Advertisement|Remove ads.

‘A Lot Less Dependable’: Jim Cramer Warns Robinhood’s Bitcoin Exposure Is Spooking Investors

- Jim Cramer said on CNBC’s Mad Money that Robinhood’s stock traded closely in line with Bitcoin during recent price swings, raising investor concerns around crypto-linked volatility.

- Bitcoin narrowly avoided falling below $60,000 on Thursday before rebounding from intraday lows, according to CNBC Africa.

- Robinhood reported that crypto trading revenue rose more than 300% year-over-year to $268 million in the third quarter, underscoring the stock’s exposure to cryptocurrency market moves.

Robinhood’s stock (HOOD) traded closely in line with Bitcoin (BTC) during recent price swings, CNBC’s Jim Cramer said on Friday.

Cramer, CNBC’s Mad Money host and a former hedge fund manager, said investors appeared unsettled by how closely Robinhood (HOOD) tracked Bitcoin’s price, even after a sharp rebound. Cramer said Bitcoin’s recent price action weakened claims that the cryptocurrency functioned as a hedge against inflation or a stable alternative to fiat currencies.

“It may be the repository of something that's become toxic, and I think, a lot less dependable,” Cramer said on the show, adding that Bitcoin continued to move like a high-risk asset during periods of market stress.

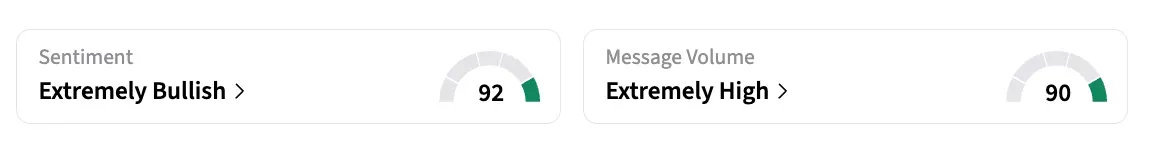

Robinhood (HOOD) was trading at $84.40, up by 1.91% during after hours. The stock closed at $82.82 on Friday. On Stockwits, the retail sentiment around HOOD remained in the ‘extremely bullish’ territory, as the chatter remained at 'extremely high' levels over the past day.

Robinhood’s exposure to crypto markets stems from its reliance on digital asset trading activity. In its third-quarter earnings report for last year, the company said crypto trading revenue rose more than 300% year-over-year to $268 million, while total transaction-based revenue increased to $730 million, highlighting the stock’s sensitivity to swings in cryptocurrency prices.

Cramer Says US Government Buys Bitcoin At $60K

According to reports, Cramer also suggested on Mad Money that President Donald Trump allegedly bought Bitcoin for a U.S. strategic reserve at around $60,000. “The word is that Trump’s buying Bitcoin for the reserve at sixty,” he said.

However, U.S. officials have not confirmed any new government Bitcoin purchases, and Treasury Secretary Scott Bessent said last week that the government lacks the authority to buy additional Bitcoin beyond seized assets.

Bitcoin (BTC) was trading at $69,281, up by 0.6% over 24 hours. On Stockwits, the retail sentiment around BTC remained in the ‘bearish’ territory, as the chatter around it remained in ‘extremely high’ levels over the past day.

Bitcoin Volatility Returned After $60,000 Test

The renewed focus followed a sharp selloff earlier in the week, when Bitcoin narrowly avoided falling below the $60,000 level. The cryptocurrency briefly tested that threshold on Thursday before rebounding from intraday lows, according to CNBC Africa.

Bitcoin fell amid broader market volatility, even as the U.S. dollar weakened, CNBC Africa reported. The move extended the cryptocurrency’s pullback from its late-2025 highs.

Read also: Are Hedge Funds Really Behind Bitcoin’s Wild Week? BlackRock’s IBIT Comes Under Spotlight Again

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)