Advertisement|Remove ads.

US Election 2024: Bitcoin, Dogecoin Ride Trump Crypto Wave Higher As Retail Bets On Bigger Gains

Bitcoin ($BTC.X) and Dogecoin ($DOGE.X) surged on Tuesday morning as retail traders continued to ride the momentum from Donald Trump’s recent U.S. Presidential election victory.

The so-called “Trump Trade” has ignited a rally across digital assets, cryptocurrencies, and related stocks, with traders betting on further gains ahead.

Bitcoin hit a fresh high above $89,000 early Tuesday before retracing to around $86,500. The leading cryptocurrency has seen renewed interest from retail investors, especially in crypto exchange-traded funds (ETFs).

BlackRock’s iShares Bitcoin Trust ($IBIT), which launched earlier this year, witnessed a record $1.1 billion in net inflows on Friday, per a report by The Wall Street Journal.

The fund’s assets under management have reportedly grown to $35 billion, up by $12 billion in the past month as excitement built up around Trump’s prospects.

Meanwhile, Dogecoin has been on a tear, rallying 145% since Trump was declared the winner. The meme coin has outperformed both Bitcoin and Ethereum ($ETH.X) in recent days, partly fueled by support from billionaire Elon Musk, a key Trump ally.

Dogecoin enthusiasts are also optimistic that Trump’s victory could spur more news around Musk’s proposed Department of Government Efficiency, cheekily abbreviated as “DOGE.”

Still, the meme coin is still below its all-time high of $0.7376, which was hit way back in 2021.

During his campaign, Trump positioned himself as a crypto-friendly leader, promising to transform the United States into the “crypto capital of the planet.” His plans include establishing a strategic Bitcoin reserve and promoting domestic mining to bolster the U.S. as a global leader in digital assets.

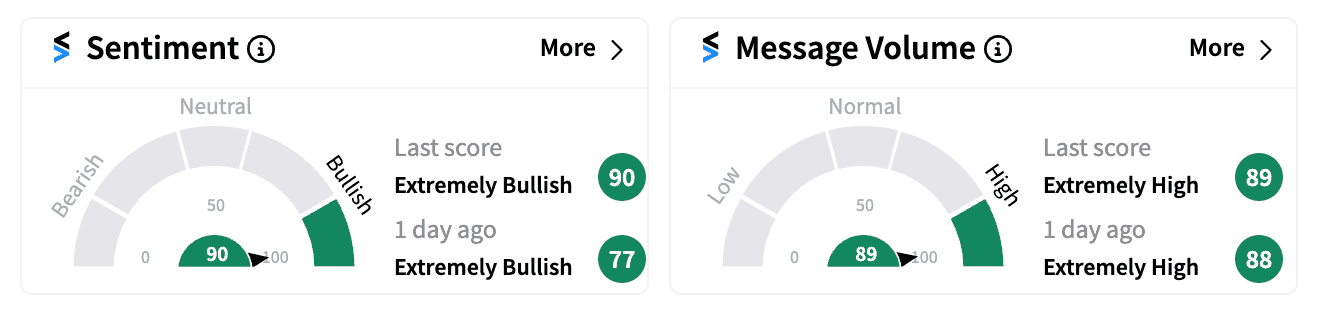

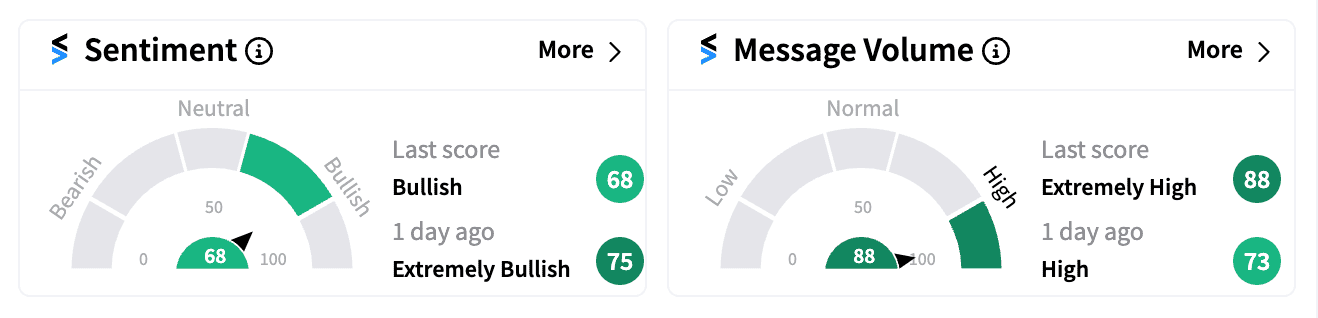

On Stocktwits, retail sentiment for Dogecoin hit ‘extremely bullish’ levels heading into Tuesday, amid a surge in message volume and optimistic chatter.

In contrast, sentiment for Bitcoin dipped slightly but remained in the ‘bullish’ zone, with traders expressing confidence in the long-term outlook despite near-term profit-taking.

Bitcoin has now gained 94% year-to-date, while Dogecoin has skyrocketed over 290%, driven by speculation, retail interest, and renewed support from high-profile figures like Trump and Musk.

According to a Stocktwits poll, 67% of retail investors believe that “Trump policy speculation” is solely fueling Bitcoin’s record highs, while 16% believe it’s because of “institutional adoption.”

On Dogecoin, 48% of retail investors say their strategy is waiting for the meme coin to hit $1, while 35% want to hold it for the long term.

For updates and corrections, email newsroom@stocktwits.com

Read next: Home Depot Stock Rises Pre-Market After Q3 Beat: Retail Saw It Coming

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)