Advertisement|Remove ads.

Coinbase Bitcoin Premium Stays Underwaters While Demand Turns Negative

- Coinbase Institutional said 26% of institutional and 21% of non-institutional investors now view crypto markets as bearish.

- The Coinbase Bitcoin Premium Index has stayed negative for nine straight days, signaling weaker U.S. spot demand versus global markets.

- Glassnode data shows Bitcoin trading below key cost-basis levels, with short-term holders selling into resistance near $98,400.

Crypto investors are preparing for downside, as fresh survey data and U.S. trading signals point to fading risk appetite at the start of 2026.

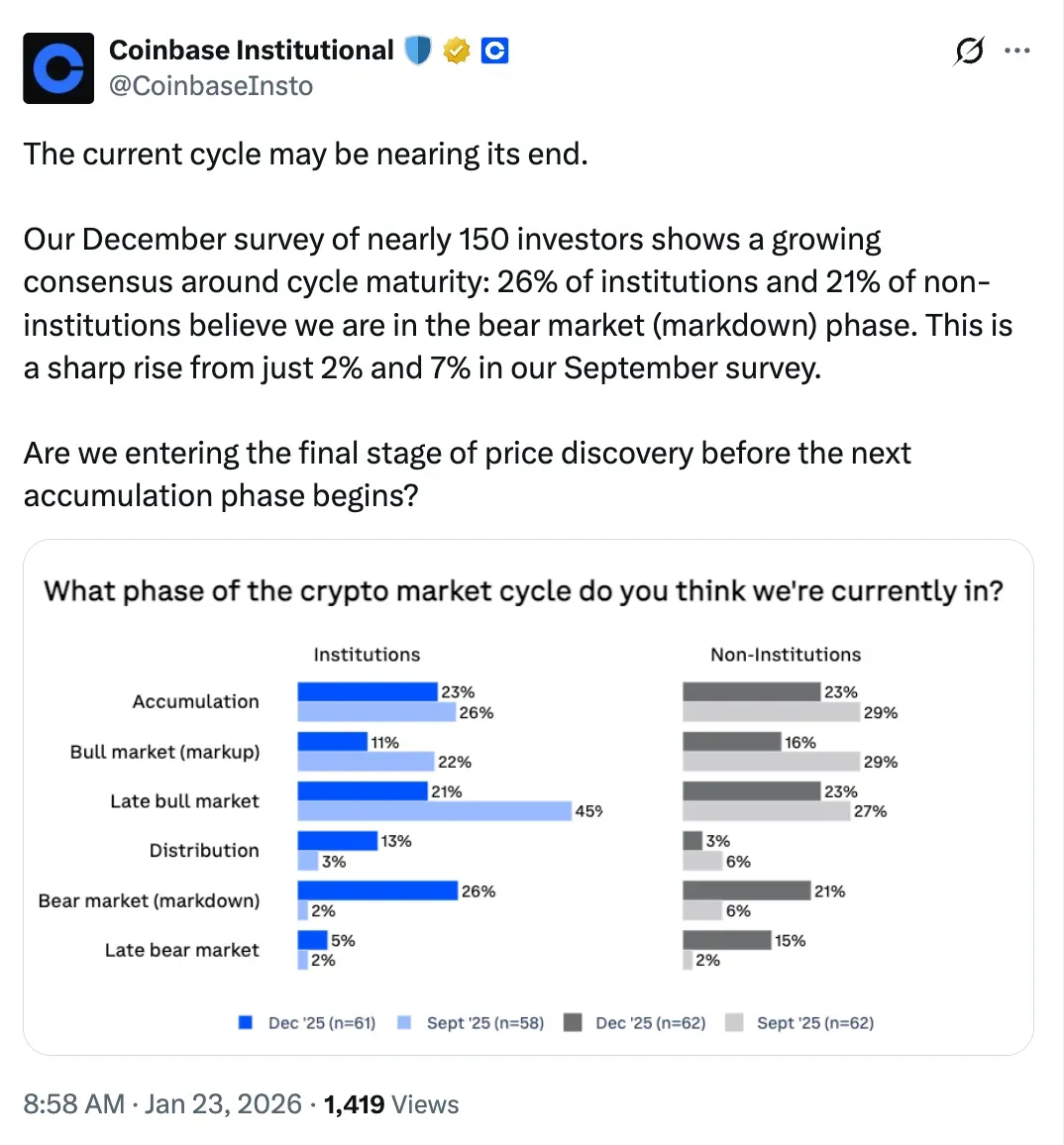

On Friday, Coinbase Institutional said that a December survey of nearly 150 investors showed a sharp rise in expectations around the crypto market entering the bear phase.

Coinbase Institutional, the firm’s research arm, noted that 26% of institutional investors and 21% of non-institutional investors believe the market is in a bear phase. That compares with just 2% and 7%, respectively, in the firm’s September survey, marking one of the largest sentiment shifts across its quarterly readings.

The survey asked investors to identify which phase of the crypto market cycle they believe the market is currently in, including accumulation, bull market, late bull market, distribution, bear market, and late bear market.

Coinbase said the results reflect a change in how respondents are categorizing the current stage of the cycle compared with earlier readings.

