, Standard Chartered analyst Geoffrey Kendrick also echoed a similar sentiment. Apologizing for his price target of $120,000 for the quarter ending in June, he said that Bitcoin’s price could reach $200,000, representing an upside of nearly 93% from current levels.

According to him, investors are growing risk-averse towards U.S. assets, and whales are accumulating Bitcoin, which could drive the apex cryptocurrency’s price higher by the end of the year.

On Monday, Michael Saylor-backed Strategy (MSTR) announced another purchase of 13,390 Bitcoin for around $1.34 billion. The company now holds 568,840 BTC in its treasury.

Strategy’s stock rose 1.7% during the previous session but has dipped 2.6% in pre-market trade.

Bitcoin’s price is up 11% year-to-date, with gains of 68% over the past 12 months. However, the cryptocurrency is trading 4.7% below its all-time high of nearly $109,000, seen in January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Dow, S&P 500, Nasdaq Futures Edge Lower Ahead Of Inflation Data

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ark_Invest_5fb0c3e42a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_dce41bddd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249343553_jpg_9514c23c09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2176869147_jpg_120d632578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CFTC_d95b7fc1c2.webp)