Advertisement|Remove ads.

Jupiter Ticks Higher as CEO Weighs Pausing Buybacks After $70M Spent in 2025

- Jupiter token briefly edged up as co-founder Siong questioned the effectiveness of spending over $70 million on buybacks in 2025, suggesting it could be better utilized for user growth and incentives.

- Despite investing up to 50% of protocol fees in repurchasing and locking JUP, the token has fallen 89% from its all-time high, indicating limited impact from the buyback strategy.

- After Helium CEO Amir Haleem said Helium would stop HNT buybacks and focus on operations, Siong agreed, fueling the debate.

Jupiter (JUP) briefly edged up on Saturday, early hours after co-founder Siong asked the Jupiter community whether they should suspend buybacks of its JUP token.

Jupiter (JUP) was trading at $0.2061, up 1.42% in the last 24 hours, with trading volume hitting over $43 million, up nearly 88% during the same period. After months of weak price performance. JUP edging higher came on the heels of Jupiter (JUP) co-founder Siong’s dilemma about the JUP token.

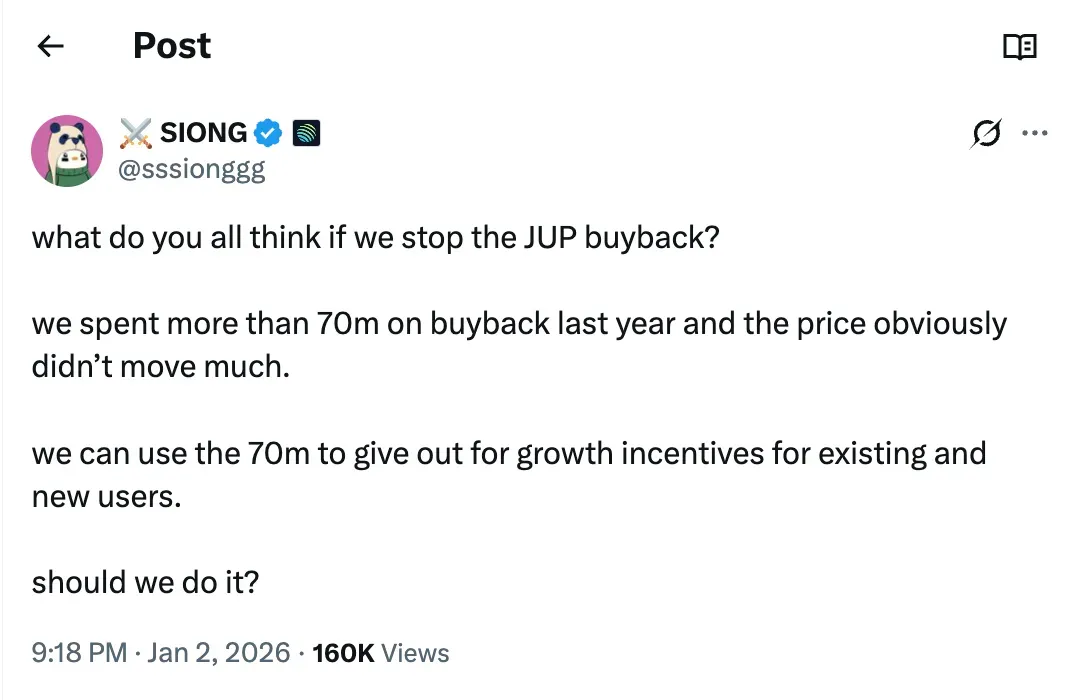

In an X post, Siong said the protocol had allocated more than $70 million to JUP buybacks in 2025, but the token “obviously didn’t move much,” raising questions about whether those funds would be better used to drive growth. He suggested redirecting capital toward incentives for existing users and new participants and asked the community directly, “Should we do it?”

On Stocktwits, retail sentiment around Jupiter remained in ‘bearish’ territory, with chatter around the token dropping from ‘high’ to ‘low’ over the past day.

Why Jupiter Is Rethinking Buybacks

Jupiter has previously committed a large share of protocol revenue to buybacks. Earlier this year, Jupiter posted on X, saying that the exchange planned to use up to 50% of protocol fees to repurchase JUP and lock the tokens for up to three years as part of its supply management strategy.