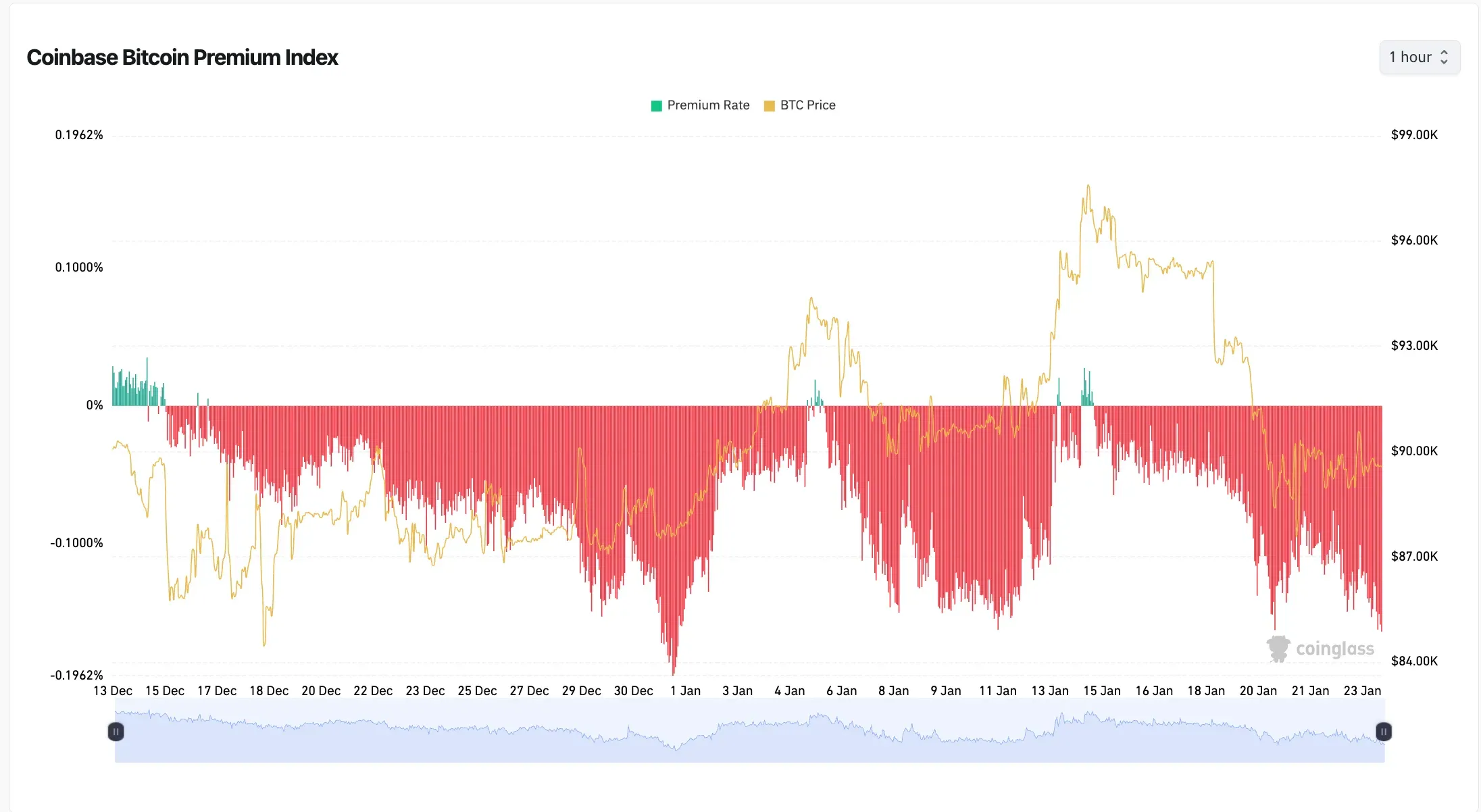

US Bitcoin Pricing Shows Sustained Discount

According to data from CoinGlass, the Coinbase Bitcoin Premium Index has remained negative for nine consecutive days, standing at -0.1399%. The index has been positive for only two days so far in January. Bitcoin (BTC) was trading at $89,486, up by 0.5% in 24 hours. On Stocktwits, retail sentiment around Bitcoin remained in ‘bearish’ territory, as chatter remained at ‘normal’ levels over the past day.

The Coinbase Bitcoin Premium Index tracks the difference between the price of Bitcoin on Coinbase and the average price across global exchanges. CoinGlass data shows that a negative reading indicates Bitcoin is trading at a discount on Coinbase relative to offshore markets.

Separately, on-chain data pointed to continued selling pressure.

According to Glassnode, Bitcoin has fallen below the 0.75 supply cost-basis quantile, meaning a majority of circulating BTC is currently held at a loss. Glassnode also said Bitcoin’s recent attempt to reclaim the short-term holder cost basis near $98,400 was met with selling from holders in the 3 to 6 month cohort, whose average cost basis sits around $112,600.

Focus Shifts To Capital Flows And Positioning

In its post, Coinbase Institutional also asked whether the market is approaching the final stage of price discovery before transitioning into a new accumulation phase. The firm did not provide a forecast or timeline.

Read also: Crypto Or Gold? A $4M Bet On Tether Gold Suggests Investors Want Both

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)