Advertisement|Remove ads.

A Top Hedge Fund Manager Is Warning Crypto Investors About Trump – Says He Is ‘Not’ A Friend To The Industry

- By cautioning that proposed laws like the CLARITY Act could centralize control over Bitcoin rather than safeguard decentralization, Mark Yusko rebutted the notion that the Trump administration is generally pro-crypto.

- Due to increased volatility and growing regulatory uncertainty, Bitcoin's post-election surge has waned, with prices retracing from highs of $125,000 to to $70,000.

- Given the long-term expansion of on-chain activity, developer growth, and institutional participation, analysts say the pullback is due to sentiment-driven risk-off rather than deteriorating fundamentals.

As Bitcoin pulls back from record highs, founder, CEO & CIO of Morgan Creek Capital, Mark Yusko, is challenging the idea that the Trump administration is broadly pro-crypto. On Sunday, Yusko, in an interview, warned that proposed legislation could increase control over digital assets like Bitcoin (BTC) rather than supporting decentralization.

“Everyone thinks the president is our friend, meaning our collective friend in crypto. He’s not,” Yusko, in an interview on Sunday, cautioned crypto investors against assuming that political leaders genuinely support the crypto industry. His comments come as a reply to President Donald Trump, who stated, “I’m a big crypto person" in an interview last week at the Oval Office.

CLARITY Act Raises Centralization Concerns

Speaking on the regulatory front, Yusko criticized the Digital Asset Market Clarity Act (CLARITY Act), saying, “The CLARITY Act as written is a non-starter because it takes us down the path of centralization and control.” He also added that the price pullback in Bitcoin and the crypto market reflected growing concerns about how crypto could be regulated going forward.

The 62-year-old veteran hedge fund manager added that political support for crypto did not always mean fewer rules or more freedom. He reiterated that recent market moves suggested investors were becoming more cautious, as uncertainty around regulation continued to weigh on Bitcoin prices.

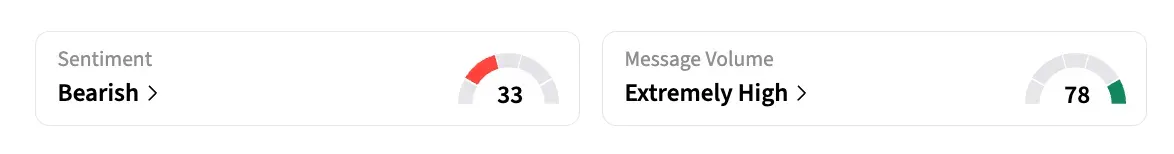

Bitcoin (BTC) was trading at $70,355.97, up 1.5% over the previous day and down 7.5% over the last week. As traders responded to the weekend volatility, on Stocktwits, the retail sentiment around Bitcoin remained in the ‘bearish’ territory, with chatter at ‘extremely high’ levels over the past day.

Bitcoin’s Trump Rally Fades

Bitcoin's post-election surge has waned, according to numerous market participants. According to historical price data, Bitcoin felt significant volatility and subsequently retraced a significant portion of its gains after soaring in the weeks after Donald Trump's election.

By October of last year, Bitcoin had risen from about $70,000 in early November 2024 to an all-time high of over $125,000. The asset has since experienced a sharp decline, with numerous sell-offs driving prices well below their peak.

Brian Rudick, chief strategy officer at Upexi, stated, "I don't think the current price action signals much for digital assets." Digital assets are highly volatile and rely more on sentiment than on fundamentals due to their nascency. Meanwhile, daily active users, developer activity, and institutional participation keep growing in a secular way, says Rudick.

Read also: Bitcoin Finds A Floor At $70K Amid Surging Liquidations And Fed Succession Talk Enters The Frame

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)