Advertisement|Remove ads.

Bitcoin Turns 17 As Spot ETFs Suffer Historic Losses

- Bitcoin turned 17 on Saturday, marking its evolution into a core asset within global financial markets.

- U.S. spot Bitcoin ETFs saw heavy losses, with major funds recording sustained outflows.

- ETF trends remained mixed, as Bitcoin faced its first annual loss since 2022, even while global ETF inflows hit record highs in 2025.

Bitcoin (BTC) turned 17 on Saturday as the apex cryptocurrency moved from an idea to being deeply ingrained in the financial landscape. However, the U.S. spot Bitcoin exchange-traded funds (ETFs) faced their heaviest losses since launch last week.

Bitcoin was launched on Jan. 3, 2009, by Satoshi Nakamoto, in the shadow of the 2008-2009 financial meltdown. In a 2010 report, U.N. Trade and Development (UNCTAD) said the financial crisis “started in the United States in 2007,” later becoming a global recession that “led to a reduction of world gross domestic product (GDP) by 0.6 per cent in 2009,” marking the first worldwide recession since the Second World War.

This backdrop helped shape Bitcoin’s early appeal as a decentralized system. The message of “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” was embedded in the genesis block, often interpreted as a commentary on the 2008 financial crisis.

Bitcoin (BTC) was trading at $89,481, up by 0.6% since Friday. On Stocktwits, Bitcoin was trending at number 1, as retail sentiment changed from ’bearish’ to ‘neutral’ territory. Chatter around the coin also improved from ‘low’ levels to ‘normal’ levels over the past day.

ETF Losses Put Institutional Demand In Focus

Seventeen years later, much of Bitcoin’s institutional story runs through exchange-traded funds (ETFs). The U.S. Securities and Exchange Commission approved spot Bitcoin exchange-traded products in January 2024, opening a simpler route for traditional investors to gain exposure through regulated markets. The approval marked a major step in Bitcoin’s institutional adoption, bringing in asset managers such as BlackRock and Fidelity.

However, 2025 did not end well for Bitcoin ETFs, according to The Kobeissi Letter. The largest Bitcoin ETF, IBIT, recorded $244 million in net outflows last week, marking its second consecutive weekly withdrawal. The research firm said IBIT has now seen outflows in eight of the last ten weeks, with assets under management falling to about $67.6 billion, near their lowest level since June 2025.

