Advertisement|Remove ads.

Hedera Pops Amid Broader Crypto Market Slump As Canary Capital Advances ETF Filing With SEC – Retail Sentiment Improves

Hedera (HBAR) token’s price rose 2.6% during U.S. market hours after Canary Capital submitted a 19b-4 filing with the U.S. Securities and Exchange Commission (SEC) for a spot Hedera exchange-traded fund (ETF).

The crypto investment firm was the first to file an S-1 registration for the proposed Canary HBAR ETF in November.

The fund aims to provide exposure to Hedera’s native token, HBAR, which powers the decentralized public network.

A 19b-4 filing is the second step in the SEC’s approval process for a crypto ETF. Once acknowledged, the filing is published in the Federal Register, marking the start of the regulatory review period.

On Stocktwits, a poll of users had correctly predicted that Hedera was the most likely candidate for ETF approval.

HBAR is the underlying token of Hedera, a decentralized public network that utilizes the Hashgraph consensus algorithm to facilitate fast and secure transactions globally.

"Although the primary purpose of the Hedera Network is not to operate a payments system or store of value, like most public distributed ledger technology (DLT) networks, the Hedera Network requires a cryptocurrency to properly operate and incentivize consensus and behavior on the network," according to the filing.

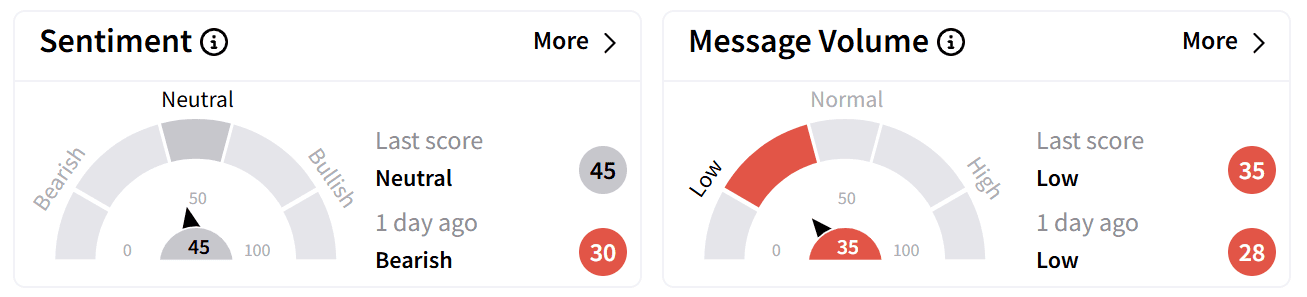

On Stocktwits, retail sentiment around the HBAR token improved to ‘neutral’ from ‘bearish’ a day ago.

Some traders speculated that Hedera’s price movement could have been stronger if the broader crypto market were not in a downturn.

HBAR has lost nearly 35% over the past month but remains up almost 100% year-over-year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)