Despite those buybacks, JUP’s price performance has remained weak. The JUP Token was trading at $0.21, and is down roughly 89% from its all-time high of $1.83. However, the token is up 58.43% since its all-time low.

Siong’s comments drew responses from other crypto founders, including Helium founder and CEO Amir Haleem, who shared a similar update regarding Helium’s HNT token.

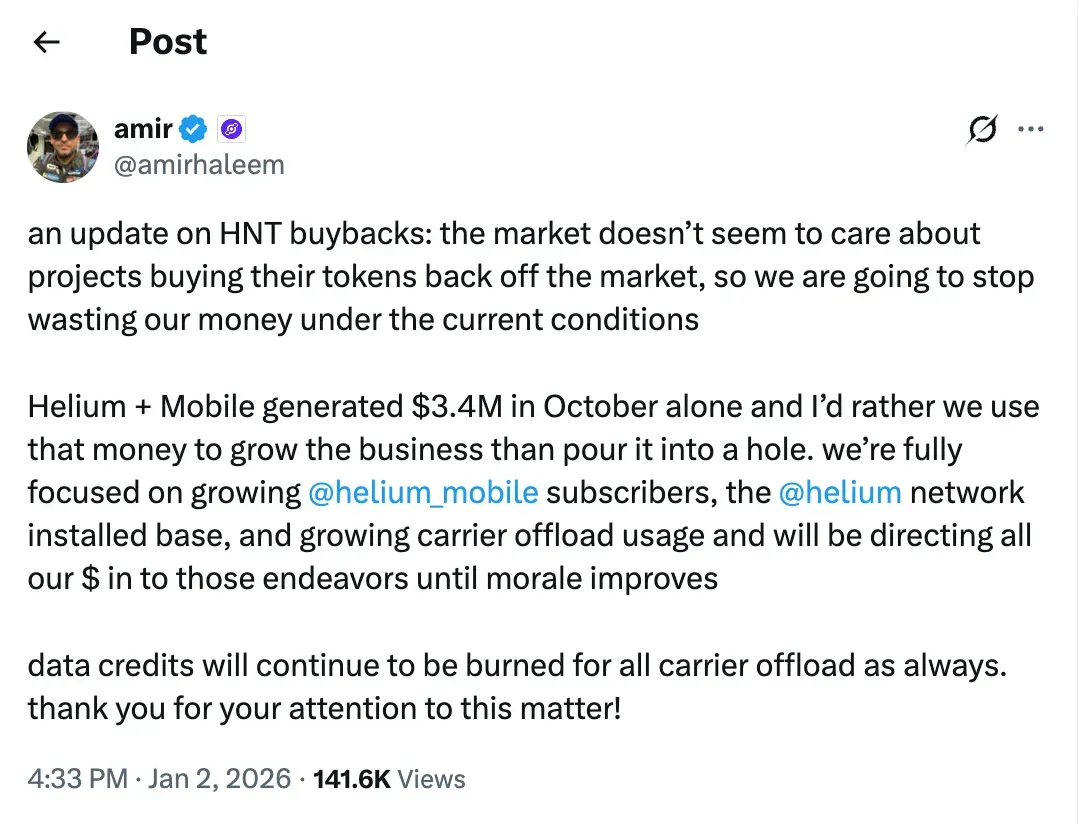

The discussion gained traction after Helium founder and CEO Amir Haleem shared a similar decision regarding Helium’s native token HNT. “An update on HNT buybacks: the market doesn’t seem to care about projects buying their tokens back off the market,” Haleem wrote on X, adding that Helium would stop buybacks and redirect capital toward growing its operating business.

Siong later thanked Haleem “for taking the first step,” signaling alignment between the two founders.

While no final decision has been made, Siong framed the move as a community-driven choice, leaving open the possibility of revisiting buybacks if market conditions improve.

Read also: Bitcoin Turns 17 As Spot ETFs Suffer Historic Losses

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_rigetti_computing_quantum_computer_representative_resized_bafe11454b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_red_cat_holdings_representative_resized_071bc0311e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)