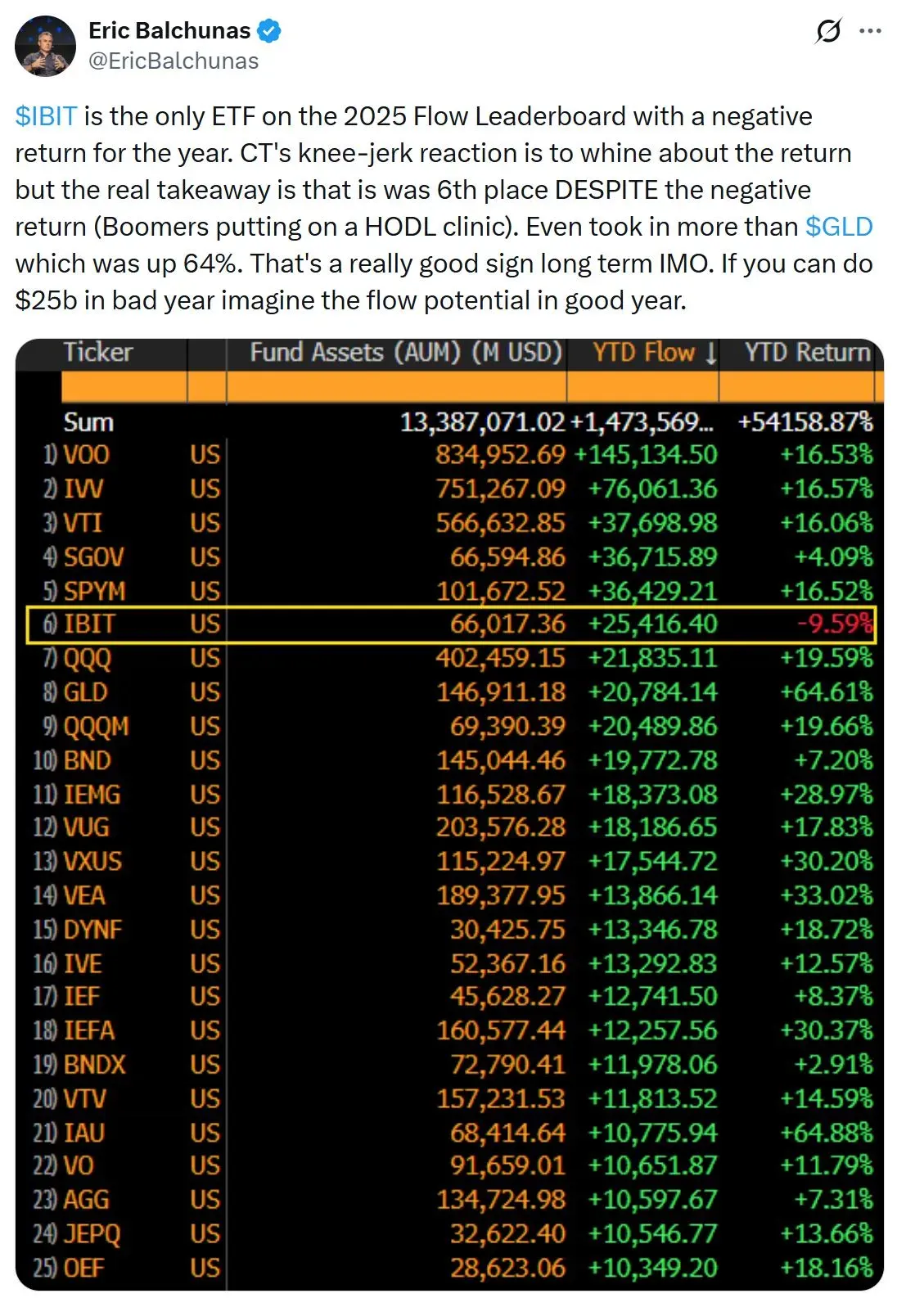

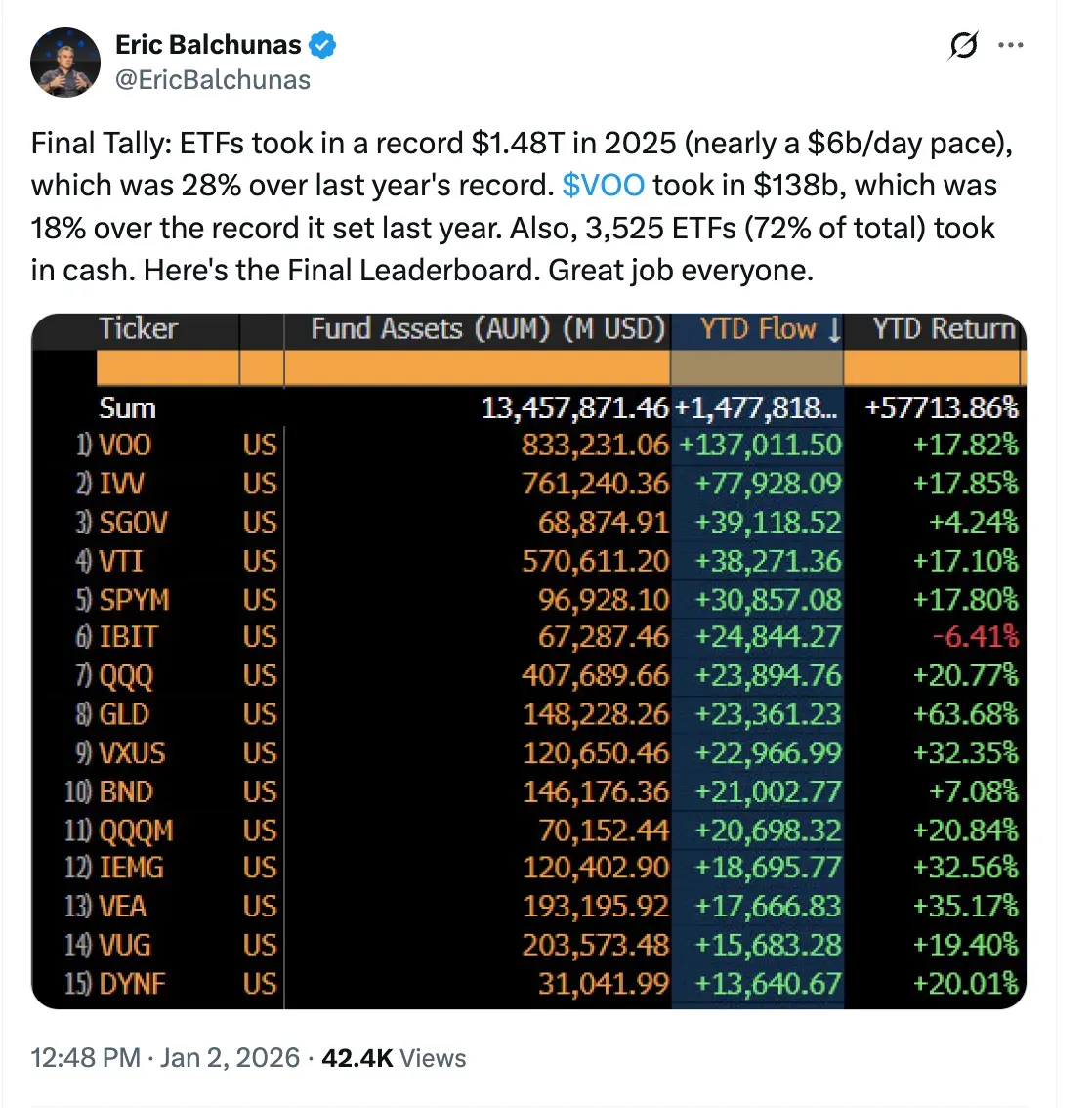

Bloomberg Intelligence ETF analyst Eric Balchunas also pointed out that BlackRock's iShares Bitcoin Trust (IBIT) ranked sixth among global ETFs in 2025 net inflows despite having one of the only top-15 funds, according to public records.

Overall, crypto funds recorded roughly $446 million in net outflows last week, the sixth weekly withdrawal in the past nine weeks, according to the same report. Bitcoin was headed for its first annual loss since 2022, increasingly trading in line with broader risk assets rather than as a standalone alternative.

However, in 2025, ETFs recorded the highest net inflow. Eric Balchunas pointed out in an X post that global ETF net inflows reached a record $1.48 trillion in 2025, a 28% increase from 2024. Balchunas pointed out that Vanguard S&P 500 ETF (VOO) led the rally, taking in $138 billion, which was 18% over the record it set in 2025. with a negative annual return, indicating strong investor interest in Bitcoin exposure despite underperformance.

Read also: US Strikes Venezuela As Trump Claims President Maduro Capture, Crypto Markets Don’t Flinch

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)