Advertisement|Remove ads.

Circle’s Acquisition Of Axelar’s Developers Stirs Up Crypto Community – AXL Price Falls Over 16%

- Axelar's native token AXL tumbled on Tuesday and fell more than 16% in the last 24 hours.

- Circle's acquisition of Axelar's developers led to token-versus-equity concerns among Axelar holders.

- The main point of contention was Circle’s announcement that Axelar remains independent, even as its team joins Circle.

Circle's (CRCL) acquisition of Axelar developers caused concerns among crypto market watchers on Monday, with Axelar's native token (AXL) tanking over 16% following the announcement.

Circle (CRCL) announced that it would buy Interop Labs, the developers of the Axelar Network, as well as its intellectual property. Following the announcement, Axelar’s price tanked more than 16% in the last 24 hours to $0.1097.

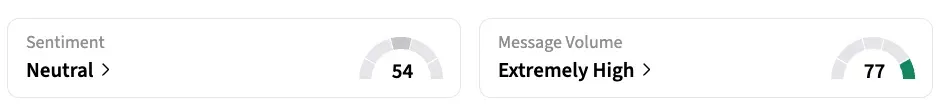

On Stocktwits, retail sentiment around AXL dropped from ‘bullish’ to ‘neutral’ territory over the past day, as chatter remained at ‘extremely high’ levels.

Token Versus Equity Debate

The news of Circle’s new acquisition seems to have sparked debate within the Axelar community, with some members on X referring to the selloff as a "token versus equity mismatch."

Crypto researcher Nick told Axelar co-founder Sergey Gorbunov in a post on X that the deal is concerning for AXL holders. He noted that even though the token is not part of the acquisition, the core development team and technology behind Axelar are. In his view, that leaves token holders exposed, as much of the platform’s value appears to have moved to Circle without directly benefiting AXL.

Mike Dudas, co-founder of TheBlock, believes the incident represents a larger issue with Circle than just the token design.

On the other hand, Avichal Garg, managing partner at Electric Capital and co-founder of Crypto Council, said on X that companies generally put shareholder value first and it is the founders who negotiate investor rights.

Circle’s Take On The Acquisition

Circle’s stock was trading at $75.46 in after-hours trade after dropping nearly 10% in the previous session. The shares edged 0.75% lower in after-hours trade. CRCL stock’s current price is the lowest it has been over the past five days. On Stocktwits, retail sentiment around CRCL remained in ‘bearish’ territory with message volume rising to ‘low’ from ‘extremely low’ levels.

Read also: ARK Invest Buys More Crypto Stocks While Its Circle And Coinbase Positions Sit at Losses

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)