Advertisement|Remove ads.

Crypto’s Market Structure Bill Heads To Senate Next Week – But Wall Street Braces For Longer Road Ahead

- The crypto Market Structure bill is expected to reach the Senate floor next week.

- Senator Tim Scott said months of draft circulation have prepared the bill for a procedural vote, though final passage remains uncertain.

- Industry lawyers and policy experts broadly expect a market structure bill to pass eventually, though illicit finance provisions remain contentious.

The Market Structure Bill for crypto is poised to reach the U.S. Senate floor as early as next week, but Wall Street and policy analysts are bracing for a far longer legislative timeline before the bill becomes law.

Senator Tim Scott reportedly said Tuesday that the crypto market structure proposal is expected to advance to Senate deliberations imminently. The bill aims to define regulatory responsibilities for digital assets and establish clearer rules for crypto markets.

“Next Thursday, we’ll have a vote on market structure,” Scott told Breitbart News on Tuesday. “It’s important for us to get on the record and vote.” He said lawmakers have spent more than six months circulating multiple drafts among committee members in an effort to build consensus. In December, the Trump’s administrations AI and crypto czar David Sacks also said he had met with U.S. senators to support progress on the broader crypto market structure legislation.

Crypto Market Structure Bill Moves Forward Under A Cloud

Despite signs of near-term movement, TD Cowen cautioned that passage this year is far from assured. In a Monday note cited by TheBlock, the firm said U.S. crypto market structure legislation could slip to 2027, with final rules potentially taking effect in 2029 if political obstacles persist.

It added that Democrats may have limited incentive to accelerate the process, particularly if they believe control of the House could shift after the 2026 midterm elections. Even so, the company’s Washington Research Group managing director Jaret Seiberg said delays may not ultimately derail the legislation. “Time favors enactment as the problems disappear if the bill passes in 2027 and takes effect in 2029,” he wrote.

Crypto Industry Split On Legislative Timeline

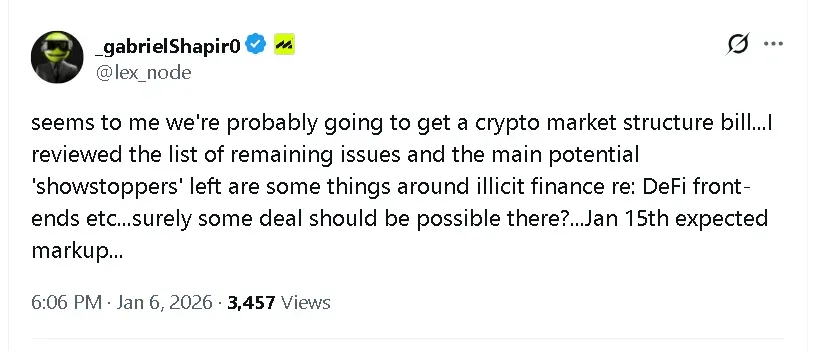

MetaLeX founder and crypto attorney Gabriel Shapiro said the U.S. is “probably going to get a crypto market structure bill,” though concerns around illicit finance remain unresolved. “There could be some deal,” Shapiro wrote in a post on X.

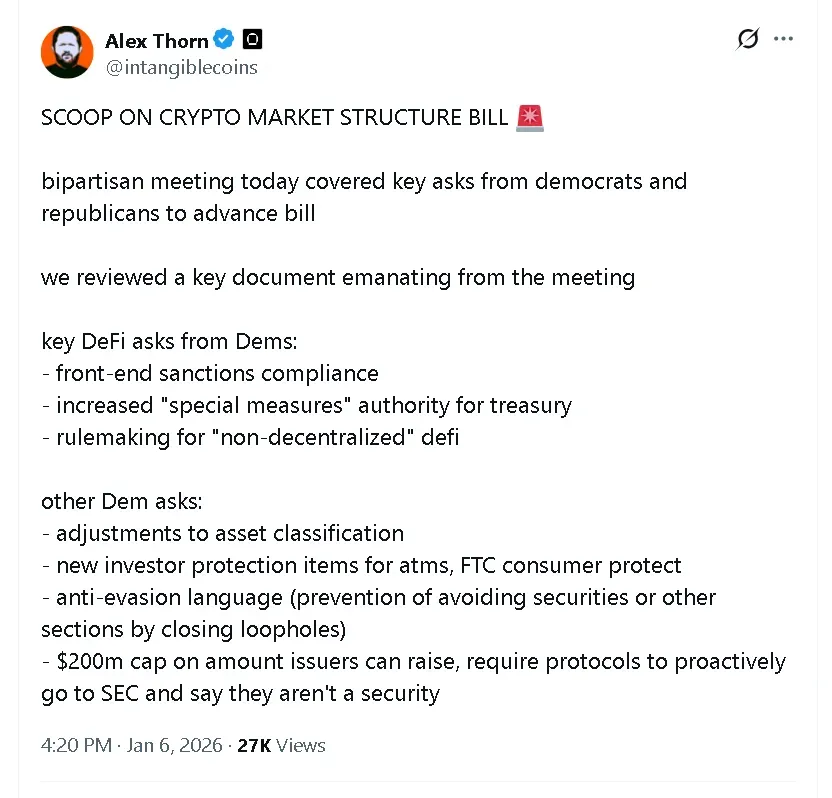

Others are less convinced. Galaxy Digital head of research Alex Thorn said in an X post on Tuesday that after reviewing materials from a bipartisan Senate meeting, it is “unclear if the two sides can come together and make that bipartisan,” citing several outstanding issues.

Some market participants argue that the legislative uncertainty is already weighing on crypto prices. CoinShares attributed $952 million in outflows from crypto investment products during the week ended Dec. 19 to delays in crypto legislation, citing prolonged regulatory uncertainty as the driver.

The overall cryptocurrency market was trading in the red in early morning trade on Wednesday. It slipped 1.75% in the last 24 hours to around $3.23 trillion. Bitcoin’s price slipped more than 2% to $91,700 with retail sentiment on Stocktwits trending in the ‘extremely bullish’ territory over the past day, amid ‘high’ levels of chatter.

Read also: Arthur Hayes Calls On Binance, Bybit To List This Crypto Token After It Hit A Record High

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)