Advertisement|Remove ads.

Bitcoin Weekend Flash Crash Sends Price To 2024 Levels, Analysts Call It A ‘Rounding Error’

- Crypto markets saw a sharp weekend flash crash, pushing Bitcoin back to late-2024 levels and triggering heavy liquidations led by Ethereum.

- The sell-off accelerated after President Donald Trump nominated Kevin Warsh as the next Fed chair.

- Analysts said the move reflects a familiar de-leveraging phase rather than structural damage.

The crypto market suffered a flash crash over the last 48 hours, where the total market cap tanked nearly 4% to $2.56 trillion, with long-side liquidation led by Ethereum (ETH). However, analysts are not too worried and have called it a de-leveraging incident.

Among the top cryptocurrencies by market cap, Ethereum saw over $255.41 million in liquidations in the last 24 hours, according to Coinglass data. Ethereum’s price was trading at $ 2,174, down over 10% in the last 24 hours. On Stocktwits, retail sentiment around Ethereum remained in ‘bearish’ territory, as chatter levels around it improved from ‘high’ to ‘extremely high’ over the past day.

Similarly, over $13,000 was wiped out of Bitcoin (BTC) in the last 24 hours, driving the price to levels last seen in November of 2024. The asset was trading at $75,594, down by 4% with over $210.75 million in total liquidation, in the last 24 hours. On Stockwits, Bitcoin was trending at number one, as the retail sentiment around the cryptocurrency remained in ‘extremely bearish’ territory and chatter levels rose to ‘extremely high’ from ‘extremely low’ levels over the past day.

Bitcoin’s Major Wipe-Out Fueled By Kevin Warsh’s Nomination

The macro shock came after President Donald Trump announced the nomination of Kevin Warsh to be the next chair of the Federal Reserve– the sell-off sped up. The move shocked markets and put pressure on leveraged risk assets, given that Warsh has always promoted a tighter approach to liquidity and money supply. Less liquidity brings less money to crypto assets.

Separately, macro shocks were also felt as Iran’s supreme leader, Ayatollah Ali Khamenei, warned that if the U.S. attacked Iran, it could lead to “regional war” in the Middle East, further raising an already heated geopolitical tension. President Trump has also vowed to launch a military strike on the Islamic Republic on Sunday.

However, market experts are not too worried. They say that the most recent crypto flash crash is just another example of a pattern that has happened many times before, not a sign that the market is falling apart.

Analyst Points To A ‘Rounding Error’ In The Larger Picture

The Kobeissi Letter said that every big crypto crash feels like the end of the world for the asset class at first, but over the long term, it becomes a "rounding error." Kobessi used Bitcoin's past drops, like the Mt. Gox crash in 2014, the ICO bust, the COVID crash, and the FTX collapse in 2022, to show that the current drop from 2025 to 2026 is just another cyclical deleveraging phase and not the end of crypto.

The company said that bear markets repeatedly lower leverage, reset expectations, and get rid of extra risk, which sets the stage for the next expansionary leg when macro pressure eases.

