Advertisement|Remove ads.

Bitcoin, XRP, Toshi See Heightened Retail Activity As Investor Sentiment Sours Ahead Of David Sack’s Digital Asset Conference

Bitcoin (BTC), Ripple (XRP), and Toshi (TOSHI) saw heightened retail activity on Stocktwits over the past 24 hours as the broader cryptocurrency market rebounded following news that U.S. President Donald Trump has paused new tariffs for 30 days.

Bitcoin briefly recovered but slipped below the $100,000 mark again on Tuesday, pressured by escalating fears of a potential trade war triggered by the tariff announcements from both the U.S. and China.

After hitting a daily low of $96,200, Bitcoin rebounded slightly and last traded at $99,733, still below the key psychological threshold.

The Chinese Ministry of Finance announced new import tariffs of up to 15% on certain U.S. goods, effective Feb. 10, in retaliation to Trump’s Feb. 1 executive order imposing tariffs on imports from China, Canada, and Mexico.

Despite the market volatility, there is speculation of a rebound with the upcoming announcement from David Sacks, the newly appointed AI and Crypto Czar, which is expected later on Tuesday.

Sacks is set to unveil the U.S. government's digital assets strategic plan, which could influence market sentiment.

Bitcoin’s price has risen 8% in the last 24 hours but remains 8.9% below its Jan. 20 peak of $108,786 just before Trump’s inauguration.

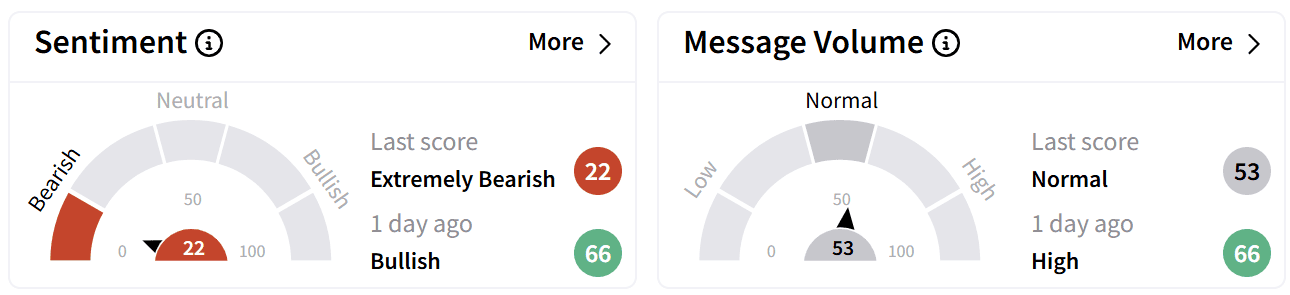

On Stocktwits, retail sentiment around Bitcoin flipped to ‘extremely bearish’ from ‘bullish’ a day ago as chatter petered down to ‘normal’ from ‘high’ levels.

Bitcoin has remained the most active crypto ticker on Stocktwits over the past 24 hours and the past week, experiencing the most significant increase in weekly message volume and maintaining the highest number of watchers.

Ripple (XRP) has seen flat price movement in the last 24 hours.

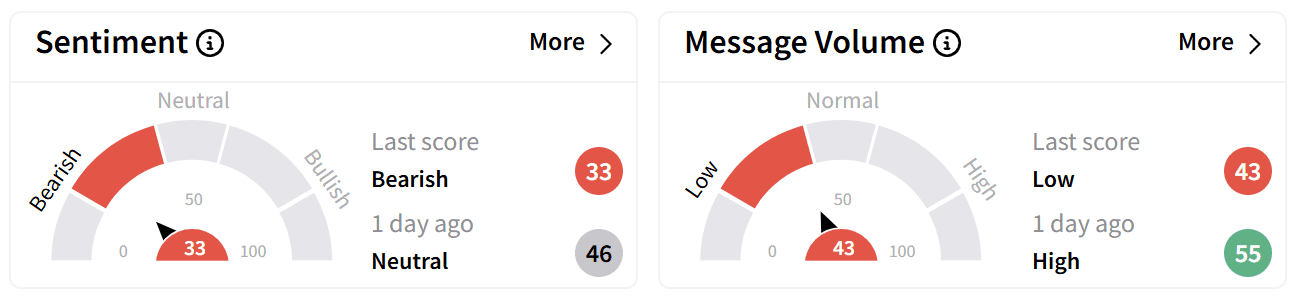

Retail sentiment on Stocktwits around XRP also dipped to ‘bearish’ from ‘neutral’ a day ago, accompanied by falling chatter to ‘low’ from ‘high’ levels.

XRP ranks as the second most active crypto on Stocktwits, daily and weekly, and saw the most significant increase in watchers over the past week.

It now holds the fourth-largest follower base on the platform, trailing Bitcoin, Dogecoin, and Ethereum.

Toshi (TOSHI), a meme coin built on the Base chain offering crypto, NFTs, and DeFi tools, has also been a focus.

After surging from $0.0001313 on Jan. 13 to an all-time high of $0.002273 on Jan. 26, Toshi's price is down 15% over the past 24 hours, trading 58.5% below its peak.

Retail investors are closely watching David Sacks’ upcoming press conference, hoping his remarks will boost market sentiment.

https://stocktwits.com/funksolbruthuh/message/602788343

One user speculated that while stablecoins may see a boost, Bitcoin may not benefit from Sack’s pending announcement.

Bitcoin’s price has more than doubled over the past year but has gained only 6% in 2025. In contrast, XRP has surged 406% year-over-year, with a 24% increase since the start of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Trump’s Meme Coin Tanks 75% From Peak Despite His Endorsement: Retail Sentiment Hits Record Low

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)