Advertisement|Remove ads.

Blackrock’s Larry Fink Sees The Future Of Finance On A Blockchain – And It’s Not Bitcoin

- BlackRock CEO Larry Fink said at the World Economic Forum that tokenization could allow assets to move seamlessly between money market funds, equities, and bonds.

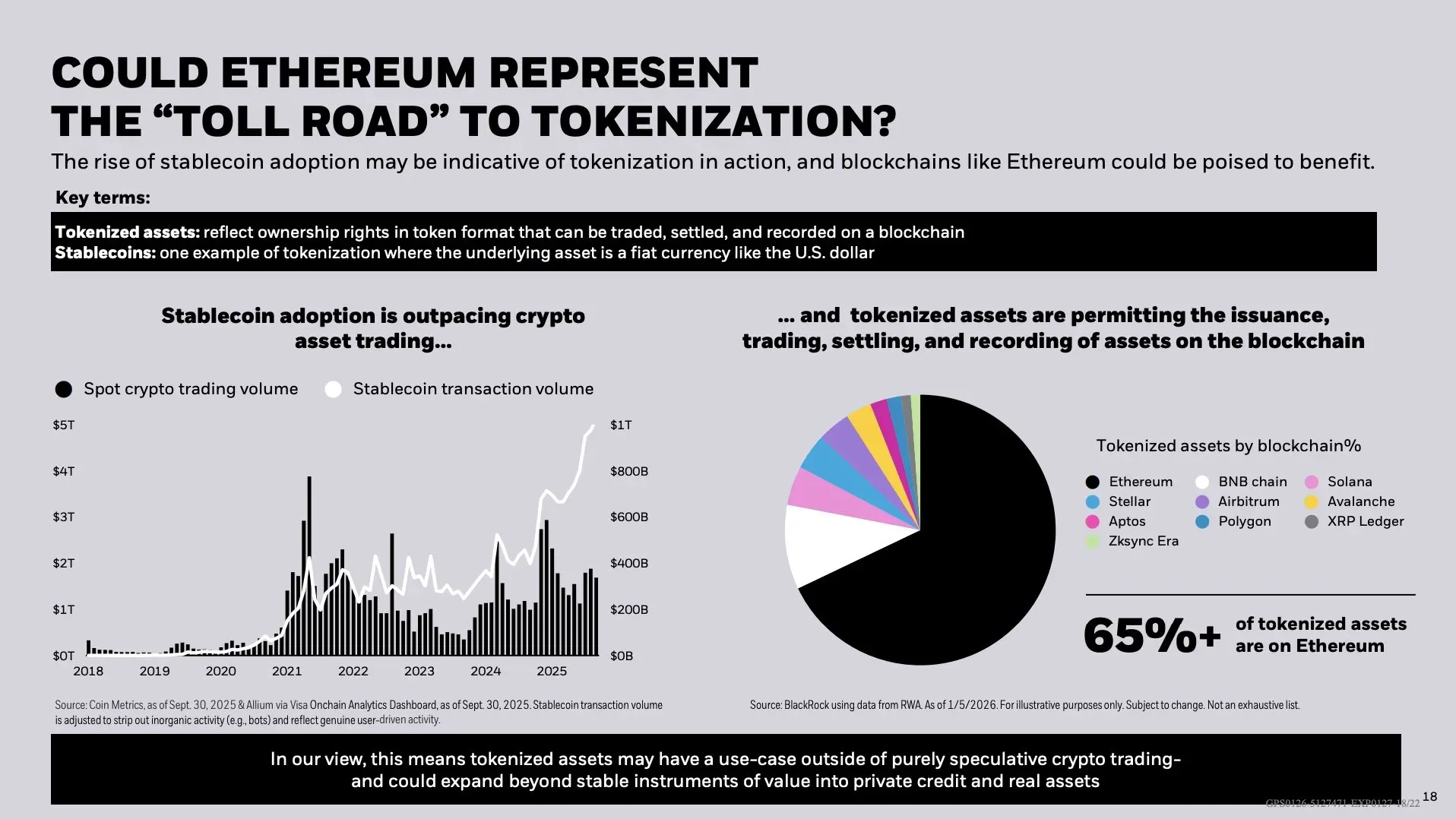

- BlackRock Research said Ethereum underpins 65% of tokenized assets globally.

- BlackRock described stablecoins as ‘tokenizations in action’, pointing to growing blockchain use beyond speculative crypto trading.

Ethereum is gaining backing from the world's largest asset manager. At Davos, BlackRock (BLK) CEO Larry Fink framed blockchain-based finance as a way to cut costs and improve efficiency. And new BlackRock research shows Ethereum already underpins more than 65% of tokenized assets globally.

Speaking at the World Economic Forum on Friday, CEO Fink framed tokenization as the next leg up for global financial markets. Fink believes that if there were a way for all investments to be tokenized on a platform, we could “move from a tokenized money market fund to equities and bonds and back and forth.”

“I think the movement towards tokenization and decimalization is necessary. It's ironic that we see two emerging countries leading the world in decimals, in the tokenization and digitization of their currency. That's Brazil and India. I think we need to move very rapidly to doing that. We would be reducing fees.”

Larry Fink, CEO of BlackRock

Link further added, “So I would argue that, yes, we have more dependencies on maybe one blockchain, which we could all talk about. But that being said, those activities are probably processed and more secure than ever.” Fink’s assertion comes as BlackRock published research that indicates that the Ethereum blockchain already underpins 65% of tokenized assets.

Ethereum (ETH) was trading at $2,957.88, up 1.1% in the last 24 hours. On Stocktwits, retail sentiment around Ethereum remained in ‘bearish’ territory, as chatter levels remained at ‘normal’ over the past day.

Is Wall Street’s Tokenization Bet Converging On Ethereum?

The study titled “Could Ethereum Represent the 'Toll Road’ to Tokenization?” BlackRock noted that the Ethereum blockchain could benefit structurally from tokenization.

BlackRock's analysis of real-world asset (RWA) data as of January 5, 2026, shows that while more than 65% of tokenized assets around the world are issued on Ethereum, the rest are made up of competing networks like Stellar (XLM), Polygon (MATIC), Solana (SOL), Avalanche, Arbitrum, and the XRP Ledger. None of these networks, however, comes close to Ethereum.

BlackRock's framing doesn't just focus on issuing tokens; it also sees Ethereum as financial infrastructure, like a payments rail or settlement layer, where value grows not just from adoption but also from being embedded across issuance, trading, settling, and keeping records.

Tokenization In Practice

The study also links Ethereum's position to the rise of stablecoins, which BlackRock calls "tokenization in action." Stablecoins are digital versions of real-world currencies that run on blockchain networks. They are often used as proof that tokenized assets can work at scale beyond just speculative crypto trading.

BlackRock's data shows that stablecoin transactions are growing faster than spot crypto trades. This suggests that blockchain activity is slowly moving away from pure speculation toward practical uses such as payments, liquidity management, and transaction settlement.

The report added that tokenized assets may have "a use-case outside of purely speculative crypto trading" and could move into markets such as private credit, structured products, and real-world assets, a point Larry Fink also emphasized at Davos.

Read also: Wall Street Treasury Buyers Scoop Up $49.7B Of Bitcoin And Ethereum, New Study Finds

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)