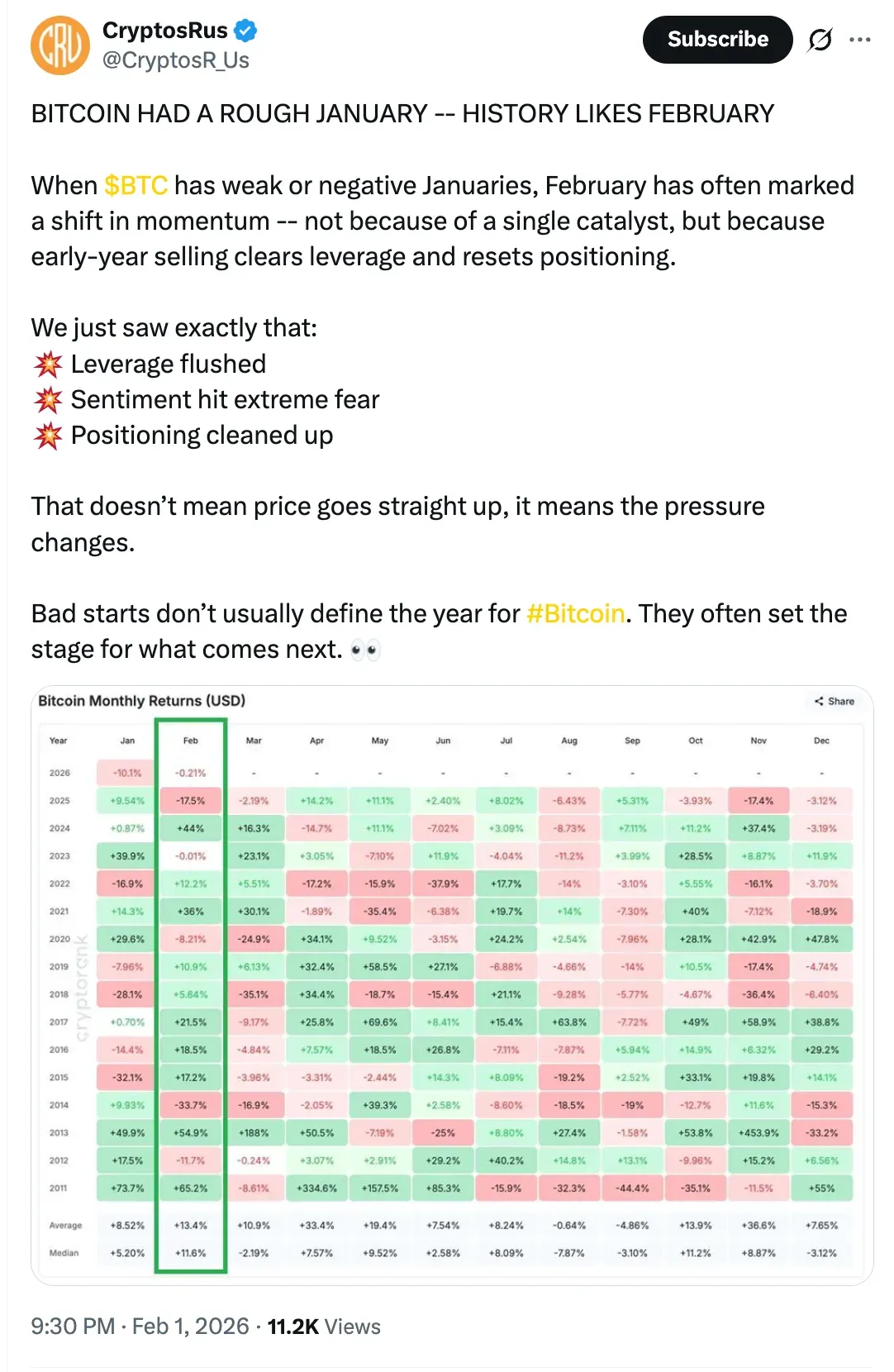

On the other hand, CryptoRus took a more tactical approach and looked at how short-term momentum changes. CryptoRus said that historically, when Bitcoin has a bad January, it tends to do better in February. He indicated that this behaviour is dictated by selling at the beginning of the year, which flushes out leverage and cleans up positioning. The market analyst said that the recent wave of liquidations meets all three criteria: leverage was wiped out, sentiment gave up, and speculative positioning was reset. This changed market pressure, even if prices don't go back up right away.

Altcoins Face The Brutal Jolt

In the broader altcoin market, prices remained in the red. For instance, Solana (SOL) was trading at $99.71, down by 4.8% in the last 24 hours, with over $30.52 million in total liquidation in the last 24 hours. On Stockwits, the retail sentiment around Solana remained in ‘bearish’ territory, as chatter levels around it dipped from ‘extremely high’ to ‘high’ over the past day.

XRP (XRP) was trading at $1.58, down by 5.3% in the last 24 hours, with over $9.62 million in total liquidation in the last 24 hours. On Stockwits, the retail sentiment around XRP remained in ‘bearish’ territory, as chatter levels around it dipped from ‘extremely ‘high’ to ‘normal’ over the past day.

Dogecoin (DOGE) was trading at $0.1026, down by 2.5% in the last 24 hours, with over $4.80 million in total liquidation in the last 24 hours. On Stockwits, the retail sentiment around DOGE remained in ‘bearish’ territory, as chatter levels around it dipped from ‘extremely ‘high’ to ‘normal’ over the past day.

BNB (BNB) was trading at $744.49, down by 4.9% in the last 24 hours, with over $3.58 million in total liquidation in the last 24 hours. On Stockwits, the retail sentiment around BNB remained in ‘bearish’ territory, as chatter levels around it improved from ‘extremely high’ to ‘high’ over the past day.

Cardano (ADA) was trading at $0.2827, down by 4.5% in the last 24 hours, with over $1.58 million in total liquidation in the last 24 hours. On Stockwits, the retail sentiment around ADA remained in ‘bearish’ territory, as chatter around it remained at ‘normal’ levels over the past day.

Read also: Washington’s Crypto Bill Could Be The Make-Or-Break Moment For BMNR Stock, Believe Analysts

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364715_jpg_59427544e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)