Advertisement|Remove ads.

Crypto Traders See Real-World Assets Outperforming Memes, Privacy Coins In 2026

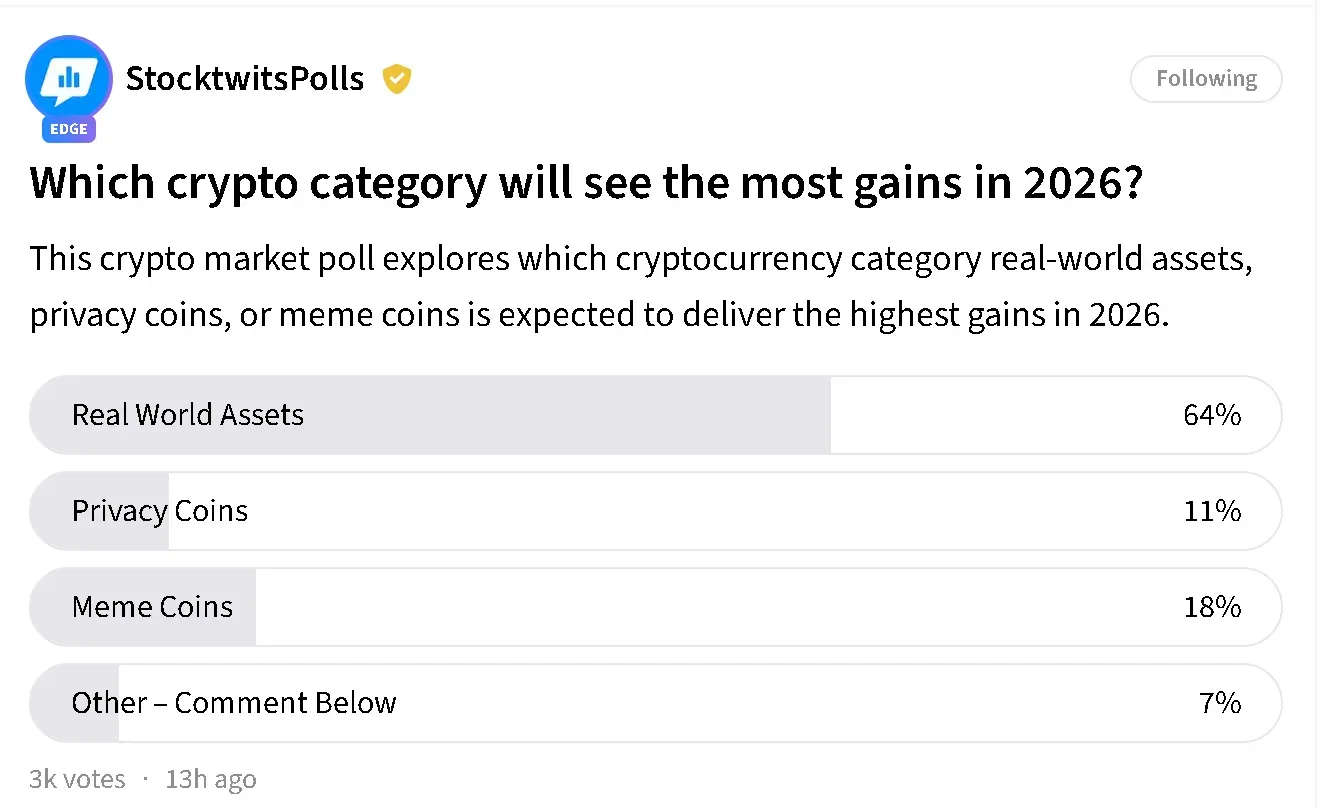

- Most investors are looking to real-world asset tokens as the next major driver of crypto gains, according to a Stocktwits poll.

- Meme coins received 18% of the vote, while privacy-focused tokens trailed with just 11%.

- Some investors continue to believe Bitcoin will remain the market’s top performer next year.

Investors are increasingly backing real-world asset tokens to lead the next phase of crypto gains, with a market poll showing strong preference for tokenization-linked projects over meme coins and privacy-focused assets heading into 2026.

According to a poll on Stocktwits, around 64% of respondents said real-world assets (RWAs) would deliver the strongest gains next year. By contrast, meme coins drew 18% of the vote, while privacy-focused tokens captured just 11%.

Other respondants maintained that Bitcoin (BTC) will lead gains in 2026.

The cryptocurrency market fell 1.2% over the last 24 hours, remaining above $3.3 trillion. Bitcoin (BTC) dipped 1.5% to around $95,500. On Stocktwits, retail sentiment around BTC remained in ‘bullish’ territory, but chatter dipped to ‘normal’ from ‘high’ levels over the past day.

Crypto Traders Move Away From Purely Speculative Trades

The trend of more investors being bullish on RWAs than privacy coins and meme coins suggests that the market is shifting away from purely speculative narratives. In 2025, the number of failed cryptocurrencies was eight times higher than the previous year, and the bulk of dead tokens were meme coins. The sector saw a surge with platforms like Pump.Fun (PUMP) and Raydium (RAY) are making it easier for a person to create a memecoin.

However, in the October quarter of 2025, when the crypto crash that wiped out $19 billion occurred, nearly 8 million coins were wiped from existence. Only a few with Pepe (PEPE) and Bonk (BONK) managed to survive with a market capitalization of nearly $1 billion.

Banks Are Pushing Towards Tokenization

The results align with increased activity among large asset managers and banks in pushing for blockchain-based settlement for credit, funds, and other financial instruments.

Grayscale forecasts a thousandfold growth in the RWA sector by 2030 in its 2026 outlook. It noted that the category currently represents just 0.01% of the global stocks and bonds market.

Meanwhile, a16z said RWA growth through native tokenization is going to be one of six key trends shaping crypto by 2026. The firm said the uptick will be driven by advances in stablecoins and blockchain-based financial infrastructure.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)