Advertisement|Remove ads.

Bitcoin Options Traders Bet On BTC’s Price To Cross $75,000 – CLARITY Act Push May Not Be Enough, Says Analyst

- Barthere stated that the most active strike over the past seven days has been $75,000, indicating that traders are positioning for Bitcoin’s price to break out above $70,000.

- She added that traders are less defensive on Bitcoin than they were 10 days ago.

- She noted that macro factors, including fiscal policy and political developments, remain key drivers of broader risk appetite.

Bitcoin’s (BTC) price remained below the $70,000 resistance level on Wednesday, but derivatives data showed growing bets on a push higher, with traders targeting the $75,000 level.

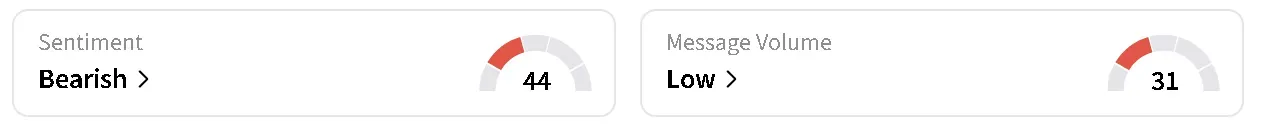

Bitcoin’s price was trading at around $67,750, down 0.1% in the last 24 hours, after paring gains from an intra-day high that crossed $68,000. On Stocktwits, retail sentiment around Bitcoin trended in ‘bearish’ territory over the past day.

Institutional Bets Cluster Around $75,000

While many worried that the ‘crypto winter’ is here to stay, positioning by traders in the options market suggests they’re betting on Bitcoin’s price to rise. According to Aurelie Barthere, principal research analyst at Nansen, call options have outpaced put buying over the past week. The activity has been particularly notable in large “block” trades, which are typically associated with institutional or professional investors.

She stated that the most active strike has been $75,000, indicating that traders are positioning for a breakout above the $70,000 resistance level rather than expecting Bitcoin to remain within its recent $60,000 to $70,000 range.

Barthere also pointed to the 25-delta call-put skew’s recovery from deeply negative levels seen on February 5, noting that it still remains slightly negative. In practical terms, Barthere said this suggests traders still see downside risks, though they are less defensive than they were 10 days ago and would likely be long on Bitcoin if it broke past $70,000.

Washington Policy Boost: CLARITY Bill Seen As Potential Catalyst

Barthere noted that Bitcoin has now retraced its entire post-Trump election ascent. “For those with the patience to hold long term and who believe favorable crypto regulations are likely to continue, albeit at a slower pace, this could be an acceptable level for patient, cautious DCAing (no financial advice),” she wrote in an email to Stocktwits.

She added that she had expected progress on the CLARITY bill, which remains a focal point in Washington. If it passes and manages to push Bitcoin’s price above $70,000, it may still not be a sustained move, Barthere said, citing that broader sentiment would also need to improve.

“Key macro events to watch include whether Warsh’s nomination is confirmed by Congress and whether the CLARITY bill is ultimately adopted by the Senate,” she said, pointing to other potential catalysts that could impact crypto market sentiment. “ I would also monitor Trump’s popularity trajectory and mid-term polls, as well as whether Q2 fiscal spending is sufficient to sustain U.S. economic momentum.”

For now, derivatives markets suggest cautious optimism, with traders watching closely for a decisive move above resistance.

Read also: MSTR's Michael Saylor Says ‘Bitcoin Is Winning’ Amid Crypto Winter, Sees ‘Glorious Summer’ Ahead

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_upwork_jpg_f9d5e591d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)