Advertisement|Remove ads.

Crypto Traders Are ‘Buying The Dip’ After Weekend Flash Crash, Shows Poll

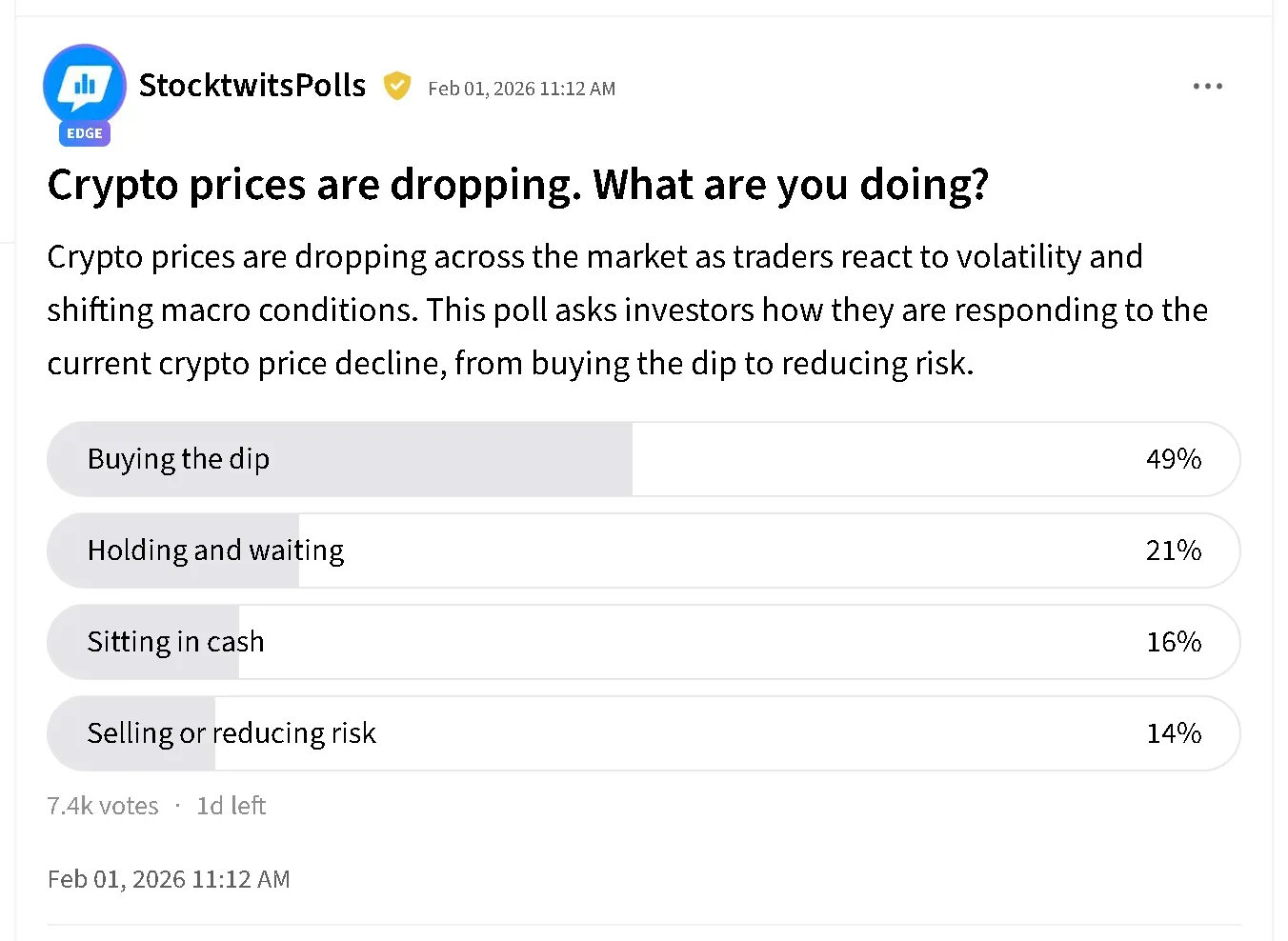

- Only 14% of respondents said they were selling, while another 16% said they were holding cash while the broader cryptocurrency market cools down.

- One-fifth of traders said they were holding and waiting to see how the crypto market plays out from the weekend flash crash.

- Cathie Wood's Ark Invest was also reported to have bought the dip, picking up crypto-linked equities at a discount after they fell on Monday.

Crypto traders are ‘buying the dip’ after the price of Bitcoin (BTC), Ethereum (ETH), and other major tokens fell during the weekend flash crash.

According to an ongoing poll on Stocktwits, nearly 50% of respondents said they’re picking up cryptocurrencies on the cheap, while another 21% said they were holding what was already in their portfolios and waiting to see how the market unfolds.

By contrast, fewer respondents reported defensive positioning. Only 14% said they were selling, and 16% said they were holding cash as the broader crypto market cools.

Dip Buyers Lean Into Volatility

One poll respondent said they were buying and selling with every dip and pump, riding the volatility in the cryptocurrency market.

Another said they were buying crypto’s dips but also dollar-cost averaging a small amount as their long-term strategy to sustain gains.

Cathie Wood’s Ark Invest also bought the dip, adding crypto-linked equities like Bitmine Immersion Technologies (BMNR) and Coinbase Global (COIN) to its portfolio on Monday as the stocks plummeted after the weekend crypto crash.

Liquidations Hit Both Sides Of The Market

The overall cryptocurrency market rose 1.2% in the last 24 hours to around $2.17 trillion. CoinGlass showed around $306 million in liquidations over the past day, with an even split across long bets and short positions being wiped out. Ethereum recorded the largest forced unwinds at $1.12 million, followed by Bitcoin at around $930,000.

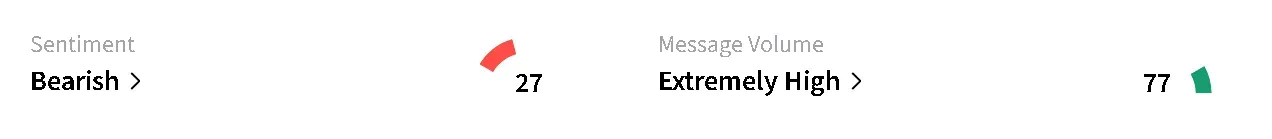

Bitcoin’s price rose 1.1% in the last 24 hours to around $78,300 – pairing gains after hitting an intra-day high of over $79,000. On Stocktwits, retail sentiment around the apex cryptocurrency improved to ‘bearish’ from ‘extremely bearish’ territory over the past day, with chatter at ‘extremely high’ levels.

Read also: Cathie Wood Says ‘I Would Shift From Gold To Bitcoin’ As ARK Invest Buys The Dip In Crypto Stocks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)